Credit rating agencies in managing climate risk

Rating agencies play an important role in providing insights into the financial risk of organisations around the world. Their ratings can have an impact on the cost of capital associated with the equity and debt issuances of our financial services sector.

In late-2021, representatives from S&P Global were invited to present to the Actuaries Institute’s Climate Risk Working Group (CRWG). The purpose of the presentation was to inform the CRWG on:

- How does S&P look at climate risk in credit ratings[1], and

- How does S&P validate climate change scenario analysis and TCFD reporting.

To answer these questions, two different parts of the S&P group presented separately.

S&P Global reminded us that credit ratings are intended to provide a “forward-looking opinion about creditworthiness”, focused on an “entity’s capacity to meet its financial commitments when they become due”.

Environmental, Social and Governance, the ‘ESG’ factors, are taken into consideration, alongside all other credit factors, when S&P considers they are relevant to and have or may have a material influence on creditworthiness. These factors are considered by industry and country, alongside the governance and entities own competitive position, risk exposure, capital, and earnings position. S&P Global outline five ESG credit factors that can influence ratings:

Principle One

| Our long-term issuer credit ratings do not have a pre-determined time horizon. |

Principle Two

| The current and potential future influence of ESG credit factors and creditworthiness can differ by industry, geography, and entity. |

Principle Three

| The direction of and visibility into ESG credit factors may be uncertain and can change rapidly. |

Principle Four

| The influence of ESG credit factors may change over time, which is reflected in the dynamic nature of our credit ratings. |

Principle Five

| Strong creditworthiness does not necessarily correlate with strong ESG credentials and vice versa. |

According to the presentation, the credit rating is extremely important for any company, especially when seeking to borrow money from the government, financial institutions, or stock markets. As a consequence, ESG has become increasingly central to an insurer’s business strategy, underwriting, and general decision-making. Specifically, S&P may adjust the operating costs situations of a company based on climate risk factors. Obviously, a company with low creditworthiness and a low-security rating will find it increasingly more difficult to borrow at lower costs of capital.

ESG factors impact 7% of insurance ratings today. In Australia, ‘S’ is having the most impact on insurance ratings, due to factors such as insurance affordability and COVID-19. However, the global reinsurance sector is dominated by the ‘E’ impact, largely related to the natural disasters and physical risk impacts of climate change.

The opposite is currently true for the global banking sector, where governance factors have driven the ratings actions. However, S&P notes that “The transition to a low carbon economy and the increasing frequency of climate events will heighten the relevance of ‘E’ factors in bank ratings analysis”.

| An example of an ESG related downgrade in 2020

“The ratings downgrade on Atmos reflects our expectations for weaker financial measures because of the extreme winter weather and extraordinary increase in natural gas prices. The severe winter weather and extremely cold temperatures created a very large increase in demand as well as a spike in natural gas prices. Atmos indicated it expects gas costs have risen $2.5 billion- $3.5 billion over this short period of time. Because of the higher costs, we expect Atmos’ financial measures to significantly weaken, including FFO to debt to about the 15%-17% range through 2023. Therefore, we are revising the financial risk profile downward to significant.” |

To validate climate change scenario analysis and TCFD reporting, S&P Global introduced Sustainable1, a single source of essential sustainability intelligence, which covers across global markets combined with in-depth data intelligence to navigate the transition to a low carbon, sustainable and equitable future.

The sophistication of the S&P Trucost Climate Change Physical Risk dataset is a great example of a tool to assist with assessing an organisations TCFD reporting and alignment to the Paris Agreement. It includes a universe of over 15,000 companies, utilising asset-level data to assess physical risk exposure where available and modelling physical risk based on company headquarters location and geographic revenue share where necessary.

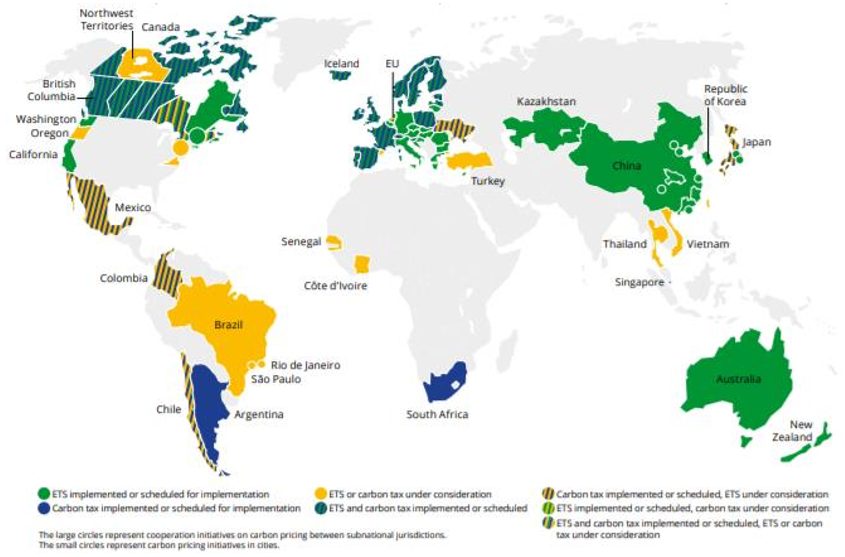

Trucost defines the gap between current carbon prices and future carbon price targets as the “Carbon Price Risk Premium”.

The estimated Carbon Price Risk Premium is around $100 per tonne by 2030. This premium, which varies by sector and geography, reflects the additional financial exposure of a company, sector or facility to carbon pricing regulations in the future and is a useful benchmark for setting internal carbon prices.

Summary of current and future carbon pricing initiatives

Achieving net zero emissions by mid-century would cost an estimated $US 1 trillion – $US 2 trillion per year of additional investments and major global companies face $US 284 billion of carbon pricing cost and 13% earnings at risk.

ESG credit factors can influence credit ratings through, for example:

- A change in the size and relative stability of an obligor’s current or projected revenue base

- Operating costs and requirements

- Risk planning

- Governance controls and standards

- Profitability, earnings, or capital adequacy

- Cash flows or liquidity

- The size and maturity of its financial commitments.

The impacts of ESG credit factors in insurance ratings are:

- Competitive positions (strength of brand name and reputation; insurer’s profitability)

- Industry and country risk

- Capital and earnings

- Risk exposure (the above-average volatility in prospective capital adequacy)

- Funding structure.

And the impacts of ESG credit factors in banking ratings are:

- Business position

- Capital and earnings

- Risk position

- Funding and liquidity.

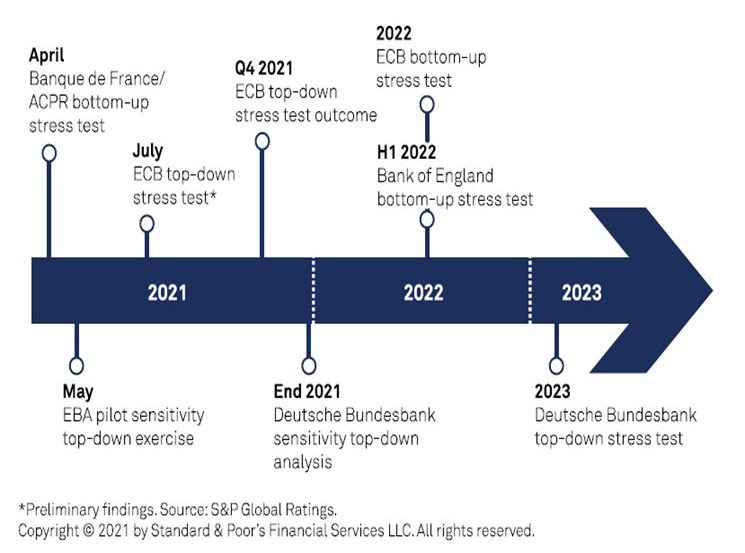

The presentation also recognised the fact that “fighting climate change has become a top priority for European governments and policymakers”.

European regulators are using scenario analysis, stress tests, and other tools to assess the financial sector’s vulnerability to climate change; foster higher disclosure and encourage banks to embed environmental risks in their strategy and risk management. The graph below shows the stress test schedule in European banks.

The main European regulatory climate works recently finalised and still ongoing

Overall, the two presentations clarified ESG factors’ influence on credit ratings and explained how Sustainable1 has been developed to validate climate change scenario analysis and TCFD reporting. Companies, governments and institutions worldwide are looking for in-depth data, and well-informed points of view on critical topics like energy transition, climate resilience, positive impact, and sustainable finance while Sustainable1 provides an unmatched level of clarity and confidence to successfully navigate the transition to a sustainable future.

Related links:

References:[1] The presenters are Paul Potter| Director – Market Outreach (moderator); Richard Timbs| Senior Director – Corporate & Infrastructure Ratings; Craig Bennett| Director – Insurance Rating; Lisa Barrett| Director – Financial Institution Ratings. |

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.