Under the Spotlight – Steve Hui (Councillor)

As we continue our Under the Spotlight column with our Councillors, we spoke to Steve Hui who has 45 years of actuarial experience. He shares his personal pursuits post-retirement and learnings for young actuaries.

My interesting/quirky hobbies… My interesting hobbies – learning Spanish (two years) and Piano (two months) as part of my exploration of new fields post retirement.

My favourite energetic pursuit… My energetic pursuits – Table Tennis (two hours a day and five times a week before the COVID-19 closure). Recently found out from social media that my coach in Shanghai represented China in the 1983 TT world championship. And Taichi movements and sword (every day).

What gets my goat…While working: people who think there are only their opinions and the wrong opinions in this world. Now: junk mail and junk phone calls.

I’d like to be brave enough to… to play ice hockey.

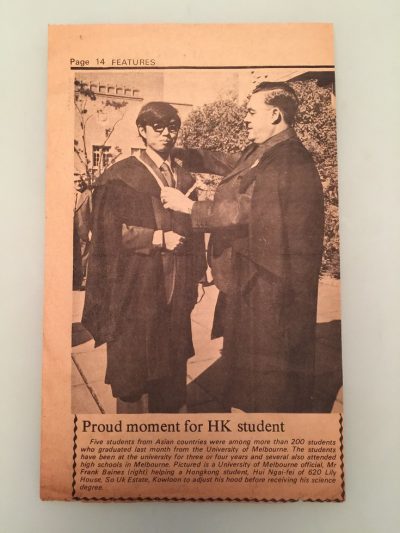

Not many people know this but I… My grandfather moved to Melbourne in 1918 as a carpenter for the housing boom after the end of World War I. That is a family history of 102 years in Australia.

Short description of career… I joined National Mutual Life immediately after completing my Maths degree at Melbourne University. In the years to follow, I qualified as an actuary, completed my Masters in IT and became a CPA. I have been very lucky to be able to utilise my qualifications in taking up diverse roles as chief actuary, chief regional information officer and head of accounting departments in various large multinational insurers such as AXA, AIA and Prudential UK. The work also took me to Shanghai and Beijing for a total of 11 years. During that period, I learned to speak Mandarin and play table tennis, two things I treasure very much. In the last two years I have been an advisor to the local regulator the HK Insurance Authority on risk-based capital development.

Where I studied to become an actuary and qualifications obtained... In our young days Macquarie just started and most like me would have qualified by self-study.

My proudest career achievement to date is … Highlights over the 45 years of working life include qualifying as FIAA in 1983 by also winning the Prescott Prize for getting the highest mark in Life Insurance, becoming the head of Accounting for the listed AXA Asia China Region, then Regional Chief Information Officer for AXA Asia and finally the CFO and Chief Actuary of AIA in China, a company with 3,000 staff and 30,000 sales people.

Who has been the biggest influence on my career (and why)… The biggest influence on my career – The senior executives and actuaries in NML (later becoming part of AXA) during my developmental years in mentoring me and giving me opportunities to work overseas as well as going outside the traditional actuarial area.

Why I’m proud to be an actuary… Actuaries are very highly regarded as professionals with the ability to solve financial problems in all the markets I have worked in.

The most valuable skill an actuary can possess is … The most valuable skill an actuary can possess is financial ability in translating data into ideas and solutions, then communicating effectively and convincingly to decision makers.

At least once in their life, every actuary should… work overseas and preferably in a developing market. The challenges you face and the experience gained in overcoming them are something you cannot get locally or from the textbooks.

If I were President of the Institute, one thing I would improve is… I would work hard to bed down the new education strategy to get the pass rates up without weakening the standard, allow younger actuaries to have more say in the Institute, and our work is to be more global.

My best advice for younger actuaries… My advice to new actuaries coming into the profession is that you may wish to plan your development in three phases. The first phase say five years should include qualifying as FIAA as one of your targets. During this phase you should learn the technical side as much as possible to equip yourself with the fundamentals. The second five year phase is the consolidation phase where you may want to try a wider range of applications of your skills gained from studying and during the first phase. Here you would need much greater emphasis in acquiring the communication skills of listening and talking as well as people management. The third phase is one you will need to decide you stay as a technical expert or go into the management stream where the skills you have gained over the first two phases will have different weightings. Judgement is then required based on everything you have learnt.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.