The Climate Change Adaptation Gap: An Actuarial Perspective

This note discussed the IAA paper which was prepared jointly by the Climate Risk Task Force of the IAA and Working Group I of the Intergovernmental Panel on Climate Change (IPCC), published in May 2023.

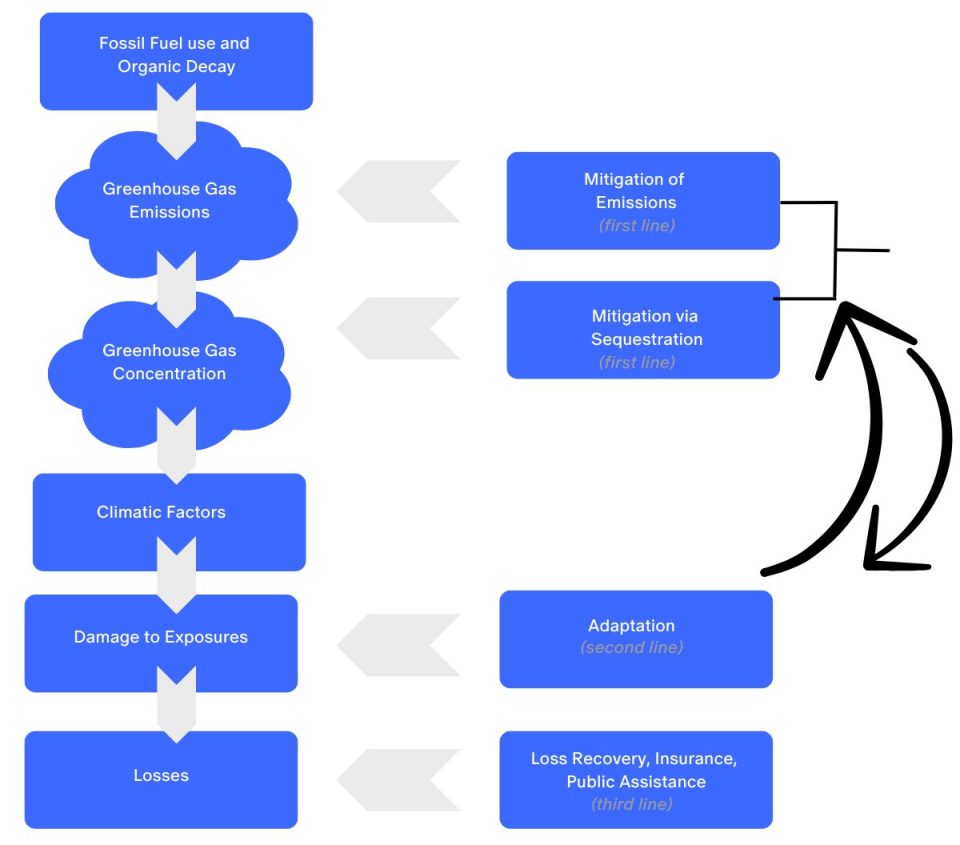

The Paper discusses a ‘three lines of defence’ model:

- Mitigation: Reducing emissions of greenhouse gases (GHGs) and capturing.

- Adaptation: Adjusting to actual and expected climate and its effects.

- Loss recovery: Minimising the ultimate losses from damage caused by climate change, e.g., by the use of insurance.

Figure 1: The Climate Change Loss Process and Lines of Defense

The Paper focuses on adaptation and its ability to build resilience. It notes that progress has been slow, siloed, and incremental, without the transformative adaptation needed[1], leading to the adaptation gap in the Paper’s title. As is clear from numerous extreme climate-related events both in Australia and overseas, adaptation action is needed on a transformational scale.

There are significant synergies between mitigation and adaptation. For example, protecting eco-systems through enhanced cropland management can assist both adaptation and carbon storage.

Both adaptation and mitigation require investment, although there is a significant timing mismatch between upfront costs and long-term benefits. The National Emergency Management Agency (NEMA) finds that every dollar spent on disaster risk reduction provides an estimated $9.60 return on investment[2].

Mitigation tends to be global in nature, while adaptation is generally local or regional. This has implications for poorer economies which are often most affected by climate change but least able to afford adaptation measures. More affluent countries probably need to help poorer countries with mitigation costs, such as the cost of moving away from fossil fuels. This is because without mitigation the costs of adaptation will continue to increase, e.g., the effect of rising sea levels on Pacific Island nations.

Risk management must take into consideration future conditions, and the uncertainty surrounding those conditions. Stochastic consideration of possible hazards may be appropriate.

The Role of Actuaries

Actuaries can contribute significantly in address the adaptation gap:

- Assessment of potential adaptation actions using their experience and skills in risk management, scenario, and cost-benefit analysis, along with consideration of the time value of costs and benefits. This could encompass cost benefit analysis of wealthier countries subsidising mitigation costs (e.g., the cost of electrification) in poorer countries. This would generally raise the economic growth of the local region, for a more global benefit.

- Actuaries are used to consideration and communication of future uncertainties, across a range of scenarios.

- Actuaries can play an important role in inter-disciplinary considerations of interactions between climate change and adaptation measures, and the financial system.

- Actuaries experience in risk assessment and management can help quantify, compare, and prioritise alternative future courses of action.

- There is a clear need for actuarial involvement in traditional areas of life, general and health insurance.

The Actuaries Institute is very aware of climate risks generally, and in relation to insurance in particular. It has recently published two Reports discussing the affordability of insurance: the Home Insurance Affordability Update[3], and ways to address the costs of floods: Funding for Flood Costs: Affordability, Availability and Public Policy Options[4].

The current Home Insurance Affordability Index is compared with the index in the 2022 Green Paper, Home Insurance Affordability and Socioeconomic Equity in a Changing Climate. Both Reports refer to the Australian Actuaries Home Insurance Affordability (AAHIA) Index.

Key takeaways include:

- 12% of households are now thought to be experiencing insurance affordability stress, compared to 10% in 2022.

- For these stressed households, the index is 8.8 weeks (insurance premiums absorb 8.8 weeks of the household income), c.f. 7.7 in 2022.

- The average household index is 1.3 weeks.

The Funding for Flood Costs: Affordability, Availability and Public Policy Options Report focused on flooding ,and riverine flooding in particular. It draws on the Home Insurance Affordability Update finding that 12% of households are facing insurance affordability stress. It notes that this represents a potential $3.6 billion ‘protection gap’ through a lack of insurance or underinsurance.

This Report considers policy options such as risk reduction, cost sharing and government cost reduction activities.

The International Association of Insurance Supervisors (IAIS) is also actively considering the role of insurance supervisors in addressing natural catastrophe protection gaps, having issued a statement in April 2023.[5]

Interested readers are encouraged to refer to the linked papers to learn more about actuaries’ contributions to natural catastrophe risk management and adaptation.

References

[1] https://report.ipcc.ch/ar6/wg2/IPCC_AR6_WGII_FullReport.pdf; IPCC, 2022: Climate Change 2022: Impacts, Adaptation and Vulnerability. Contribution of Working Group II to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [H.-O. Pörtner, D.C. Roberts, M. Tignor, E.S. Poloczanska, K. Mintenbeck, A. Alegría, M. Craig, S. Langsdorf, S. Löschke, V. Möller, A. Okem, B. Rama (eds.)]. Cambridge University Press. Cambridge University Press, Cambridge, UK and New York, NY, USA, 3056 pp., doi:10.1017/9781009325844.

[2] Disaster Ready Fund | National Emergency Management Agency (nema.gov.au)

[3] Home Insurance Affordability Update; Actuaries Institute Report; Paddam, S., Liu, C., Philip, S; August 2023

[4] Funding for Flood Costs: Affordability, Availability and Public Policy Options; Actuaries Institute Report; Chow, E., Barnes, D., Blunden, J., Davidson, J., Pang, E., Turvey, W., & Manton-Hall, J; August 2023

[5] IAIS statement on natural catastrophe protection gaps_2023 (iaisweb.org); IAIS Statement; April 2023[5]

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.