How do individual risk perceptions impact citizens’ willingness to adopt the COVIDSafe app?

The development and endorsement of the Australian COVIDSafe app, the government’s initial form of tracing COVID-19 infections, received a mixed response from citizens and heightened the conversation around data privacy.

In late-2021, Dr. Dapeng Liu, lecturer at the School of Information Systems and Technology Management at UNSW, hosted a Virtual Insights session, where he presented a model framework to explore the risk beliefs and trust concerns regarding the use of digital contact tracing by citizens, specifically with COVIDSafe.

COVIDSafe was originally launched on 26 April 2020 by the Australian Government. The app is developed based on protocol exchange and Bluetooth communications, where the information is logged through a digital handshake with nearby devices. The Government encouraged citizens to download and use COVIDSafe with huge marketing efforts, but adoption is voluntary, and the health authorities must gain users’ consent to access their private information.

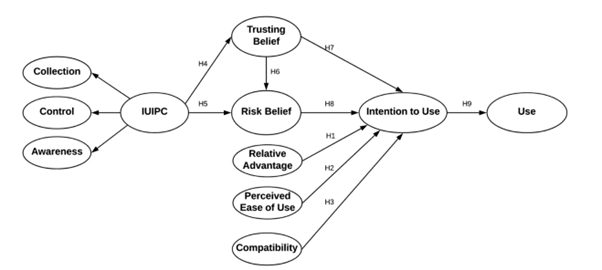

The researchers proposed an integrated Internet Users’ Information Privacy Concerns (IUIPC) and Diffusion of Innovation (DOI) model (Figure 1) to develop eight hypotheses:

Figure 1 – Research Model

The eight hypotheses considered in the research are as follows:

- H1 – Relative advantage will have a positive effect on intention to use COVIDSafe.

- H2 – Perceived ease of use will have a positive effect on intention to use COVIDSafe.

- H3 – Compatibility will have a positive effect on intention to use COVIDSafe.

- H4 – Internet users’ information privacy concerns will have a negative effect on trusting beliefs.

- H5 – Internet users’ information privacy concerns will have a positive effect on risk beliefs.

- H6 – Trusting beliefs will have a negative effect on risk beliefs.

- H7 – Trusting beliefs will have a positive effect on intention to use COVIDSafe.

- H8 – Risk beliefs will have a negative effect on intention to use COVIDSafe.

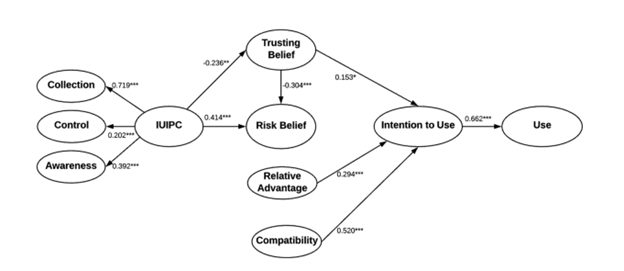

Using the collected data from an online survey to a sample of Australian residents, the researchers used the confirmatory factor analysis and structural equation modelling to test their model. The results of hypothesis testing (Figure 2) illustrate that all hypotheses except two (H2 and H6) were supported by the survey outcomes. The intention to use of COVIDSafe is increased by relative advantage, compatibility and trusting beliefs. Risk beliefs are increased by information privacy concerns but decreased by trusting beliefs.

Figure 2 – Significant results and path coefficients: p-Value

Their proposed model can be used to help predict the adoption intentions of digital apps by citizens with privacy concerns, in the future. In the global pandemic, individual risk beliefs about COVIDSafe were shown not to reduce the intention to adopt the technology. This finding reinforces the prevalence of ‘the privacy paradox’ where citizens are willing to balance their privacy concerns with the value from providing access to their data, in this case as a response tool for managing the pandemic (‘the value proposition’). This may not necessarily be the case for the use of apps in other situations.

For actuarial analysis, it requires enhanced senses in the art of risk perceptions to measure, predict and manage the potential threats to business and individuals. While risk beliefs can be decreased by trusting beliefs, actuaries are used to working with the known factors. Emerging risks like climate change and cyber security have posed new challenges in unknown unknowns for the actuarial profession.

Actuaries need to work together with the domain experts and establish a consistent risk framework to identify and quantify new types of risk arisen in the post-COVID era.

The talk also made links to the digitalisation of the service platforms for banks, financial institutions and insurance companies. The intention to adopt a new app can be boosted by improving the relative advantage, compatibility and trusting beliefs. It is recommended to add more support features and better integration with existing platforms to increase ease of use and uptake. Mass promotion and greater transparency can strengthen users’ trust.

It is also important to reinforce the trusting beliefs with regular updates addressing any emerging privacy concerns. With more businesses embracing new technologies, enhancing the mobile apps, as well as online capability, can be a more direct way to improve overall customer experience and add significant value to the company given the high uptake and use of smartphones in the community.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.