“Know thyself”

Over the past year, the Actuaries Institute has gone through a deep and extended process of strategic thinking. Our HorizonScan35 (H35) project and our new strategy are unfolding soon. An important part of that process is understanding how the profession perceives itself.

Legend has it that the forecourt of the Temple of Apollo at Delhi had three aphorisms inscribed there. The most famous is “Know Thyself.”

Leadership at the Institute took this advice seriously, running a focused EDM/SMS survey in July 2021 as part of H35. The survey reached out to nearly 5,000 members and nearly 30% of members provided at least one answer. The survey canvassed three big questions and in this article we’re focusing on the brand and career-related questions.

Let’s start with what members think about the future of the actuary brand.

Q. It’s 2035, brand actuary is redefined, list three words that describe us.

Interestingly, there were over 350 different words used to describe the profession’s brand in 2035. Some were perhaps predictable – including unruffled and financial-whizz. Others were less predictable but essentially true – like Uncertainty-Whisperers. Even Fat Tails got a mention. Sadly, while there were 127 members for whom ‘trustworthy’ was a response, only one member thought the brand in 2035 would be described as ‘exciting.’

Difference of views?

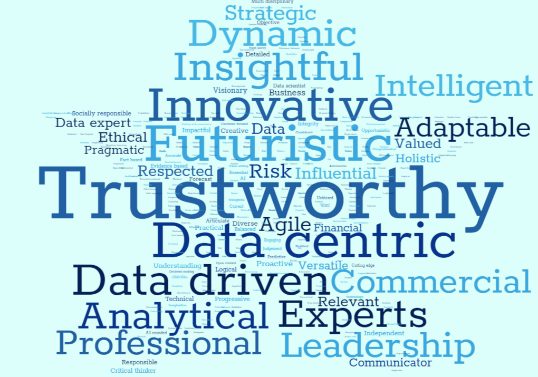

The Word Cloud below illustrates how all Members responded to this future-focused question.

The dominance of ‘Trustworthy’ across the all-member population is telling. Trust is a brand attribute prized by many businesses and professional organisations. It’s seen by members as central to the future perception of actuaries. At a time when the Institute will soon celebrate 125 years in Australia it’s clear members still cling to the traditional view of our role – we’re the profession that’s trusted to help organisations manage uncertainty and deliver on their promises.

The Word Cloud below illustrates how Members under-35 responded.

Seeing through younger eyes

The survey assessed how young actuaries answered the question and the differences are interesting. There’s a greater focus on data and innovation, reflecting the direction the profession is moving in the eyes of its younger cohort. Comparing the response of Fellows vs Students revealed a similar dynamic. For Students, data-centric is central, while Fellows focus on trust.

I am multitudes

Whilst the difference between the views of older and younger actuaries is striking, it’s not a negative. The profession as a whole is encouragingly future focused – the second most popular word across all members was ‘futuristic’. Its obvious different cohorts will have different experiences – and expectations – of life as an actuary and these differences come to life in their perceptions of the brand.

The bigger point is that the profession has room to define itself broadly: in a way that aligns with members’ different experiences and with the perceptions of our clients and partners. The breadth of the roles actuaries take and the variety of industries we work in has always made it hard to define ourselves simply. But it is important we get it right.

It’s why more work and focus on the brand is such an important part of the new strategy. And why we’re developing a brand framework that is easier to understand and relatable – yet one that encompasses all our diversity.

Career opportunities

The second question in the HorizonScan35 (H35) research focused on how members think the Institute can best support their careers.

Here’s the career-related question members responded to:

Q. We want to grow career opportunities for actuaries, name one thing we could do to help our members.

Strategic themes

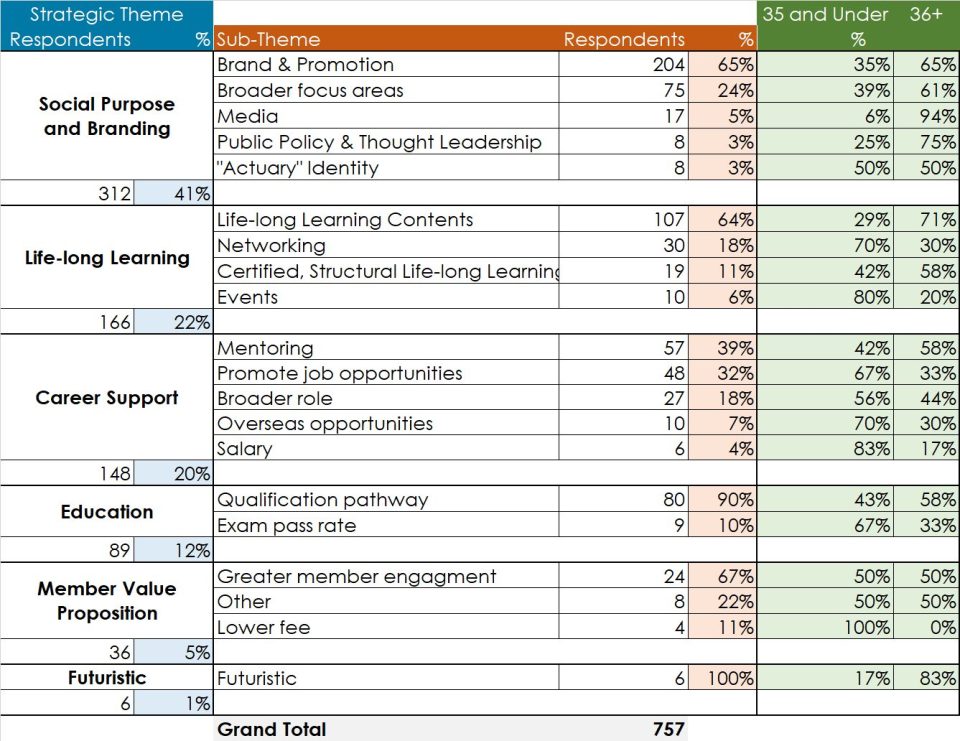

To garner more insights from the free-range responses to the question, the Institute mapped responses to 20 sub-themes and then categorised those into six Strategic Themes. The table below shows how responses lined up against each theme and sub theme.

As you can see, Social Purpose and Branding was the dominant theme and a significant percentage of members cited Brand and Promotion as the one thing that would help grow career opportunities for members.

The verbatim responses to the survey echoed the importance members placed on continuing investment in our brand.

One respondent referred to the perception of actuaries as “cardigan wearing boffins with our sense of humour gland removed at birth.” It’s idiosyncratically put but others echoed their argument that not enough employers understand our unique skillsets, training and capabilities.

As another respondent said, “many potential employers seem put off by actuarial salaries or actuarial consulting fees. Given the ROI could be 1000x times or better, it seems like a greater branding exercise is required.”

All-age students

For those respondents who were more focused on life-long learning, there are interesting distinctions across age groups. For actuaries over 35, content is king and certification is important. Tellingly, in a (hopefully) post-lockdown world, younger actuaries are more focused on life-long learning through human connection – on networking and events.

Mentor me

For those members whose responses fitted under the education theme, a focus on the Qualification Pathway was overwhelmingly important. For some respondents this meant what one described as “better pathways to fellowship and careers for actuaries who don’t do traditional actuarial work like pricing, reserving and valuation”. That same member also spoke of the benefits of having a dedicated data analytics pathway for non-traditional actuaries.

Interestingly, under the Career Support theme, mentoring was the clear winner across all age groups, with older actuaries citing mentoring (58%) even more than their younger colleagues (32%). Verbatim responses support mentoring’s value: “Reintroduce the mentoring program … like a ‘chat with a member’ service where young actuaries (or not so young actuaries) can chat with an actuary about something career-related.”

A holistic approach?

The survey data suggests that supporting the career aspirations of tomorrow’s actuaries is a multi-layered task. It’s about education and lifelong learning and Institute support. But it’s also about efforts to broaden the perception of actuaries – and to enhance their own ability to tell their unique story.

|

In the next article on the H35 survey, A view of the future, we look at how members see the overall future of the profession and take a wider look at what the H35 survey says about the profession. Horizon 2035 Taskforce members:

|

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.