Future of Health Seminar 2019 – an overview

“What is healthcare?” This fundamental and foundational question kicked off the October 2019 Future of Health Seminar (FOHS); an annual gathering of healthcare professionals, actuaries, policymakers and stakeholders from industry bodies.

The FOHS is a unique Actuarial gathering that provides attendees many insights into where our healthcare system is today, and the challenges that we will need to face in the future. Beyond ‘what is healthcare?’, the sessions posed questions on ‘what is the far future of healthcare?’, ‘what is the near future of healthcare?’ and perhaps the most pertinent, ‘where do we go from here?’

Before we delve into each of the plenary sessions, it’s worth highlighting some universal themes from the day: How does the Australian healthcare system operate? What is the value and role of private healthcare? How does data play a role? And possibly the most mentioned topic – how can we make our system more equitable?

How does our health system operate?

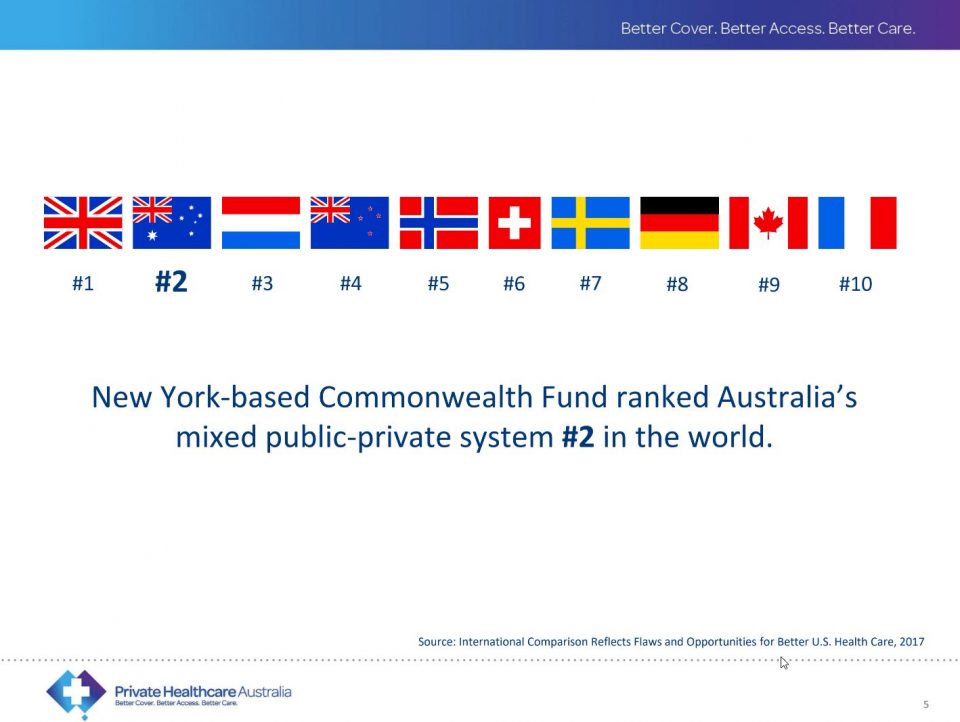

While there are many challenges, Australia does compare favourably to many other countries and performs reasonably well. This was explored in the recent Health Dialogue: Private health and health care financing – Learning from the world paper and Green Paper: How to make Private Health Insurance Healthier and was reaffirmed by many stakeholders in during the FOHS.

One aspect that isn’t often discussed is that private health insurance (PHI) only covers around 9% of the healthcare costs in Australia. Out of pocket costs are more than double this amount (at about 20%) and the remainder is funded through various government sources. The Honourable John Hill of Private Healthcare Australia pointed out that the voluntary uptake and use of PHI translates into $18 billion of additional funding into our system. While PHI affordability is an issue worth exploring, this amount would otherwise need to be funded from other sources (government or out of pocket) to maintain the level of care provided in our system.

What is the value of private health insurance?

Many of the speakers touched on the question of PHI’s value within the healthcare environment. In Plenary Four, the audience was polled on what “a ‘successful’ private health insurer of the future” will do. Nearly all of the audience (96%) responded that this will include encouraging policyholders to lead healthier lives.

In recent years, many in the media, government and consumers have questioned the value of healthcare (one symptom of this is the lower uptake by younger age groups). The rising cost of premiums each year attracts many negative headlines. However, often what’s missed in these headlines is that the public sector’s funding of healthcare is increasing at a similar rate.

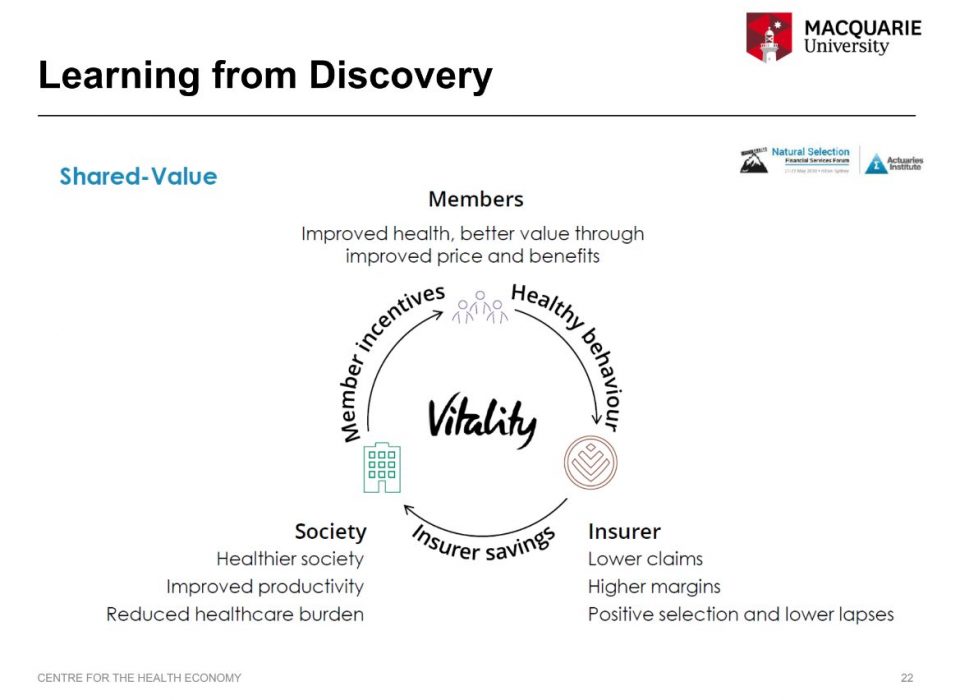

Health insurers like Medibank (and Discovery Health in South Africa) were put forward as case studies of insurers being increasingly involved with improving the underlying health of their members.

While complex to introduce, this can materialise into more innovative arrangements to reduce healthcare costs, while improving the lives of their members.

How can the health system become more equitable?

Perhaps the strongest theme of the morning was the many underserved populations in the health system. In Australia; Aboriginal and Torres Strait Islander people and those with mental health conditions were two groups highlighted as being underserved.

The inequity in the system could become more ingrained in the system as future innovations and technologies continue to develop. Several sessions explored the applications of genomics and advancements in the development of health-related artificial intelligence and posed the question of “how can we progress technology to better care for traditionally under-served groups?”

Much of our healthcare resources are directed towards hospitals. Dr. Henry Cutler of the Macquarie University Centre for Health Economics (MUCHE) presented data that showed the top healthcare needs of different age cohorts.

He highlighted that younger groups have anxiety, depressive disorders, and suicide as top healthcare needs while older ages have conditions that are typically serviced in a hospital-based environment (heart related conditions topping the list).

Over 80% of private hospital related costs are from patients over the age of 65, according to Sue Williams at Cabrini.

[ngg src=”galleries” ids=”3″ display=”basic_slideshow” arrows=”1″ transition_style=”slide”]

The role of data

Data is foundational to understanding and innovating healthcare delivery and treatment. Plenary Two outlined how health informatics and genomics relies on vast amounts of data to better understand what affects our health and how to better treat health conditions.

On the ground initiatives by Medibank and Cabrini rely on claims data to bundle healthcare costs to add clarity to out of pocket costs for patients. But these are limited by availability of data. And both initiatives are only possible for conditions and interventions where the provider or insurer has access to sufficient data.

While private health insurers are increasingly trying to improve the health of their members, there is a massive gap in ability to do so, as insurers have no access to claims data from the public system.

“If we want [insurers] to innovate and bring about change, they need data” said Henry Cutler on the topic.

Without being able to identify a patient who has diabetes or a heart condition, there is no way that a health insurer can make sure those members have the best care to improve their health and life

Even for the most traditional insurers who might view their role as a passive payer of claims, without a more holistic view of their members’ health, they are limited in their ability to identify fraud or waste.

Read moreSee a summary of the Plenary sessions written by Brendan Pon, Lulu Wang, Nora Lam and Zachary Tirrell |

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.