Actuarial work in the mid-1970s

What was life as an actuary like back in the 1970s? Veteran actuary Dermot Balson has seen it all in a career spanning nearly 50 years. In this piece, Dermot takes a trip down memory lane and details his early days as an actuary.

I started my first actuarial role in 1974, in the pensions department of a large South African insurer. At the time, the South African insurance space shared many similarities with Australia.

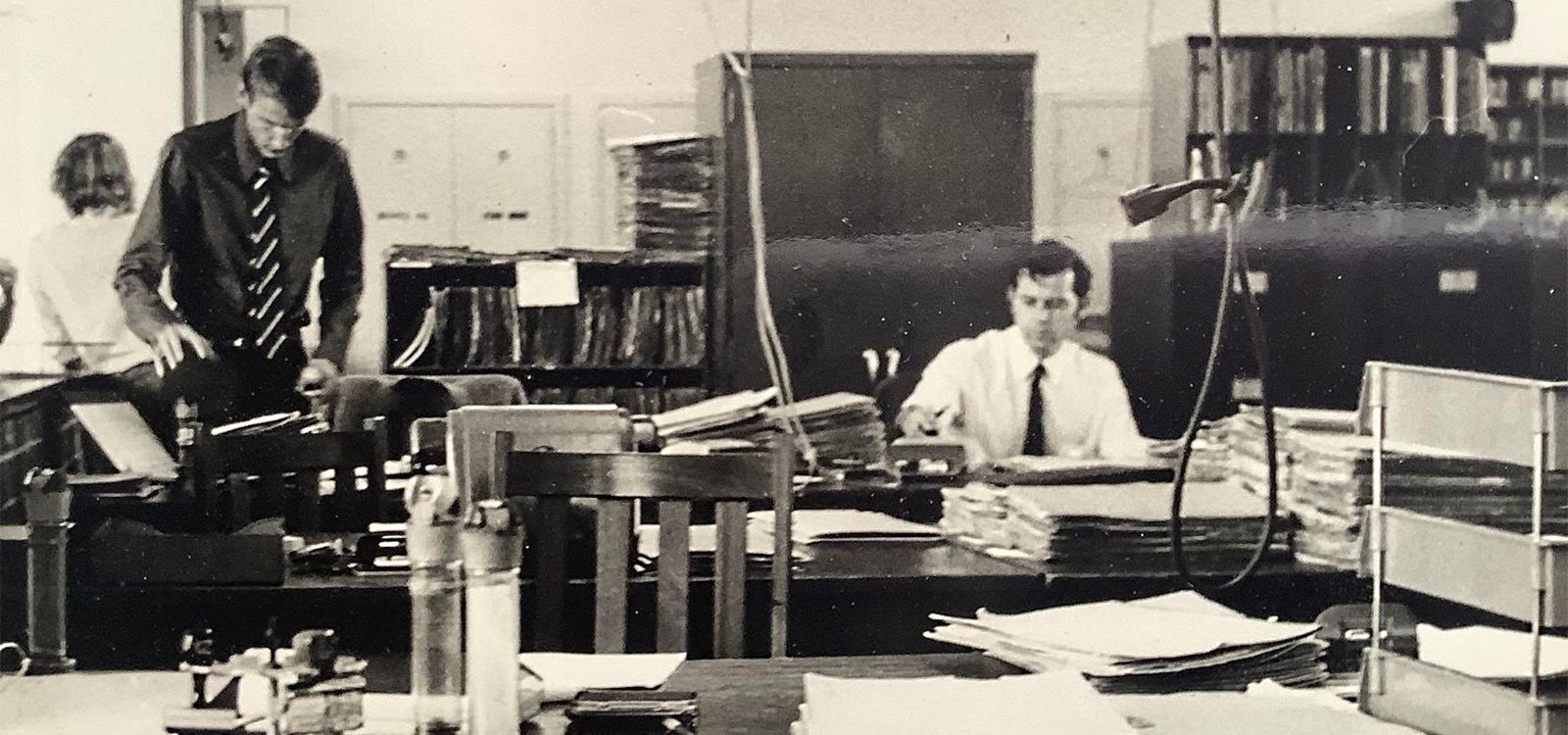

Below is a 1974 photo of part of the room we worked in with desks, hard-backed chairs, no computers, paper, and a couple of plastic containers.

These containers were used to request files using a vacuum tube down to the basement. New workers were pranked to shout a warning down the tube before dropping in a container so it wouldn’t hit someone at the bottom!

Technology

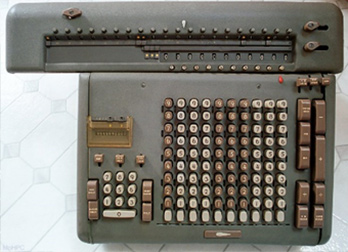

The actuarial department had electric mechanical calculators that looked like monstrous typewriters. They multiplied and divided by turning cogs and gears to add and subtract. I started work just as they were replaced with basic electronic calculators.

We also had a very primitive mini-computer in our department that printed results on a narrow paper tape, but I can’t remember what it was used for! I only recall that I once programmed it to play simulated cricket until I was told to stop!

By 1975, the first pocket calculators (no scientific functions) emerged. I paid $70 for mine, which would cost about $600 today.

The work

Our pensions quotation section produced funding quotations for pension schemes for employers on request by insurance brokers. Given staff and benefit details and commission level, we collated the salaries on a sheet with little boxes for the ages, added them, and applied a table factor. It was mindless drudgery.

The people were friendly and the managers among the best I ever had, but we were usually busy and under deadline pressure. Quotes poured in and we churned them out under time pressure. I often went home with a headache.

The whole industry was highly unprofessional. Insurance brokers were flogging anything they could to clients (e.g. defined benefit schemes for groups of as few as 5-10 employees) and then pressuring insurers to quote the lowest possible cost with high commission.

Our cost factors projected benefits for only 15 years ahead, which was a proxy for including new entrants (something we couldn’t handle).

Other insurers used a similar approach. I remember my bosses being very upset when a competitor started projecting benefits for only five years, which gave them a cost advantage with brokers. The brokers didn’t care as long as the cost was low and the commission was high.

We sat at plain wooden tables fairly close together, so it was easy to chat. The downside of the office layout was that many people smoked, and if they left their cigarette in their ashtray, it would drift across your desk and into your eyes. A tea lady came round twice a day with proper teacups and saucers.

There was a clear hierarchy in the office and a lot of respect shown for the managers and executives – and especially actuaries. The reason was the same as in any job-for-life organisation. We expected to rise through the ranks over the years, getting promoted every few years, and it wasn’t common for people to jump between jobs.

The actuaries

Looking back, I wonder what real actuarial work some of the actuaries did most of the time, because the factor tables we used for quoting, and for valuing existing pension schemes, were only reviewed every few years. However, those decisions were crucial.

Also, the lack of calculation tools meant that actuaries often had to find simple approximations for complex calculations, and the pressure to keep quoted costs to a minimum strained their professionalism. If there was any grey area the salespeople pushed it right to the edge.

Where actuaries really earned their money was in life insurance, during the era of whole of life with profit and endowment schemes.

Bonus rates were only reviewed every year and competitive pressure was intense. But for us junior actuaries, it was the day-to-day conversions. This included whole life to endowment that required genuine algebraic ability and actuarial understanding.

Some of those conversions were diabolical. This course led to another initiation prank where newcomers were given an enormous file with about 30 existing conversions (all from earlier newcomers) and told to make yet one more nasty conversion. I spent a little time working in that area and it was more than enough.

I liked working with all our actuaries without exception. They were friendly and open, if mostly reserved, very professional, and some were characters.

One actuary I knew was about 40 and lived with his mother. He was very shy and used to sidle along the side of the office to avoid people. We had a company swimming pool and he would doggy paddle up and down. There were also stories going around about how someone saw his car in the carpark one morning and it was rocking. He was trying to get out his seatbelt still on.

Another actuary had gone for a run at lunchtime and went to shower in the changerooms next to the pool. Trouble was, he had forgotten his towel. So he used the wall-mounted hand towel (you don’t see many of these in showers anymore!) mounted three feet off the floor. To reach the towel to dry himself, he put one foot on one wall and one on the shower door and wedged himself halfway up the wall. And that’s where he was when I walked in. I just walked straight out and never told anyone.

One memory really stuck with me. A colleague plotted a set of five yearly withdrawal rates on graph paper and showed our actuary asking if he should interpolate using a cubic spline (they had just been invented). My friend was hoping to spend a happy afternoon playing with them as a change from the usual drudgery. Instead, he came back with his mouth wide open, because the actuary drew a line through the points, and said “use that”. It took me years to realise I’d been given an important lesson in materiality.

Studying

There were six technical subjects and four practical finals, all taken through the UK, in my day. We got a couple of exemptions if we did a Bachelor of Science first, which I did. The technical exams were twice a year and the finals once a year. We had three weeks study leave for each final and less time for the technical subjects.

The most memorable part of my studying was general insurance. I wrote it when it was introduced in 1978 and the course materials were a shambles. First, we were sent an extremely technical book on risk by a Finnish mathematician, which was terrifying.

Then we were sent proof photocopies of the unfinished textbook and it was a mess. It had different terminology and writing styles in each chapter. I later found out why the chapters were so different when a general insurance actuary offered me a number of old papers to read. I saw several of them had been included verbatim in the new textbook. I think I benefited from the chaos as they couldn’t mark us harshly after that!

Career path

Nearly all actuaries worked in insurance companies. Consultancies were almost non-existent and only a handful of actuaries worked in other fields.

The career path in an insurance company inevitably led to management and so there was a focus on management training, of which I did my share. I got initiated the hard way. Soon after assuming my first management role, I was asked to retrench an older worker who was no longer needed.

I feel very fortunate that I was able to escape this career path fairly early thanks to new technology and changing market conditions. It would have been excruciatingly narrow and dull.

Overall

The working conditions were primitive, the technology almost non-existent, and the actuarial work tedious, but there was a strong sense of family, of belonging to something. Not to mention the canteen, sports club, and other social events added to it. Sadly, that insurer disappeared in a later merger.

Given a choice, I wouldn’t like to relive those days. Despite all the pressures we see in workplaces today, there are more career choices, better and greater tools, and fantastic opportunities to develop skills.

What I wouldn’t change is working with those colourful actuary characters. Meeting interesting, quirky, and inspiring people is something I think we’re all the better for experiencing!

| Do you have any photos from old workplaces? How about interesting stories from previous jobs? We’re always on the lookout for more stories from all eras as part of our 125-year celebration. Just reach out to actuariesmag@actuaries.asn.au. |

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.