Survey results from actuaries – unemployment rate and disability claims

As part of our blog article What is the relationship between unemployment rate and disability claims experience?, we conducted a survey to collect actuaries’ views on the relationship between unemployment rate and disability claims costs.

We received 63 responses. We would like to thank everyone who participated in the survey profusely. This blog analyses the survey results.

The key takeaways from the survey are:

- For Income Protection (IP), respondents’ views on the impact of claims costs for a 1% increase in unemployment rate, were quite widespread.

- There was a better consensus for Total and Permanent Disability (TPD) as the majority of respondents believed that the impact on claims costs for a 1% increase in unemployment rate is less than 6.5%.

- Most respondents believed that the impact on IP is more significant than the impact on TPD for a 1% increase in the unemployment rate.

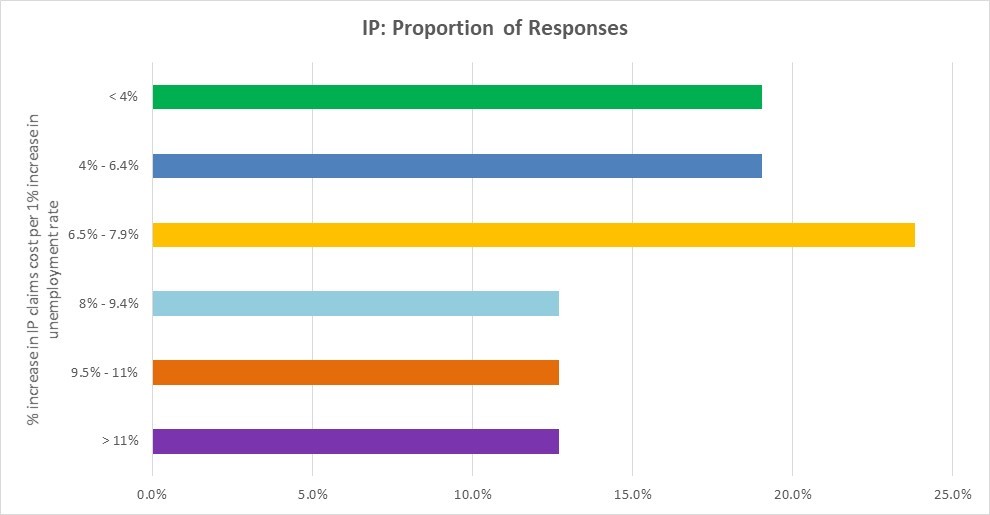

Q1 In your view what’s the impact on total disability claims cost for Income Protection (IP) per 1% increase in official ABS headline unemployment rate? Please note that Australia’s official unemployment rate would have increased much more in April if using a broader measure including workers on zero hours due to no or not enough work or being stood down.

For IP, the impact on claims costs per 1% increase unemployment varies among different actuaries. 62% respondents held the view that the IP claims impact is less than 8% for 1% increase in unemployment rate while the remaining 38% respondents think the impact is more than that.

The highest proportion of respondents (23.8%) believed that IP claims cost is about 6.5%-7.9% increase per 1% unemployment rate increase.

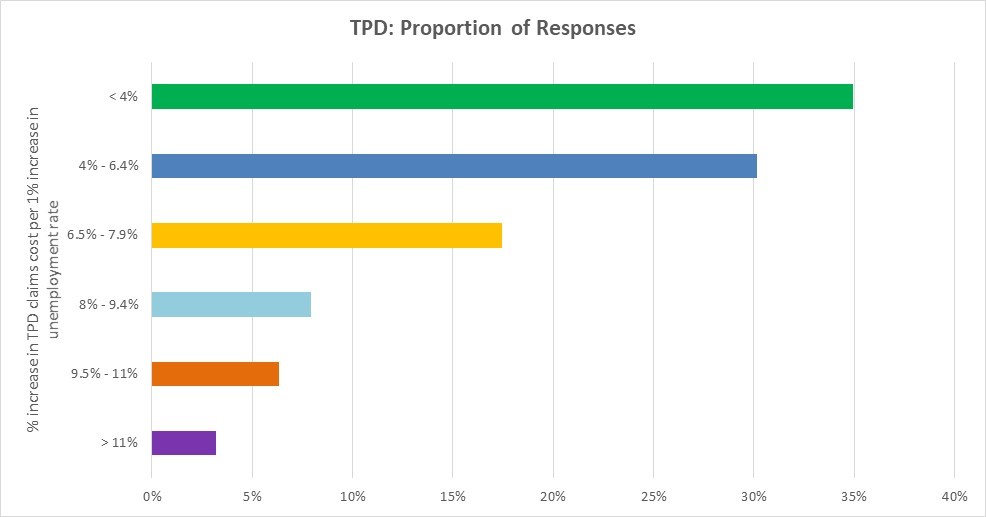

Q2 In your view what’s the impact on total disability claims cost for Total Permanent Disability (TPD) product per 1% increase in official ABS headline unemployment rate? Please note that Australia’s official unemployment rate would have increased much more in April if using a broader measure including workers on zero hours due to no or not enough work or being stood down.

For TPD, about 83% respondents held the view that the TPD claims impact is less than 8% for 1% increase in unemployment rate. The proportion of respondents reduces as the percentage claims impact becomes higher. 65% of respondents agreed that the TPD claims impact is more on the lower end (4-6.4% and less than 4%).

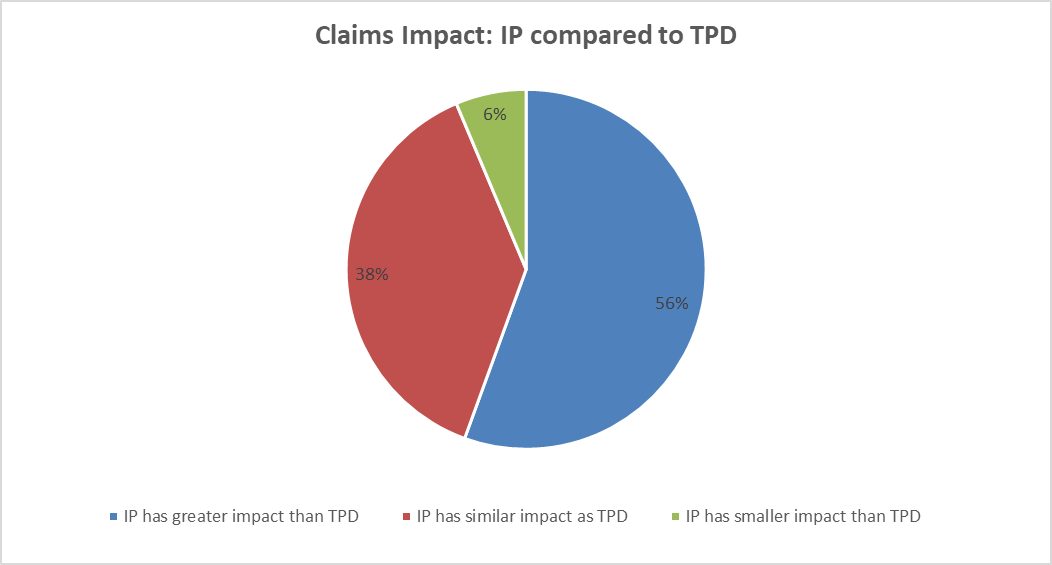

The following chart shows the comparison of the respondents’ relative views between the IP and TPD claims impact.

There were about 56% respondents with the view that an increase in unemployment had a greater claims impact for IP compared to TPD while 38% of respondents believed that the IP claims impact might be similar to the TPD claims impact. Only a small proportion (6%) of respondents thought that an increase in unemployment would affect IP less than TPD.

The survey result is broadly consistent with our previous blog post summarising relevant research articles on the estimated impact on the disability experience due to a change of unemployment rate. However, opinions on the IP claims impact display more diversity. Overall, the survey results point to the view that the IP claims impact is more significant than the TPD claims impact for a 1% increase in the unemployment rate. On average, respondents believed that the IP claims impact would be about 1.5%-2% higher than that of TPD for each percentage increase in unemployment rate. One possible reason for this observation is that an increase in unemployment affects both incidence and termination for IP. The extra dimension of termination rates might cause a greater claims impact for IP. It is also possible that TPD has a theoretically high bar for admittance, which might lead to an expectation of a lower impact for a 1% increase in unemployment rate.

If we use the ABS unemployment rate up to August 2020, we can estimate what the actuarial community thinks the expected claims cost for both IP and TPD would be based on the survey result. The average unemployment rate prior to COVID-19 is roughly 5.2% (average unemployment rate from Sep 2019 to Feb 2020). The average unemployment rate after COVID-19 is close to 6.7% (from March 2020 to August 2020). So up to August 2020, the average unemployment rate increase is about 1.5%. The average survey response for the IP claims impact per 1% unemployment rate is 7.1%. Hence this implies an expected increase in claims cost of around 10.7% for IP. Similarly, the average survey response for the TPD claims impact is close to 5.4% for a 1% increase in unemployment rate so the implied expected increase in claims cost is approximately 8.1% for TPD.

Following this observation, an obvious question is what the “time lag” is for us to observe such an increase in IP and TPD claims cost, if it has not happened already. Unfortunately, we do not yet have the answer to this important question! Please feel free to share your thoughts and views around that in the comments section below.

Disclaimer: This article presents factual results from our survey. Any opinions or conclusions drawn consist of our own views and do not necessarily reflect the views of the Actuaries Institute or that of our employers.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.