Losing Interest? What a Low Interest Rate Economy Means for Products, People & Investment

The Actuaries Summit plenary on low interest rates showed that structural changes in the economy will have enduring implications for the financial services industry. Hugh Miller reflects on the session.

Recent economic history has seen several firsts. But one of the most stark is the introduction of a 10-year fixed rate home loan in Denmark that offered a mortgage rate of negative 0.5%; every month you make a repayment and the bank in turn slices an additional amount off the outstanding balance. If you click through to the bank’s FAQ the first question is “How is this possible?”, with a surprisingly honest answer that begins “Yes, I hardly understand it either”. In Australia too, we have our lowest-ever cash rate, currently 0.25%.

To make sense of this, one of the plenaries at the recently concluded Actuaries Summit explored the topic of low interest rates. Happily, overall interest was not too low, with about 150 people logging in to Zoom to both listen and contribute to the discussion.

I led the first part of the discussion, starting with a look at the macroeconomic context of low interest rates. An important point was that low interest rates cannot be attributed wholly to events or cyclical factors; much of the decrease is a structural movement to lower interest rates.

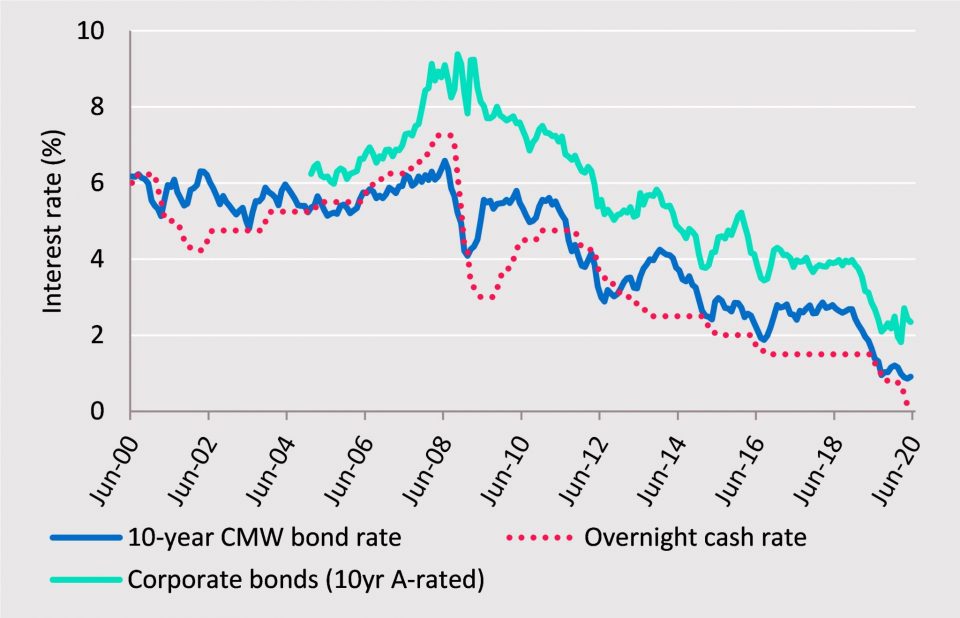

Interest rate movements over the past 20 years

The figure above shows changes in rates over time; while the decreases associated with the GFC and COVID-19 pandemic are clearly visible, there is a still steady decrease between 2012 and 2018 that is suggestive of longer-term trends. Models of neutral interest rates, both in Australia and overseas, consistently point to a fall in the neutral rate – the rate the reserve bank should adopt when unemployment is low without putting undue pressure on inflation.

There are several factors contributing to the structural decrease in rates – while they apply to Australia they also apply to most developed countries, since low interest rates is a global phenomenon. Persistent low inflation has certainly been a key factor; despite low unemployment, Australia has seen little inflationary pressure in the past two decades. Other structural reasons include:

- An aging population which has more net savers (and so less overall benefit to borrowers from an interest rate cut).

- Increased saving rates, particularly since the GFC. This may also reflect the already high rate of household debt in Australia.

- Low productivity growth, which in turn has been linked to low real wage growth.

- A moderate shift in GDP allocation away from wages and to profits.

- Rising inequality, particularly for wealth. Over the 15 years to 2018 the top quintile for household wealth had a real increase of 65%, compared to just 3% for the lowest quintile. Inequality has been associated with lower economic growth rates.

The COVID-19 pandemic has accelerated some structural effects too; government debt was already high in many countries and it has risen substantially.A higher debt burden means that a central bank rate increase raises interest bills to government when debt rolls over.

Low interest rates have created a challenge for central banks, who have limited room for further interest rate cuts to stimulate the economy. This has led to increased use of ‘unconventional’ monetary policy, which the session briefly covered. While many European countries have experimented with negative interest rates, Australia is more likely to continue to rely on other tools such as:

- Quantitative easing. In Australia the RBA has begun QE via a 0.25% target yield for the 3-year bond rate of 0.25%. After an initial round of $40b of purchases, the market has adjusted to this lower yield. Other countries have also seen reserve banks buying corporate bonds and even equities in Japan.

- Liquidity operations, which are activities to keep credit markets open, which we’ve seen in many countries including Australia

- Forward guidance, assuring markets that interest rates will stay low until there is clear evidence of economic recovery in for both employment and inflation.

Finally, I looked at implications for some financial service products. If the evidence is that rates will stay lower for longer, this means that organisations must adapt to lower expected investment returns. This means that:

- Retirement products such as annuities offer significantly less value to consumers, in some cases becoming unviable. Low investment returns coupled with slow superannuation drawdown rates by retirees may lead to lower standards of living in retirement and increased dependence on the age pension.

- Long-tailed insurance policies often fund cheaper premiums through investment returns. For example, a notional CTP premium sees a 19% increase if profit margins are maintained and risk-free rates fall by 4%, a material increase.

- Investment markets may see greater uncertainty in valuations, as traditional valuation metrics that rely on historical higher risk-free rates begin to break down. Companies too may need to re-evaluate their usual 12% or 15% hurdle rates required for projects if cash is cheap.

Sean Carmody provided some further insights on the impact of low interest rates as well as providing details of how APRA had responded to the changing environment, including the impact of the COVID-19 pandemic.

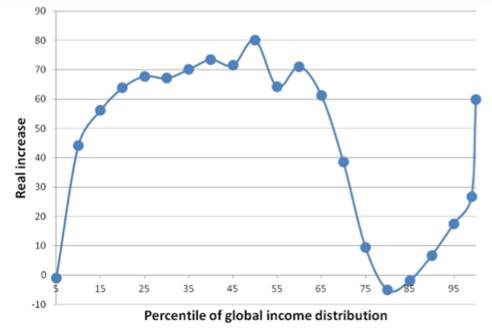

APRA’s takes a broad approach to identifying and understanding risk and vulnerability. While there is obvious attention paid to systemic economic risks, it is important to understand how low interest rates interacts with in the broader context of other factors that may amplify or mitigate the risk. He shared the ‘elephant chart’, shown below, which highlights the low wage growth for the global upper-middle class, which interacts with lower consumption growth, and increased populism as dissatisfaction with the economy increases. Such interactions are important for understanding specific risks around profitability and sustainability in financial services.

Change in real income 1998-2008 (2005 dollars)

Sean pointed to a range of risks and developments observed as part of APRA’s role as supervisor:

- Bank margins have been falling in recent years, with pressure to offer both competitive loans and deposit rates squeezing profitability. Banks, and other organisations may also see limited ability to increase prices due to competitive pressures.

- Insurance companies with long-term products have generally had good matching between assets and liabilities, protecting them from the increases in their liabilities due to lower risk-free rates.

- Companies may be tempted to hunt for higher yields by taking on more risks. However, he gave the example of general insurance companies who have maintained high levels of government and other high-grade bonds in their portfolios.

- Superannuation funds have seen a sharp increase in cash holdings in their asset allocations, reversing the trend of the previous few years.

In the context of COVID-19, Sean flagged that by early August superannuation early release was $31b, which represented a substantial fraction of all money made available to people by government to support them through the pandemic. He also made the case for transparency and making good data available quickly to help government and the market during the pandemic. APRA has been releasing new statistics such as the amount of loans subject to repayment deferrals.

The session then saw a wide-ranging question and answer session, ably managed by chairperson Melinda Howes. Overall, the session was a good reminder to actuaries that times have changed, and our modelling and assumption setting should reflect that so that we can offer appropriate advice to our organisations and clients.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.