Electricity, Ethics & Actuaries: A Case Study on Meridian Energy

Meridian Energy Limited (Meridian) is New Zealand’s largest electricity company, owning and operating many hydro stations across New Zealand. Meridian is known for being a ‘green’ generator of electricity, however, its reputation has been threatened in recent months through reported unethical market behaviour and detrimental environmental impacts.

In December 2019, Meridian was accused of spilling more water from its dams than necessary to intentionally raise wholesale prices and make excess profits[1]. These actions threatened the integrity of the wholesale market for electricity in New Zealand and led to regulatory action from the Electricity Authority (the regulatory body for the

New Zealand electricity market).

However, the world of ethics is not black and white. Particularly within business environments, there can be an attitude that it is okay to push the limits, if one does not cross the boundary. In an article published by the London Business School[2], David de Cremer writes, “Despite the fact that everyone in business is aware that the “pushing the limit” approach creates grey zones, allowing for more opportunities to deceive, the system continues… Business is comfortably grey.”

This article will introduce the basics of the electricity market; reflect on the ethical failure, its causes, and the relevance of the Actuaries Institute’s Code of Conduct; and explain how a similar failure can be prevented in your own workplace.![]()

What went wrong?

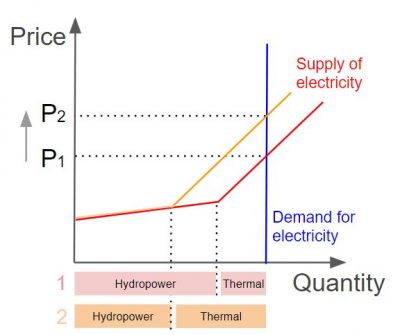

The NZ electricity market operates in a way that suppliers achieve higher profits when a greater proportion of total electricity demand is met by high-price energy sources, such as fossil fuel (thermal power). The lowest price energy source is used first, and when depleted the next energy source is used to meet demand for electricity. Therefore, despite an abundance of water in December 2019, hydropower generators were incentivised to reduce their supply and operate below capacity.

The electricity industry operates under a Code of Conduct[4]. One aspect of the Code relates to the incidence of undesirable trading situations (UTS), which threaten the integrity of the electricity market.

The Electricity Authority (EA) released a preliminary report in June 2020[5] declaring that Meridian’s behaviour in late 2019 was unethical, and that the Authority believed it constituted a UTS. The EA estimated that Meridian caused NZ$80 million[6] extra to be paid by electricity consumers. Meridian’s actions also meant that fossil fuels, associated with climate change and environmental degradation, were unnecessarily required to generate the additional energy.

Why did this happen?

The Electricity Authority’s preliminary report highlighted the ability of large electricity companies to manipulate the market and act in an anti-competitive manner. Other key drivers of the ethical failure include:

- Forgetting about stakeholders, and so not prioritising good consumer outcomes.

- Ignoring social responsibility and the public good. Flick Electric, one of the companies supporting the UTS claim, aptly commented: “We believe Meridian has been ignoring the social responsibility associated with managing public assets and maintaining a social license to operate.”[7]

- Accepting ethically ambiguous actions, to maximise profits.

Meridian maintains that their actions did not constitute a UTS, arguing in a recent statement[8] that the Authority is enforcing expectations that differ from those set out in the Code. Parallels can be drawn to the life insurance industry in New Zealand; a 2019 report on life insurer conduct and culture[9] highlighted several regulatory gaps that expose life insurance consumers, and action is being taken to remediate this.

On Thursday 29 October 2020, the Electricity Authority announced that it will publish a supplementary paper for a short consultation, considering the complexity of the information and subsequent analysis required[10]. A final decision on whether Meridian breached the Code, and contributed to a UTS, is intended to be made in December.

The Code of Conduct

Ethical business conduct is integral to the way we work in a professional environment. Many businesses and industry bodies publish their own ‘Code of Conduct’, setting out how individuals should act on a day-to-day basis and reducing the risk of ethical failures. The Actuaries Institute’s Code of Conduct is based on six key principles: integrity, compliance, competence and care, objectivity, speaking up and communication. Similarly, the electricity industry in New Zealand has a Code which sets out the responsibilities that apply to industry participants.

Integrity is one key principle from the Actuaries Institute’s Code of Conduct. This principle requires members to demonstrate high standards of behaviour, such that their actions are consistent with their values. Meridian’s website states: “We believe that by doing the right thing by people and the planet, we’re working to build a better future for our customers, communities, and environment”[11]. However, Meridian’s recent actions contradict this value.

‘Speaking up’ is another key principle from the Actuaries Institute’s Code of Conduct, requiring members to appropriately respond to non-compliance by others. The UTS Claim was lodged by a boutique trading firm, Haast Energy Trading. Haast demonstrated courage in speaking against the largest electricity provider in New Zealand. When speaking up, it is important to first validate concerns. The claim form was detailed and supported by clear evidence; Haast used simulation tools to assess the impact of Meridian’s manipulative trading activity. The claim letter also detailed that this breach was not an isolated incident, and that Meridian had been previously warned against breaching the Code. Haast wrote: “…it is abundantly clear that Meridian is in breach of the Code requirements and any reasonably well-informed market participant would have understood their actions were not of a high standard.”[12]

Good conduct, not misconduct

Despite the ‘grey zones’, it is important to act in a way that will reduce your own organisation’s exposure to such ethical business failures. Understanding and learning from the mistakes of tarnished companies can help prevent similar failures occurring in the future. Practically, actuaries should:

- Prioritise good consumer outcomes.

- Consider business decisions with a social responsibility lens.

- Know that a value statement is worthless unless actioned.

By applying these recommendations, and learning from mistakes made, actuaries can take pride in contributing to an industry that is praised for good conduct, rather than publicised for misconduct.

This article was written as part of an assignment on ethical decision making for the Communication, Modelling and Professionalism subject through the Actuaries Institute’s Actuary Program. The opinions expressed are the author’s own and not necessarily those of Georgia’s employer.

[1] Flick Electric Co – The Blog. (2020, June 30). FLICK YEAH! AN (ALMOST) WIN FOR THE CONSUMERS AS WATCHDOG CALLS OUT MERIDIAN. New Zealand. Retrieved from Flick Electric Co: https://news.flickelectric.co.nz/2020/06/30/flick-yeah-an-almost-win-for-the-consumers-as-watchdog-calls-out-meridian/

[2] Meridian Energy (2020, August 19). Meridian disagrees with UTS finding – asks Authority to clarify market rules. https://www.meridianenergy.co.nz/news-and-events/meridian-disagrees-with-uts-finding-asks-authority-to-clarify-market-rules/

[3] FMA and RBNZ (2019, January 29). Life Insurer Conduct and Culture. https://www.fma.govt.nz/assets/Reports/Life-Insurer-Conduct-and-Culture-2019.pdf/

[4] Tom Pullar-Strecker (2020, October 29). https://www.stuff.co.nz/business/123242875/electricity-authority-announces-extra-step-in-meridian-investigation

[5] Meridian Energy Limited. (2020, July). Who we are – Our purpose. Retrieved from Meridian Energy: https://www.meridianenergy.co.nz/who-we-are

[6] Electricity Authority New Zealand. (2019, December 12). Haast letter to Authority 12 December 2019. Retrieved from Electricity Authority: https://www.ea.govt.nz/code-and-compliance/uts/undesirable-trading-situations-decisions/10-november-2019/

[7] Electricity Authority New Zealand. The Code. Retrieved from Electricity Authority: https://www.ea.govt.nz/code-and-compliance/the-code/

[8] Electricity Authority New Zealand. (2020, June 30). The Authority’s preliminary decision on claim of an undesirable trading situation. Retrieved from Electricity Authority: https://www.ea.govt.nz/code-and-compliance/uts/undesirable-trading-situations-decisions/10-november-2019/

[9] Refer to paragraph 14.21 of Electricity Authority New Zealand report: The Authority’s preliminary decision on claim of an undesirable trading situation.

[10] Electricity Authority New Zealand. (2019, December 12). UTS claim form 12 December 2019 Haast and others. Retrieved from Electricity Authority: https://www.ea.govt.nz/code-and-compliance/uts/undesirable-trading-situations-decisions/10-november-2019/

[11] de Cremer, David. (2013, June 19). Business ethics: Black, white, or grey? https://www.london.edu/think/business-ethics-black-white-or-grey/

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.