Understanding super tax concessions

In recent weeks, there has been considerable public commentary about superannuation tax concessions.

In particular, the discussion has focused on the Government’s suggestion that individuals with very high superannuation balances are receiving concessions that cannot be justified in the context of the proposed objective of superannuation, including that the superannuation system should operate in an “equitable and sustainable way.”

Public debate is raging and there are many conflicting and confusing statements being made. So let’s try and sort out the facts from the fiction, and assess whether there really is a need to tackle the existing super tax concessions, particularly at the top end.

The best place to start is at the purpose of these tax concessions.

Traditionally, concessions (or incentives) were present to encourage individuals and households to save for their retirement. That is, to overcome the natural myopia that most people have not considered the longer-term future. However, within the compulsory superannuation system that Australia has for employees, this argument has less credibility.

Nevertheless, the Henry Tax Review suggested that “There are at least two reasons for taxing superannuation more favourably than other saving”[1].

“The first reason is that taxing investment earnings … means that the effective rate of tax on the real value of saving increases the longer an asset is held.[2]”

Of course, this effect is more pronounced in superannuation as assets are normally held for a longer period.

“The second reason is that superannuation is a form of deferred income” and that “a person’s retirement income is generally lower than their income while they were working.”[3]

However, there is also another reason for the existence of super tax concessions. This relates to the strong preservation rules that exist in Australia. That is, most individuals are unable to access their superannuation until age 60, at the earliest. This is very different from their other forms of savings which they can access, as and when needed.

Preservation ensures that superannuation benefits are available at retirement and this is consistent with its ultimate purpose. But it is reasonable that some compensation is provided to offset this lack of access.

Of course, preservation until retirement also means that many superannuation benefits will be used to reduce an individual’s access to the Age Pension, thereby reducing future government expenditure on the Age Pension. In fact, as the Australian super system matures, this is the very outcome that is occurring.

In summary, there are several reasons why superannuation should not be taxed in the same way as other forms of saving. Yet, that is the very benchmark that is used when the value of super tax concessions is calculated.

The calculation of the superannuation tax concessions

There are two major types of super tax concessions; namely concessional contributions (such as those made by employers) and investment income earned by super funds.

The value of the concession in respect of contributions is calculated as the difference between the individual’s marginal income tax rate and the 15% tax rate paid by the superannuation fund on these contributions. High-income earners also pay an additional 15%.

For most individuals, the value of this concession is in the order of 15-20% of the concessional contribution, but there are some exceptions. One exception is for those with incomes below the income tax threshold of $18,200. These individuals, in effect, receive no concession as they pay no income tax on their normal income and although the low-income super tax offset (LISTO) offsets the tax paid by the super fund, the net effect is no concession. The other exception is for some individuals earning between $180,000 and $250,000 who may receive a concession worth as much as 32%.

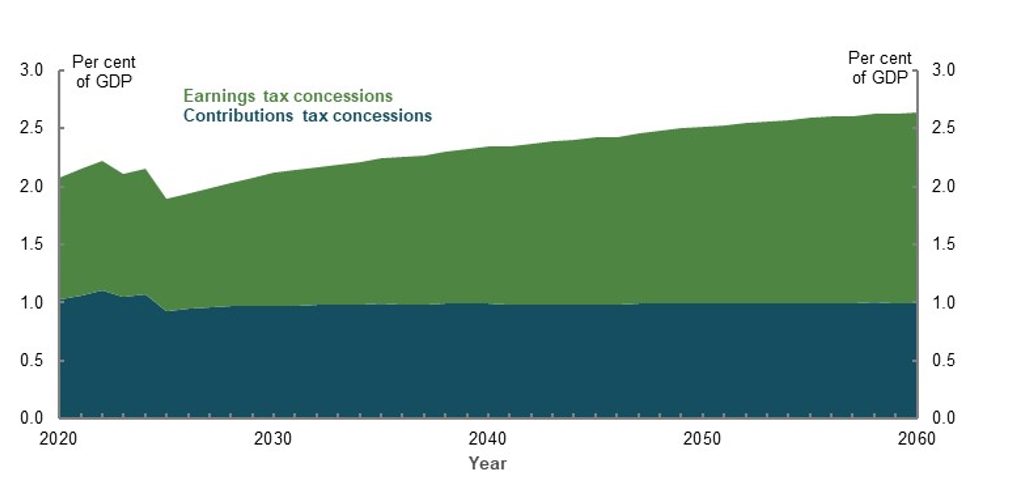

As shown in the chart below[4], taken from the Retirement Income Review, the value of this concession is expected to remain relatively steady at about 1% of GDP.

(Author’s own calculations)

The calculation of the investment earnings concession is calculated in a similar way; namely the difference between an individual’s marginal rate of tax and the tax rate paid on investment earnings paid by the super fund – 15% on income and 10% on realised capital gains.

Not surprisingly the value of this concession is expected to increase in future years as the size of Australia’s superannuation assets increases at a faster rate than GDP.

However, the calculation of this particular concession has some shortcomings. Let me mention two.

First, the benchmark used: If this concession were reduced, there would be significant behaviour change. Hence the use of the top marginal tax rate as the benchmark exaggerates the value of this concession. To be fair, the Retirement Income Review noted that the potential revenue gain is less than the revenue forgone but this distinction is not recognised by most commentators.

Second, the compounding effect: The projected concession assumes that the concession continues. That is, if this concession were to be reduced in some way, the value of future concessions would also be reduced.

Comments from the Retirement Income Review

There are several comments in the Final Report of the Retirement Income Review that are relevant when considering the equity of the current superannuation tax arrangements.

In particular:

- “There are areas where superannuation tax concessions are not a cost‑effective way to help people achieve adequate retirement incomes. In particular, the cost of the earnings tax exemption in retirement will grow faster than the growth in the economy as the system matures and provides the greatest boost to retirement incomes of higher‑income earners.”[5]

- “A superannuation balance of $5 million can achieve annual earnings tax concessions of around $70,000.”[6]

- “Overall, superannuation tax concessions increase inequity in the retirement income system, while the Age Pension helps offset inequity in retirement. One of the suggested elements of the retirement income system’s objective is that Government support should be targeted to those in need. This would appear to be the case for the Age Pension. However, the combination of a system where people on higher incomes achieve the largest superannuation balances, combined with tax concessions on superannuation contributions and earnings, means that higher‑income earners receive more Government support than other income groups over their lifetime .”[7]

- “Changes to earnings tax concessions would increase the system’s cost‑effectiveness and directly contribute to improving its sustainability by reducing the growth in costs relative to growth in GDP.”[8]

Although no recommendations were made by the Retirement Income Review, it is clear that the Review was concerned by the level of taxation concessions received by higher-income earners and particularly those with large super balances.

Should super tax concessions be reviewed at the top end?

Although one can debate the methodology used to calculate the size of the investment earnings concession, there is no doubt that those with very large super balances receive significant concessions from the current taxation arrangements. It is also worth noting that these balances have not arisen from illegal activity. Rather these individuals have followed the rules of the day and invested well.

Nevertheless, the concessions received are not required to support an above-average standard of living during retirement and they will not reduce future Age Pension expenditure. It is therefore appropriate for the Government to consider ways of reducing the current level of concessions received by those with very large super balances to improve both sustainability and equity.

The best way to do this is the topic for another paper!

References

[1] Australia’s Future Tax System Review, Final Report, p96.

[2] ibid, p97.

[3] ibid, p97.

[4] Retirement Income Review, Final Report, Chart 4A-17, p391.

[5] ibid, p20.

[6] ibid, p40.

[7 ibid, p41.

[8] ibid, p53.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.