From frontier pioneer to data innovator: Celebrating 125 years – Part 2

In the second of a two-part series, we celebrate the pioneers of the actuarial profession and the cornerstone moments which have shaped the Actuaries Institute’s 125-year history.

Humble beginnings, tumultuous times

Within its first year, the Actuarial Society of NSW had 26 members. That number had almost doubled by the early 1900s with an annual membership at 5 shillings per head. It was another boom time for the profession, as actuaries were involved in Australia’s recovery after World War I. Life insurance offices now needed to consider the impacts of increased mortality on policies affected before the start of the war. Australia’s armed forces lost around 60,000 men and more than 152,000 were wounded (23 servicewomen died).

As more members outside of NSW were joining the ‘Actuarial Society of NSW’, the name ‘Actuarial Society of Australasia’ was adopted in 1918.

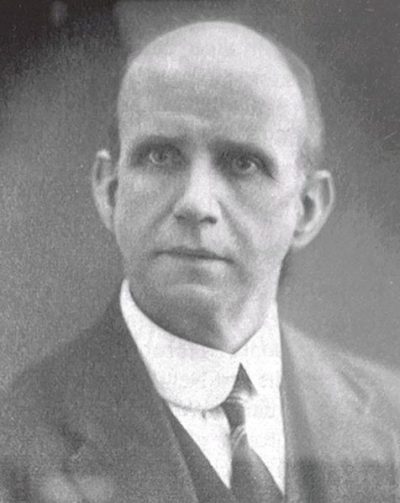

A new generation of actuary was also beginning to emerge during the 20s and 30s as demand for actuarial skills remained high. This included Charles Wickens, the Commonwealth Statistician from 1922 to 1932. Wickens was instrumental in developing the Bureau of Census and Statistics.

The profession continued to grow, even during the Great Depression. After WWII, actuaries again helped in the post-war recovery. They were instrumental in drafting Australia’s first life insurance legislation.

By the end of 1946, the Society had grown to 167 members, including 35 fellows, 26 associates, 60 students, and 46 lay members.

The Macquarie degree

In the 1950s, after a long period of steady growth, the profession was finding it difficult to attract students into the profession. With tertiary education more widespread, actuaries were losing some of their elite status. The small size of the professional community made it tough to attract students.

In 1955, Society President Alfred Hurlstone Pollard called for the establishment of a school of Actuarial Science within a university as the only solution to the profession’s growth problems.

Even so, it wasn’t until the late 1960s that President Pollard’s dream became a reality. Australian Actuaries, tired of correspondence through the UK to study as an actuary, established their own degree at Macquarie University in 1968. The model quickly became an international benchmark for similar qualifications.

Australian actuaries were also pioneering new Actuarial techniques. This included the world-leading unit pricing structure Equities, Fixed Interest and Government Bonds (EFG) through National Mutual in 1965. EFG is a selective investment facility that is used by some financial institutions for superannuation investment to this day.

By the early 1970s, Actuaries were deemed essential after the passing of the Insurance Act in 1973. Actuarial advisors were also increasingly sought in the general insurance space. The general insurance sector become a major employer of actuaries in the decades to follow.

Hawke, Keating, Howard, actuaries

The 80s and 90s were a time of significant financial and policy reform in Australia. Actuaries had an important role to play helping governments, industry and society navigate the implementation and growth of compulsory superannuation.

This included helping provide better retirement outcomes for Australians. A group of actuaries submitted the Proposed Retirement Incomes Strategy in 1994 and A Better Retirement Income Strategy for Australia in 1996.

After almost 20 years of work, these submissions eventually helped bring about changes to how super funds disclosed fees and costs. As a result, consumers can now make better decisions about their financial futures.

In recent years, actuaries have been key to recent super reforms in simplifying the complexities of the system.

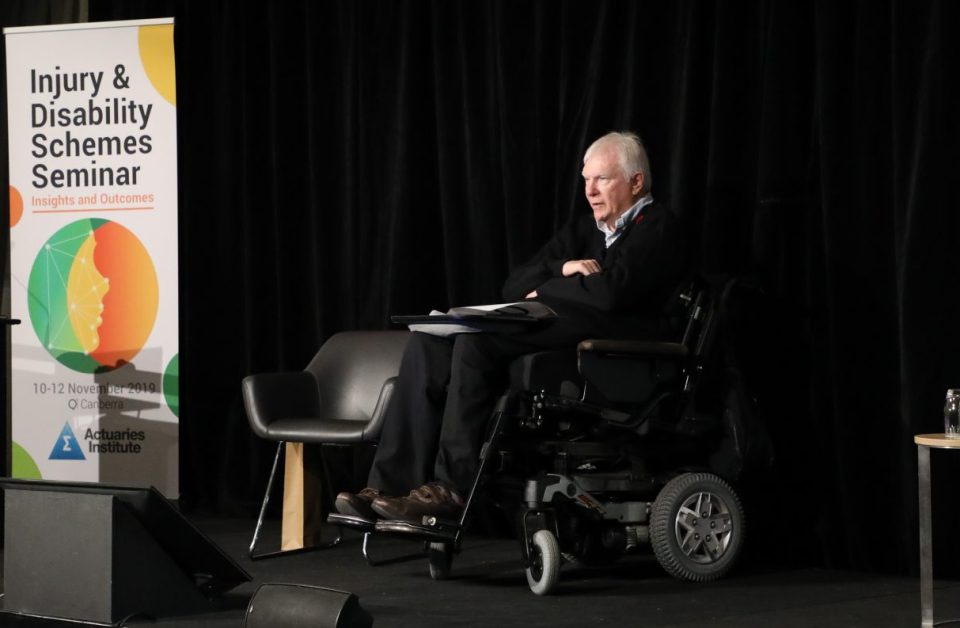

Actuaries have also been key in establishing vital health programs and agencies. This includes prominent actuary John Walsh’s involvement in establishing the National Disability Insurance Agency.

Today, more actuaries are working in emerging industries including fintech and Artificial Intelligence (AI). Actuaries have been working to mitigate the impacts of climate change from as early as 1999.

In more recent years actuaries have pushed themselves to the forefront of the data revolution. In 2015, the Institute launched the Data Analytics Working Group (DAWG). Now called the Data Science Practice Committee, it is helping equip actuaries with a wider data knowledge base that complement their existing skillsets. This training means actuaries can lead this ever-more crucial industry.

A time for fearless, ferociously competent actuaries

For more than 125 years, actuaries have made their mark on Australia, building new business, shaping new industries, keeping the powerful honest and protecting the vulnerable.

While the day-to-day life of an actuary in 1897 was very different to the one we may live today, what hasn’t changed is the link between our professional skills, ethical underpinnings and concern for the public good. We can look back with pride on the lasting contributions the influential figures celebrated above made on our profession and our society.

We can also be proud of the significant improvement in gender and race diversity throughout the profession of today, and the meaningful, enduring steps the Institute is embracing to ensure diversity remains in future millennia.

With the flowering of data, machine learning, AI, climate science and health sciences the current generation of actuaries now has a chance to write their own chapter in the stellar history of our profession.

|

Click here to read Part 1 and find out more about the Institute’s 125-year history.

|

|

References

|

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.