What is ‘loss and damage’?

A topic of increasing focus, and likely to be a major agenda item at COP27 (Conference of the Parties #27) in Egypt this November, is ‘loss and damage’

Broadly, this could be seen as referring to the adverse effects of human-caused climate change, including loss of life and irreparable and repairable damage to property. This can include the loss of land through rising sea levels, and also the loss of the use of land through salination.

Loss and damage is not clearly defined, largely for political reasons. Developing countries and small island states lean towards holding the big historical greenhouse gas (GHG) emitters responsible for causing climate change. This leads to an argument for compensation from those emitters (sometimes referred to as climate reparations).

These large historical emitters, particularly the US, prefer a framework centred on adaptation. This argument means that ongoing efforts to cut emissions and adapt to climate change impacts are already addressing loss and damage.

A more widely accepted way of defining loss and damage centres on climate risks that remain despite efforts to cut emissions and adapt to the consequences of climate change. This supports developing countries aiming at risks remaining beyond adaptation, while not discussing compensation. It still remains difficult to understand where adaptation ends and loss and damage begins.

Who is most vulnerable to loss and damage?

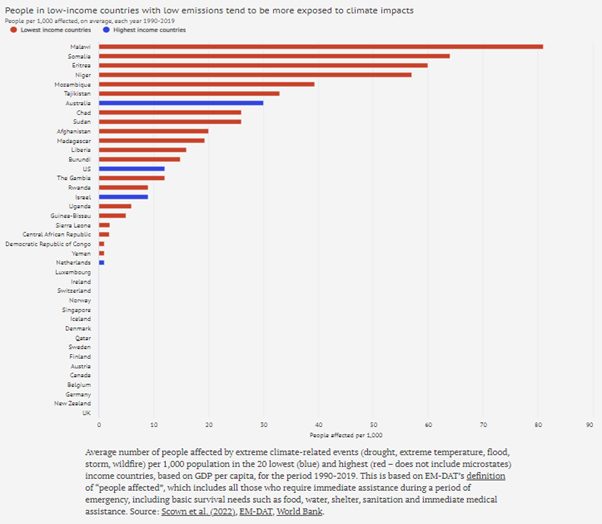

Climate impacts are most often faced by people in the least wealthy countries, who coincidentally have the smallest contributions to global GHG emissions. This brings climate justice into the discussion.

The first chart below shows that people in low-income countries are generally more at risk of loss and damage than more affluent populations.

Australia is notably the most at risk of the high-income countries, as the more intense and frequent experience of floods and fires in recent years illustrates.

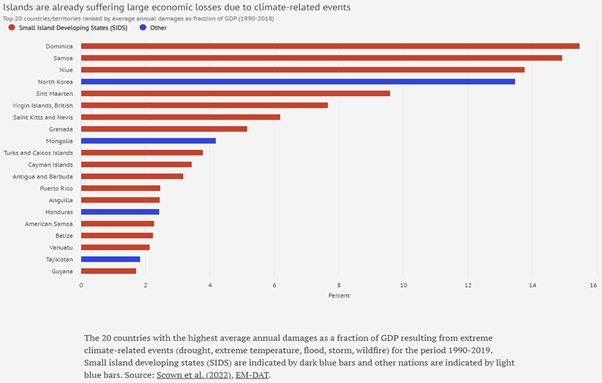

Small island nations are particularly vulnerable to climate change with risks of rising sea levels and inadequate funds to address the problem. The second chart below shows annual losses as a percentage of GDP. Small island developing states are very prominent in terms of economic loss. Australia’s neighbours, small inland nations in the Pacific Ocean, are at risk, with Tuvalu considered the first nation that could become uninhabitable.

The Intergovernmental Panel on Climate Change (IPCC) recently noted, “It has long been recognised that greenhouse gas emissions from small islands are negligible in relation to global emissions, but that the threats of climate change and sea level rise to small islands are very real. Indeed, it has been suggested that the very existence of some atoll nations is threatened by rising sea levels associated with global warming.”

Paying for loss and damage

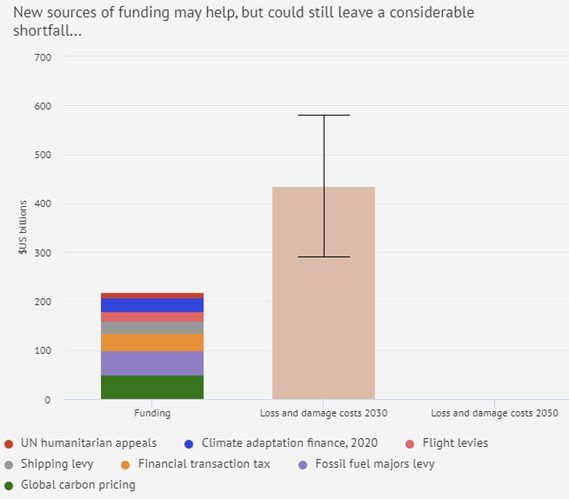

A recent study estimated that damage costs for developing countries from climate change, that cannot be prevented by adaptation, will be USD$290-580 billion per annum by 2030. This could rise to exceed USD$1 trillion by 2050.

Insurance for extreme weather events can cover some of the damage and has been done in the past. But this is very much in favour of developed countries rather than developing countries.

Support by developed countries for developing countries, including Insurance schemes, has been inadequate or sporadic. Developed countries continue with existing finance arrangements such as adaption spending and humanitarian aid, rather than establishing new arrangements to address loss and damage. Even adaptation finance is significantly below what is needed.

Developing countries believe loss and damage finance should be new and additional funding. Innovative funding has been proposed, such as levies on fossil fuel companies, and airline and shipping fuels. A financial transaction tax on monetary transactions or trades has also been proposed. But these proposed funding vehicles still fall short of meeting projected costs (see chart below).

Compensation is not entirely off the table, but developing countries are calling for funding on the basis of solidarity.

Spending loss and damage finance

Spending any loss and damage finance is best determined using local knowledge. There are three broad categories of needs:

- Relief and rehabilitation/emergency response

- Recovery and reconstruction / reconstruction

- Disaster risk reduction/prevention and preparedness.

The Warsaw International Mechanism (WIM), the loss and damage oversight body under the United Nations Framework Convention on Climate Change (UNFCCC), is a vehicle for countries to specify measures and needs to recover from loss and damage.

As an example, Vanuatu has raised the need for finance to assess and redress climate impacts and address:

- Relocation costs for coastal communities

- Rebuilding homes and infrastructure lost through extreme weather events

- Safety net programmes for the most vulnerable

- Emergency funds to use as needed

- Risk management programmes

- Technological cooperation and transfer, including measurement of loss and damage.

Climate justice

As discussed, countries and people most at risk from climate change are more often developing nations or small inland states. Generally speaking, these countries have not been responsible for significant amounts of GHGs. Arguments that those most responsible for generating GHGs should finance the losses and damages of those most at risk are put forward as a matter of climate justice.

This year, at the United Nations General Assembly, the United Nations chief, Antonio Guterres, raised concerns regarding loss and damage. He noted it was a “fundamental question of climate justice, international solidarity and trust” saying that “polluters must pay” because “vulnerable countries need meaningful action”.

|

This note is based on a series of articles in Carbon Brief, edited by Leo Hickman, published in the week ending 3 Oct 2022. This series includes many further references.

|

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.