Driving the future: supporting a rapid transition to electric vehicles

Australia’s transitioning automotive ecosystem from Internal Combustion Engine (ICE) vehicles to electric vehicles (EVs) means major changes for manufacturers, financiers, motor dealers, EV infrastructure players, repairer networks, and insurers.

This article outlines key issues and explores the role of insurance in the EV transition with excerpts from articles in Finity’s Driving the Future series.

The EV transition

EVs are a critical component of the Commonwealth government’s targeted 43% reduction in carbon emissions by 2030. Labor’s policy modelling[1]assumes significant growth in EVs – from about 2% of new car sales currently up to almost 90% by 2030, with EVs forecast to represent about 15% of total registered vehicles by that date.

The Commonwealth Government has outlined a number of key initiatives in support of meeting this target, including making EVs cheaper (with planned exemptions on FBT and import tax), increasing the number of models (and therefore choice) available, mandating targets in government fleets, and significant investment in charging infrastructure. State governments have also developed various incentives and investment programs.

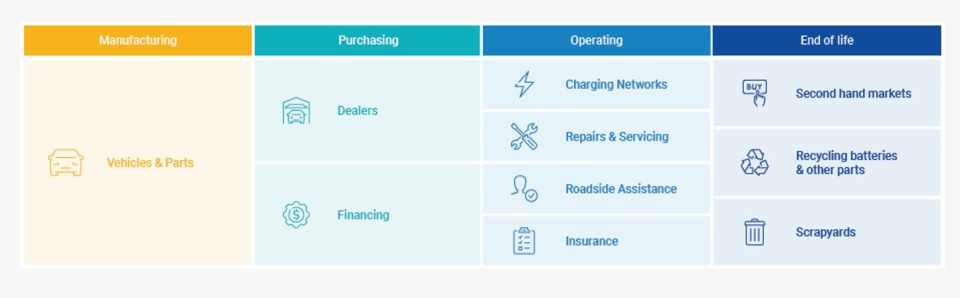

Against this backdrop, the figure below summarises important considerations across each stage of the EV life cycle.

Considerations for stakeholders across the EV life cycle

- Manufacturing: Major vehicle manufacturers globally have adopted EV-centric strategies, although in the short-run, many are facing supply chain disruption and resource constraints. Both retail and commercial consumers are showing strong demand for EVs.

- Purchasing: EVs are likely to require less service and repairs, which presents challenges for the dealer network which has traditionally relied on financing, servicing and repair income to subsidise vehicle sales.

- Operating: While the need for charging networks has captured a large part of EV infrastructure discussions to date, other elements including, repairs, roadside assistance and insurance, are less well understood.

- End of life: CSIRO research[2] shows that only 2% of electric batteries are recycled. Safe disposal of written-off EV bodies is another area that needs scoping out before a commercial local industry in this area can be developed.

State of the market

EVs make up a small but rapidly growing number of cars on the road in Australia. According to the Electric Vehicle Council’s State of Electric Vehicles[3] March 2022 report, EV sales tripled in 2021 to almost 21,000 (2% of total sales) compared to 2020s 7,000 (0.8% of total sales), with more choices in terms of models and lower prices, and state and territory government incentives generating market demand.

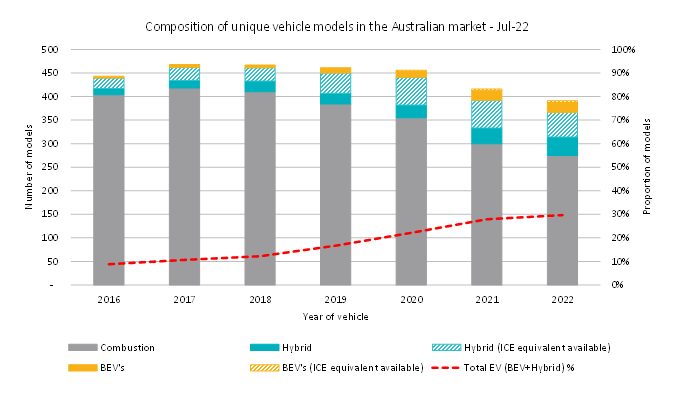

The graph below based on Glass’s Guide (July 2022)[4] data shows that both the number of EV models and the proportion of all models that EVs represent have grown over time. Conversely, the number of unique ICE vehicles has been decreasing, reflecting both increasing consumer EV demand as well as a broader manufacturer push for range simplification.

The State of Electric Vehicles[5] report notes that

“Rising sales and long waiting lists emphasise that further growth in Australia is inhibited not by a lack of consumer demand, but by supply constraints.”

EV Infrastructure

The building blocks of EV infrastructure go beyond simply installing charging infrastructure across the nation[6]. Other systems we have come to rely on within our historic ICE vehicle environment – such as roadside assistance, parts, repairs, finance and insurance – need to be adequately evolved to support EVs.

At the moment, the services component of the EV market is tightly held, with EV manufacturers adopting vertical integration models and taking a greater stake in associated sub-sectors, such as repair shops, salvage providers, battery disposal operators, roadside repairers and insurance.

Parts supply is also a weakness, exacerbated by existing global supply chain strains, with spare parts expensive and difficult to access. One Senate inquiry[7] found although there was an argument for establishing an EV parts industry in Australia using 3D printing. In reality, the tiny nature of the market here makes it uneconomic.

The nature of repairs also complicates these processes. For example, in an EV, controls are integrated into one panel in the vehicle, so it is not usually possible to replace just one component. Existing networks of repairers will need to upskill and expand to meet increasing volumes of EVs, requiring substantial investment in specialist workshop equipment, diagnostic tools, personnel training, technical data and repair methods. We foresee a likely increase in labour costs, and a likely reduction in competitive repair choices – placing upwards pressure on repair costs for insurers.

Claims considerations

The prima facie expectation is that EVs are safer, with fewer collision claims expected as EV share grows. This is due to the more advanced driver-assist technology embedded within EVs, as well as their ability to incorporate further technology advances. However, the risk dynamics at play go beyond safety features to numerous other factors including driver behaviour and vehicle range. A recent analysis by Cambridge Mobile Telematics[8] found that EVs display unique risk factors distinct from ICE vehicles (such as faster acceleration) and that a driver’s risk profile can differ depending on what kind of vehicle they are driving.

Another risk consideration is vehicle weight, with EVs being heavier due to the battery and associated componentry. For a given speed of impact, the stopping distance and any damage are generally greater to both vehicles and pedestrians for EVs compared to ICE vehicle collisions. EVs also have a high power-to-weight / acceleration ratio relative to comparable ICE vehicles, opening up more powerful vehicles to a broader, younger (and higher risk) audience. EVs are also quieter, leading to an increase in the rates of incidents involving pedestrians.

Considering the cost of repair issues noted above, we expect that in the short term the net result will be higher claims cost pressures. This is supported by industry experience to date, with Suncorp motor expert Steve Cratchley noting that,

“There is absolutely no question that EVs are costlier at this point [for claims] – every insurer’s data would show this.”

However, Cratchley believes the difference between EV and ICE repairs will reduce over time, as parts supply issues are addressed and repairer capacity and capability increase.

Product, Underwriting and Pricing observations

Finity’s analysis shows that at an overall market level there is little evidence of a price differential between ICE vehicles and EVs, all else being equal. On average, a consumer does currently pay more for EV insurance – however, this is essentially a reflection of higher sums insured, rather than insurers’ pricing for the higher claims costs discussed in the previous section.

Product differences are negligible across the market and there is generally good availability of insurance for EVs. There are some minor exceptions – for example, one insurer in Finity’s analysis currently excludes Teslas, and another does not write high sums insured, which will reduce underwriting of EVs due to their higher price point. This may perhaps be an indication that differing EV strategies across insurers are beginning to emerge.

Conclusion

All players in the automotive ecosystem have a role to play in supporting Australia’s transition to electric vehicles (EVs). This transition will create a range of challenges and opportunities for stakeholders across the entire vehicle lifecycle. Currently, insurers are largely adopting a ‘wait and see’ approach in relation to EV products, underwriting, pricing and developing an EV strategy, including due consideration of the transition phase. However, these are becoming looming imperatives for insurers.

The Driving the Future series is available in the links below:

- Supporting a rapid transition to electric vehicles

- Navigating the road ahead for insurers

- Gearing up for maturity – Developing an Australian electric vehicle market

References

[1] Reputex Energy, December 2021, The Economic Impact of the ALP’s Powering Australian Plan – Summary of Modelling Results https://www.reputex.com/wp-content/uploads/2021/12/REPUTEX_The-economic-impact-of-the-ALPs-Powering-Australia-Plan_Summary-Report-1221-2.pdf

[2] Lithium battery recycling in Australia: current status and opportunities for developing a new Industry, A CSIRO Report

[3] Electric Vehicle Council, 2022, State of Electric Vehicles March 2022 report, accessed 9/8/22, https://electricvehiclecouncil.com.au/wp-content/uploads/2022/03/EVC-State-of-EVs-2022-1.pdf

[4] Note ‘Hybrids’ for this analysis incorporates PHEVs as well as regular hybrids (i.e. including regenerative braking batteries).

[5] Electric Vehicle Council, 2022, State of Electric Vehicles March 2022 report, accessed 9/8/22, https://electricvehiclecouncil.com.au/wp-content/uploads/2022/03/EVC-State-of-EVs-2022-1.pdf

[6] It is worth noting that advancements in charging technology continue to reduce concerns of home electrical upgrades being required.

[7] Report of the Select Committee on Electric Vehicles, 2019, https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Electric_Vehicles/ElectricVehicles/Report

[8] https://www.cmtelematics.com/news/cambridge-mobile-telematics-research-into-electric-vehicle-risk-unveils-key-insights-into-changes-in-road-safety-in-an-ev-future/

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.