Disability Insurance Taskforce Update – Part 1

In the first of a two-part series, Greg Bird and Danny Bechara from the Institute’s Disability Insurance Taskforce provide the background surrounding the impetus in forming the Taskforce, the approach taken and an outline of some of the key provisional findings and recommendations made.

Background

The Institute’s Disability Insurance Taskforce (the Taskforce) was set up in August 2019 with the aim of assessing the many factors at play in the retail disability insurance market in order to effect significant change in the industry, either by directly making changes where it can or by driving change through direct action, reason, influence and transparency.

The Taskforce, chaired by Ian Laughlin, is made up of 16 Institute members who have many years of experience in the industry in a variety of positions across life insurers, superannuation funds, reinsurers and regulators including in senior management, on insurance company Boards, as regulators, and in technical roles (such as Appointed Actuaries, CROs and Product Managers). Members include representatives of Council (Institute President, Hoa Bui) and the LIWMPC.

In addition, the work of the Taskforce has been supported by three working groups made up of a further 33 volunteers[i] with relevant skills and experience, while members representing the Australian Prudential Regulation Authority (APRA) and the Financial Services Council (FSC) are observers on the Taskforce.

The initial focus of the Taskforce has been on the Individual Disability Income Insurance (IDII) product[ii], the market for which is at risk of failure following:

- Increasing product complexity in recent years, with product terms guaranteed for decades into the future;

- Declining affordability and accessibility of cover, as customers have suffered multiple increases in IDII premium rates;

- Substantial losses from insurers and reinsurers, as claims have climbed in frequency and duration[iii] (for which premium increases have not been enough to compensate); and

- APRA’s intervention in the market due to concerns around the prudential risks that this situation poses[iv].

Approach

The Taskforce has conducted a comprehensive review of issues with IDII, examining matters specific to the actuarial profession as well as broader market and social issues (refer to Diagram 1).

Diagram 1

The process followed by the Taskforce involved three key steps:

- Firstly, drafting a series of observations, assertions and questions into a Discussion Guide based on the skills and experience of the Taskforce and Working Group members. These were also informed by a research report which the Institute commissioned KPMG to compile that compares the IDII product in Australia against other international markets, plus consultation with non-actuarial specialists (including ALUCA and ANZIIF for claims and underwriting).

- Secondly, holding discussions with many different participants in the IDII ecosystem, through interviewing representatives of all parties who play a role in the performance and effectiveness of IDII[v]. In these interviews, the observations and assertions of the Discussion Guide were tested and the views of interviewees taken on board for further consideration;

- Finally, collating the observations and assertions with the views of the interviewees to produce a set of provisional findings and recommendations.

On 24 September 2020, the Taskforce released three documents for public consultation:

- Document A: Provisional findings and recommendations, which gives an overview of the issues in the IDII ecosystem and sets out provisional findings and recommendations of the Taskforce.

- Document B: IDII Sustainability Guide, which sets out good practice for sound prudential insurance management for insurance company boards and management, including a Sustainability Heat Map.

- Document C: Summary of an IDII Reference Product which aims to provide a reference point to aid senior management, the Board and regulators in assessing risk and uncertainty for both customers and insurance companies[vi].

Key findings

As noted above, the investigation and findings of the Taskforce were wide ranging, covering all areas of the design, operation and oversight of the IDII product. 45 recommendations were developed across these areas with brief summaries of some of the key findings and recommendations set out below.

Customer and Community Interests

An important element of the healthy operation of the insurance ecosystem is the concept of insurance pooling ensuring an appropriate balance between benefits paid to claimants and costs to all policyholders. This element is not seen as widely understood across all IDII market participants and the Taskforce recommendations in this context were focussed on improving understanding of the importance of this concept.

Consumer Advocacy and Protection

The Taskforce gained particular insight into a consumer perspective from key participants (the Australian Financial Complaints Authority, Financial Rights Legal Centre, Consumer Action Law Centre and a lawyer specialising in advocacy) with extensive experience supporting consumers in disputes with insurers. This gave useful insights to customer outcomes with respect to the IDII product, particularly from a claim perspective, and how various participants could play different roles in improving customer experiences. The Taskforce recommended insurers improve insights into customer claims experiences and establish standard practices with respect to legal involvement in customer claims.

Product

Whilst the Taskforce strongly believed the problems facing the IDII market are more deep-seated and diverse than product design, it did consider that certain current features of product design can cause major problems, and they must be addressed. Supporting this, the Taskforce spent considerable time on product design and associated risk management and governance. A key result of the Taskforce’s product work is the concept of a Reference Product (Document C above).

The Reference Product is seen as important to effect sustainable changes in the operation of key product elements – particularly simpler product alternatives and coverage explanations, stronger controls of benefit levels and income replacement ratios and embedding the loss minimisation principle in policy contracts. Additionally, management of guaranteed contract terms is seen as particularly important to avoid overly long-term guarantees on policy terms and conditions. Note that it is not intended that the Reference Product dictate the design of a retail product – it instead is to be a useful reference point to assist insurers in the prudential management of their individual disability income insurance product line.

Governance and Management

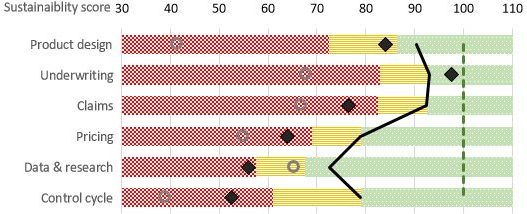

Given the extent of the issues within the IDII market, the Taskforce sought views as to whether risk management and governance practices of insurance companies have been adequate to manage the current issues. Like the Reference Product concept, a key output result of the Taskforce investigation into governance and management of the product is the Sustainability Guide (Document B above), which sets out good practice for sound prudential insurance management, including a Sustainability Heat Map (shown below).

Diagram 2

![]()

The Taskforce views the Sustainability Guide as important to improve communication, understanding and management of risks and uncertainty relating to the IDII product, and as an important tool in reporting to Management and Boards. In addition, the Taskforce recommends a focus on the composition of Board diversity, capability and experience with respect to IDII products.

The next part of the series will outline the remainder of the key provisional findings and recommendations made by the Taskforce, as well as some of the initial feedback received and the next steps.

References

[i] Refer to https://actuaries.asn.au/practice-area/individual-disability-income-insurance-in-australia/disability-insurance-force-members for further information.

[ii] The IDII product provides critical cover for many members of the community who may suffer loss of income because of disability.

[iii] The FSC-KPMG 2014-18 Disability Income industry experience studies show that claims costs also increased by 65% over about 10 years to December 2018. Statistics released by APRA show that the industry has reported IDII losses in excess of $3 billion for the five years ended 30 September 2019.

[iv] See https://www.apra.gov.au/sustainability-measures-for-individual-disability-income-insurance and https://www.apra.gov.au/final-individual-disability-income-insurance-sustainability-measures

[v] Senior people at ASIC, AFCA, and (together) the Financial Rights Legal Centre and the Consumer Action Law Centre; Non-executive directors; CEOs; CROs; Appointed Actuaries; General Insurance industry specialists; The life insurance task force set up by FPA and AFA, involving senior executives and adviser representatives; Product rating houses; The FSC Life Board Committee; Claims and underwriting professionals; A member of a law firm with deep experience in consumer life insurance claims; A benchmarking consultant to the life insurance industry; and Treasury.

[vi] The IDII Reference Product it is intended to assist insurers in the prudential management of their individual disability income insurance product line. It is not intended to dictate the design of a retail product.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.