Climate Change and Appointed Actuaries

The Climate and Sustainability Working Group (CSWG) has recently released a Climate Change Technical Paper (TP) for Appointed Actuaries.

This TP is designed to inform and educate Members about climate risks and opportunities that may be relevant for Appointed Actuaries of insurers in fulfilling their statutory duties. It is an update of the Climate Change Information Note for Appointed Actuaries originally released in November 2020.

The TP includes updates on climate change regulation, disclosure and science, including:

- Increased regulatory focus on climate change: APRA CPG229 has been published to give guidance on how financial institutions should manage climate financial risks.

- Evolving disclosure standards: The TP discusses the recently released ISSB standards and upcoming mandatory climate disclosures for Australia, and points to resources relating to these.

- Summary of the latest IPCC Assessment Report.

- Discussion of how greenwashing risk has become a focus area for regulators and examples of what liability risk means for insurers.

While the primary audience of the TP is Appointed Actuaries of general, life and health insurance companies, some of the ideas discussed in the paper may be useful for actuaries working in pricing, reserving, capital, reinsurance, investments and other areas.

This TP does not impose any new requirements on Appointed Actuaries; rather, it is designed to help interpret existing regulations and standards in the context of climate risks and opportunities.

Climate change is a very broad topic and there are many aspects of climate change-related work that actuaries may be involved in beyond an Appointed Actuary’s (AA’s) typical duties, including climate scenario analysis, measurement and reporting of emissions, climate risk management, external disclosures, etc. The TP does not try to educate actuaries on the details of these topics but does provide a selection of resources which actuaries may find useful.

The rest of this article summarises some of what is covered in the TP, with a particular focus on the most recent updates.

Types of climate risks

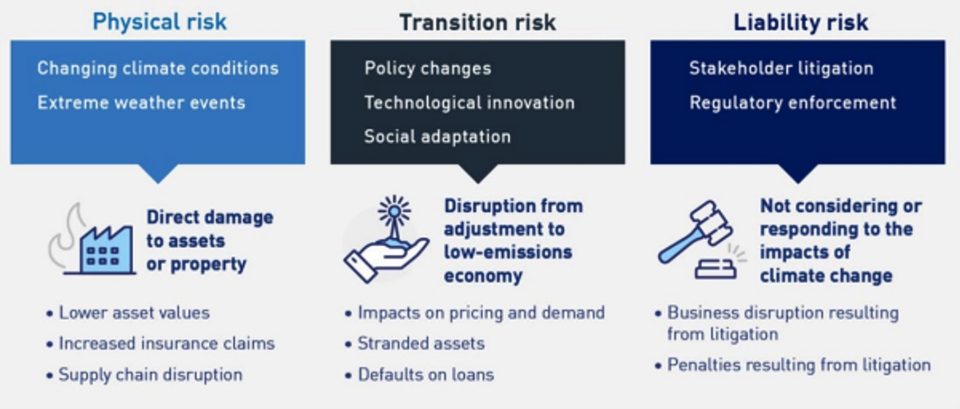

Three main mechanisms giving rise to climate impacts have been identified by the Bank of England’s Prudential Regulation authority:

- Physical risks: Risks arising from long-term changes in climate and extreme weather events, e.g., property damage, business interruption, global supply chain disruption.

- Transition risks: Financial risks associated with moving to a low-carbon economy. Changes in policy and regulation, technological change, and social change lead to changes in asset value, investment preferences and insurance costs and needs.

- Liability risks: Directors and trustees may be held responsible for failure to adequately mitigate physical or transition risk.

Climate risks may interact or compound with other risks, such as credit risk, market risk and operational risk.

Insurers

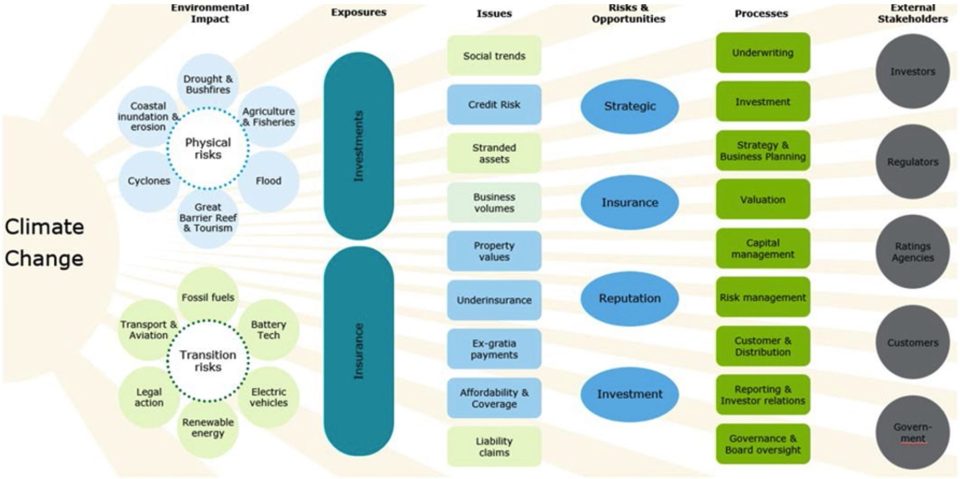

This diagram illustrates how physical and transition climate risks could affect many parts of the insurance value chain, including pricing, underwriting, product design, liability valuation, risk management and capital management. The TP gives further detail on how climate change may impact certain topics that an Appointed Actuary is expected to comment on in a Financial Condition Report (FCR).

Climate change issues and impacts[1]

CPG229 and APRA CVA

APRA released the prudential guide CPG229 Climate Change Financial Risks in November 2021. CPG229 envisages entities will work with their stakeholders to improve their climate risk profile and include climate risk in their risk management processes. The TP complements CPG229 and assists actuaries in addressing climate change and the associated financial risks.

APRA also conducted a Climate Vulnerability Assessment (CVA) for banks in 2021-22. The figure below summarises the approach to capture quantitative and qualitative physical and transition risk impacts.

APRA CVA scenario analysis approach[2]

APRA is currently in the process of designing the next CVA, which will focus on general insurance.

Climate Disclosures

The Taskforce on Climate-related Financial Disclosures (TCFD) recommendations are voluntary and are designed to provide a methodology for consistent reporting on climate-related financial risk disclosures by financial institutions. They are strongly supported by insurance regulators globally and are now seen as the global standard for climate disclosures. Disclosure is under four pillars: Governance, Risk Management, Strategy, and Metrics and Targets.

Climate disclosure requirements are rapidly evolving. The International Sustainability Standards Board (ISSB) has recently released IFRS S1 and IFRS S2, which builds on the TCFD recommendations. The Australian Treasury is undergoing a second consultation on mandatory climate reporting, and the Australian Accounting Standards Board has also released Exposure Draft ED SR1 on climate-related disclosure requirements.

Greenwashing

Increasing numbers of organisations are passing themselves or their products off as “green”, “environmentally friendly”, “sustainable”, etc., when these descriptions are not necessarily accurate. ASIC is actively reviewing such claims and has already taken action on a number of cases where such claims may be misleading. ACCC is also investigating “green” claims and is looking for reliable evidence to support such claims.

Insurers should ensure that limitations and uncertainties in climate-related analyses are understood and adequately explained to manage greenwashing liability risk and ensure that “green” claims can be backed up with reliable evidence.

Climate Change Scenario Analysis

Given the level of uncertainty around climate change outcomes, better practice suggests considering a range of climate change scenarios rather than a single “best estimate”.

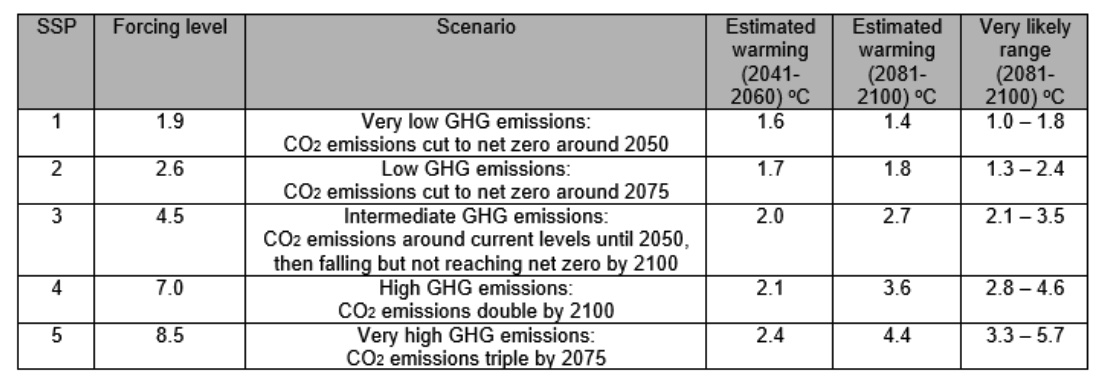

The Intergovernmental Panel on Climate Change (IPCC) put forward five Shared Socioeconomic Pathway (SSP) narratives in its sixth Assessment Report (AR6) with associated temperature increase outcomes:

IPCC AR6 scenarios[3]

When interpreting the results of climate scenario analysis, it is important to have a clear understanding of which elements are modelled and not modelled, as well as an understanding of model uncertainty.

Insights Session

The CSWG will discuss the Technical Paper at an upcoming Insights Session on 29 January 2024. More information will be shared shortly.

References

[1] Actuaries Institute (December 2023) Climate Change – Technical Paper for Appointed Actuaries https://www.actuaries.asn.au/Library/Standards/MultiPractice/2023/231207TPClimateChange.pdf

[2] Australian Prudential Regulation Authority (Nov 2022) Climate Vulnerability Assessment Results https://www.apra.gov.au/sites/default/files/2022-11/Information%20Paper%20-%20Climate%20Vulnerability%20Assessment%20Results.pdf

[3] Actuaries Institute (December 2023) Climate Change – Technical Paper for Appointed Actuaries https://www.actuaries.asn.au/Library/Standards/MultiPractice/2023/231207TPClimateChange.pdf

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.