Assessing insurance product value in a DDO world

In a new product world, the Design and Distribution Obligations (DDO) regime among other regulations, will govern the increased focus on consumer-centricity. This article explores how the concept of insurance product value can connect consumer’s needs with insurance product features and benefits.

In November 2014, the Financial System Inquiry (FSI) found the current regulatory framework for financial products was inadequate to protect consumers. The framework relied too heavily on disclosure, on general advice and the financial literacy of consumers.

Subsequently, the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry in February 2019 highlighted the poor value that some financial products offer, causing the industry to challenge its products and their value in particular, given their complexity and identified weaknesses in processes and controls.

As an outworking of the FSI, in April 2019, the Treasury Laws Amendment (Design and Distribution Obligations and Product Intervention Powers) Bill 2019 was passed and introduced.

|

DDO

|

Design and Distribution Obligations (DDO) which require issuers and distributors of financial products to target those products at the right people. Issuers and distributors of retail financial products are captured under the DDO regime and therefore DDO extends beyond insurance to credit and other products. |

|

PIP

|

Product Intervention Powers (PIP) which provide ASIC the power to modify products, or if necessary ban the sale of financial products, when there is a risk of significant consumer detriment. ASIC also have the power to impose civil and criminal penalties for any breach of DDO or PIP. |

DDO becomes effective from 5 April 2021, whereas PIP is already effective. ASIC is consulting on using this power in relation to the distribution of add-on insurance and warranties by car yard intermediaries.

Two underlying principles of DDO are fairness (in designing, targeting and distributing products that meet consumer needs) and a consumer-centric approach to the entire product lifecycle as outlined in the Australian Government’s Design and Distribution Obligations and Product Intervention Power proposals paper in December 2016. A fair and consumer-centric approach is one where target markets are determined so that products offer value to consumers.

Insurance Product Value

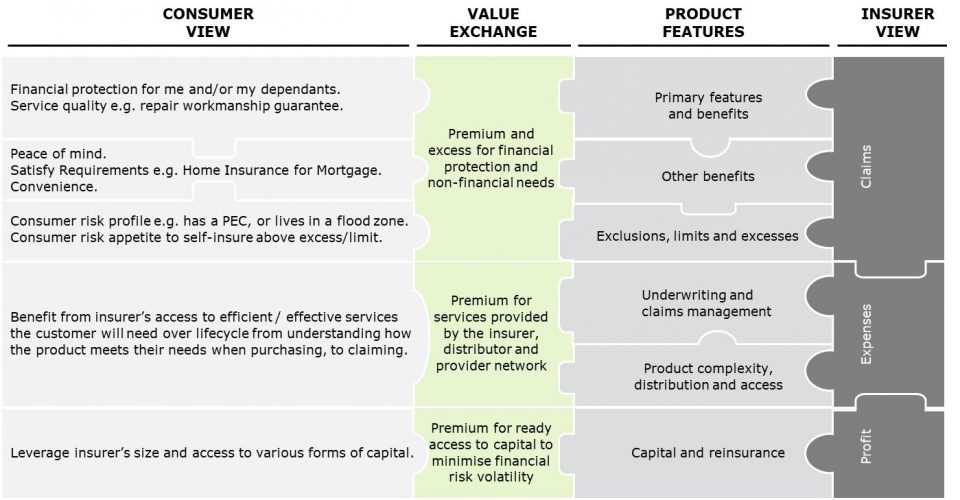

Consumers of insurance products seek to be indemnified (whether for themselves or for their dependants) so they can return to the position they were in prior to the insurable loss. Consumers have financial and non-financial needs to protect their assets, exposures and/or dependants as shown under ‘Consumer View’ in the image below.

From a consumer’s perspective, value is provided where the consumer perceives that the cost of the product is appropriate when weighed against the insurer meeting consumer needs through the features and benefits of, and services related to, an insurance product.

Historically, insurers have focused on pricing insurance products, typically on a bottom-up cost-plus basis from their own perspective. A rigorous framework to assess product value to consumers will be needed to help meet community and regulatory expectations into the future, including those principles of fairness and consumer-centricity. Under this framework, insurers will assess and regularly review the value consumers gain from their product and its suitability on an ongoing basis.

This doesn’t mean abandoning a bottom-up, cost-plus view of pricing; but rather ensuring this is put in context of a consumer view of value. From an insurer standpoint, to ensure sustainability of offerings, the premium paid by a consumer must cover at a minimum the cost of claims, the cost of distribution and other expenses, and the cost of capital required to offer and support the product, as shown under ‘Insurer View’ in the image below.

The following captures the exchange of value between the cost and benefit of an insurance product for consumers.

People who self-insure could be significantly out of pocket following an event that causes them loss or damage. This is why self-insurance is not always a viable option, and why consumers may see value in paying a premium for ready access to capital and an insurer’s service network at their time of need.

Deloitte has constructed a product value framework by considering ways to connect the value exchange between the cost and benefit of a product via a number of key considerations which are customisable for each organisation and product.

Two of those considerations are described below.

- A product value framework should identify low and negative value scenarios, for example:

- Some consumers may not need, want or understand CCI features, and therefore obtain low or negative value from purchasing the CCI product.

- If pre-existing conditions are excluded from an insurance product, and cover provided for them would be the primary benefit to a consumer, then this exclusion may result in the product providing low value to those consumers. This is also a good example of the importance of using appropriate channels for distribution to the target market defined for the product.

- There are also many less obvious examples where products are of low value. Pricing that is conducted on a portfolio rather than individual product basis, may be an area of monitoring for potential low or negative value scenarios due to potential cross-subsidies impacting certain consumers. For example, consider cross-subsidies that may exist between lump sum death and disability insurance.

- Product value considered over a longer period or through a full economic or credit cycle:

- There may be an imbalance of value exchanged from time to time, and this may be appropriate. For example, loss ratios (claims cost as a percentage of premium) related to natural catastrophes on home insurance may be zero for many years, and suddenly increase to over 100% in one year. Therefore when loss ratios are considered over a longer period, a more balanced view of value is established. The value gained from leveraging an insurer’s size and access to various forms of capital similarly requires a longer-term view, given this component of cost to the consumer minimises their long-term financial risk volatility.

All in all, a fair and consumer-centric approach, is one where products are of value to a target market of consumers. Assessing product value will also be important in the context of other reforms under consideration that impact the value exchange, including unfair contract terms. A rigorous framework to assess insurance product value, will be needed to help meet community and regulatory expectations into the future.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.