A view of the future

In our previous article in this series, “Know thyself”, we looked at member responses to HorizonScan35 (H35) research focused on the actuary brand and career support from the Actuaries Institute. Here, we look at how members perceive the future of the profession – and a holistic view of what our member research has to tell us.

In July 2021, the Institute ran an EDM/SMS research project delving into three big forward-looking questions. In this article we’re focusing on the third question:

Q. Which of the following do you believe is the future of the profession?

- Option 1 – Reimagining financial services

- Option 2 – Leading the data revolution

- Option 3 – Driving change on key societal issues

- Option 4 – Driving beyond financial services

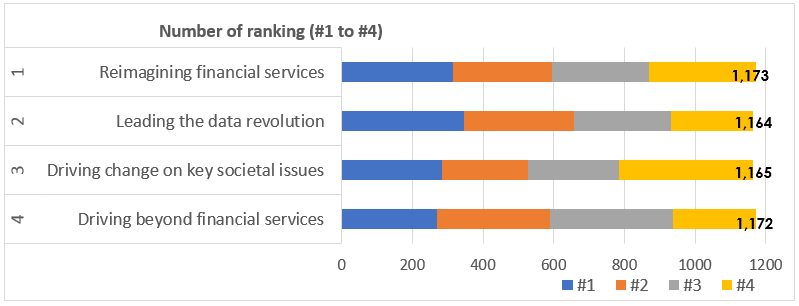

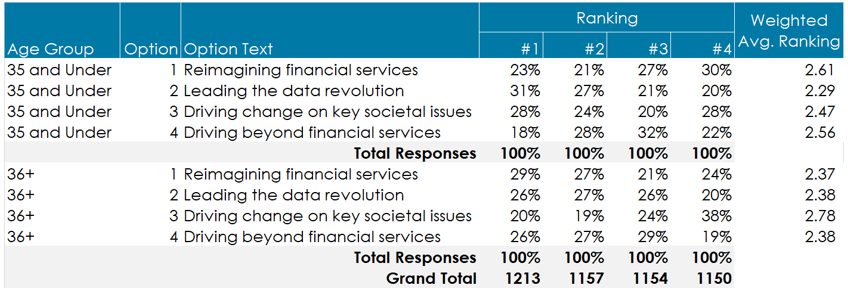

There were 1,213 responses (i.e., 28% of the total) but not all respondents ranked all four options.

What will tomorrow look like?

On a weighted average basis ‘Leading the data revolution’ was the winning choice though it’s important to note that there was a broad split across all four options. It’s clear that the four options have appeal to many members.

Taking a closer look at responses – and via age group – throws up some more interesting insights.

- ‘Leading the data revolution’ was the leader across all members and garnered solid support amongst young actuaries. It is clear that the potential opportunities in the data space are well understood across the profession.

- Overall, ‘Driving change on key societal issues’ was ranked the fourth (least) appealing option most often. However amongst those under 36, this option was the second most popular. This tallies with the view that younger professionals are more focused on the social and environmental credentials of employers and more attracted to work in professions that have an overt social purpose.

- Interestingly, ‘Reimagining financial services’ was the most important option for actuaries over 35. This perhaps reflects that many more experienced actuaries work in financial services but are well aware of the winds of change that are sweeping through the profession – data-centricity, AI, regulation, the rise of fintechs – and the effects this will have on their roles. They see plenty of opportunity to reimagine their roles in a changing but still vital sector.

- At the same time, ‘Reimagining financial services’ was picked as the least appealing option by 30% of actuaries 35 and under. They’re more interested in ‘Leading the data revolution’ and it might be surmised that many already work in ‘non-traditional’ areas.

What do all three questions tell us?

Let’s remind ourselves what the overall survey covered. Some 28% of those surveyed answered at least one of three open and future focused questions:

- Q1) It’s 2035, brand actuary is redefined, list three words that described us.

- Q2) We want to grow career opportunities for actuaries, name one thing we could do to help our members.

- Q3) Which of the follow do you believe is the future of the profession, please rank the following options:

- Option 1 – Reimagining financial services

- Option 2 – Leading the data revolution

- Option 3 – Driving change on key societal issues

- Option 4 – Driving beyond financial services.

So, let’s look across all three questions and their responses and draw some bigger picture conclusions.

Brand matters

It’s clear that a majority of the profession now see the value of investing in our brand. Answers to Questions One and Two made it clear members saw a stronger brand as a crucial part of expanding their personal employment and career opportunities. Verbatim responses suggest many actuaries are frustrated that the profession – and its many positive attributes – are less well understood than they could be. More focus on marketing – but also on thought leadership and public policy – are the solutions to this challenge. All these solutions are built into action plans in the new strategy.

Our diversity is a strength – and a challenge

It is already clear that the profession spans a wide range of skills, roles, organisations and industries. More importantly, that breadth will only increase – responses to the survey question about the future of the profession highlight a willingness for actuaries – young and old – to further expand the industries and fields they work in.

Whether it’s expanding our role in financial services through fintechs or leading in the data revolution, actuaries have the right to say, “the times will suit me.”

That said, this very diversity is one factor making it more difficult to drive home our brand. First, we need to speak to multiple diverse audiences. Secondly, we speak for multiple diverse professionals and it’s hard to encapsulate messages about all those strands simply and clearly. We know that our diversity is a strength. One of our challenges over the next five years is to make it look like a strength.

We get the data

It is clear that all actuaries ‘get’ the potential of data and its centrality to the future of the profession. It’s why there is clear support for more data-management specialties in our education programs. Clearly data-centricity is not even a debate for many of our younger actuaries – they’re not thinking about whether data-science will be part of their future. They’re just wondering about the shape that future will take.

One final point, in our discussion of Question One (list three words that describe us in 2035) we highlighted that older actuaries talked about trust and younger actuaries talked about data.

We could look at this divide and ask – how do we square that circle?

Or we could synthesise it and look at the opportunities that any profession will have when it can combine those two attributes. The chalice that actuaries can grasp between now and 2035 is to become the profession known for its mastery of data and the profession trusted to use that data ethically and expertly on behalf of its clients and communities.

|

Horizon 2035 Taskforce members:

|

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.