COVID-19 Monday Roundup 6 July 2020

Parts of Melbourne go into lockdown as cases in Victoria dominate the acceleration in Australia. Record new daily cases globally this week as over 1.3 million new cases are confirmed. Official mortality data in the US suggests that COVID-19 deaths may be under-stated, and anti-body testing shows the burden may be more than 10 times greater than reported. Travel insurance complaints dominate the COVID-related AFCA complaints, and next year’s Australian Open will not have Pandemic Insurance with the current policy expiring beforehand.

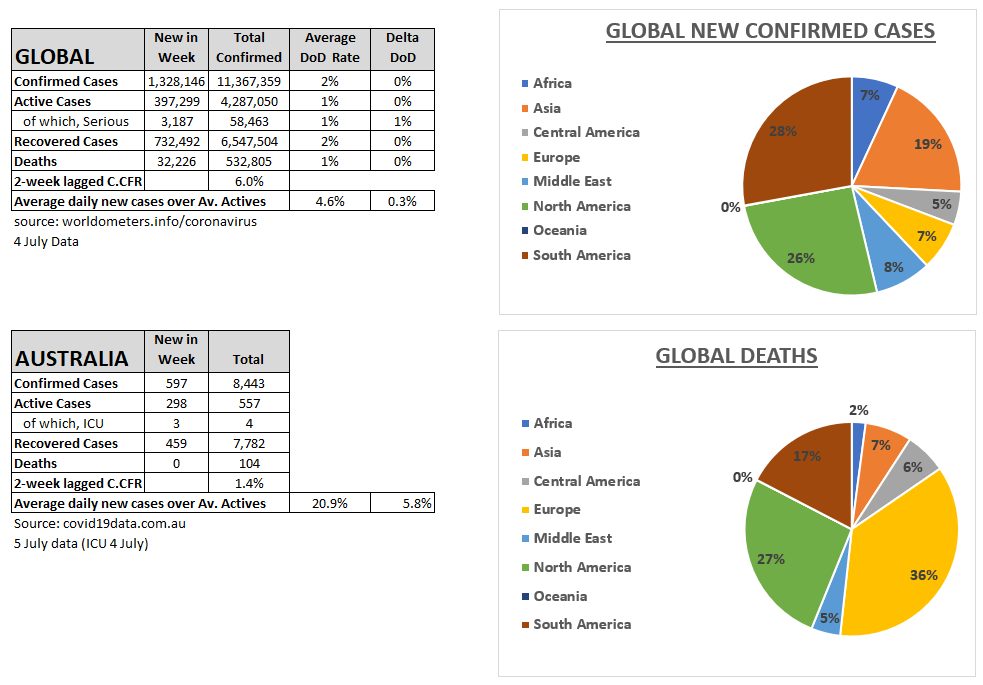

World Summary – 4 July

- Another week of acceleration of the pandemic, but this week more mild, with new cases growing 14% to pass 1.3 million new cases. On 1 July there were over 1/4 million new cases, the highest daily new case tally.

- 45% were in just two countries, USA and Brazil, with a further 11% in India.

- Still worrisome for the world economy, the USA outbreak materially accelerated with over 300,000 new cases, up 28% from the prior week. SARS-CoV-2 antibody testing suggests the burden may be more than 10 times greater than currently reported. Top infectious disease expert, Dr Anthony Fauci, said he wouldn’t be surprised to see daily new cases in the U.S. reach 100,000.

- Deaths eased back slightly again, with new deaths in Brazil 174% of new deaths in the USA while new deaths in Mexico were 97% of those in the USA, and India 76%.

- Official COVID-19 deaths in the US may be understated. There were over 122,000 excess deaths in the U.S. (excluding North Carolina & Connecticut) between March and May 2020, but just 78% – or roughly 95,000 – were reported as COVID-19 deaths.

- Oceania was the fastest growing regional outbreak, but off its very low actives base. West Asia was next with 13%, driven by a surge in Kazakhstan, part of which was catch-up reporting.

- Deaths in England and Wales fall below 2019 levels for the first time since March

Australia Summary – 5 July

- Victoria dominates the Australian situation with 537 new cases, 90% of all new cases in the week:

- Following the increase in Victoria, the 10 postcodes linked to the recent outbreaks will go into local lockdown until at least 29 July. Residents are only permitted to leave their homes for four reasons: shopping for food and supplies, care and caregiving, exercise, and study or work. Breaches of hygiene protocols by contracted security staff led to the significant number of the new infections.

- In addition, several apartment blocks have been put into short term, police enforced hard lockdown with residents unable to depart at all.

- South Australia and Queensland have delayed the opening of their borders to Victoria.

- NSW had 54 (+22) new cases. SA had 3 (+3), WA 2 (-1) and NT had 1 (+1) ACT, Tasmania and Queensland had no new cases. 53 of the NSW cases were overseas acquired infections, the other is still under investigation.

- Daily testing has remained high at over 47,000 daily average. Over 40% of those tests are in Victoria which has substantially increased testing. Discovery rates have risen again, to 0.17%.

- According to Citimapper’s mobility index (3 July data), Sydney rose to 47% (+4%) and Melbourne fell to 27% (-5%), making Sydney the 11th and Melbourne the 27th most mobile cities..

Key market update

- Health experts were shocked by the US Government’s announcement that it has secured most of the world’s planned supply of the drug Remdesivir between July and September at a cost of $3,200 per course. Several countries including Australia, Germany and the UK have indicated they currently have adequate stockpiles. Manufacturer Gilead has linked up with generic drug-makers in India and Pakistan to supply Remdesivir in 127 developing countries.

- ABS figures show gradual recovery in payroll jobs with a 1% increase in the month to mid-June, but are still 6.4% below mid-March levels.

- The Reserve Bank haswarned that, while Australia’s economy is doing better than originally feared, government and interest rate support will be required for years.

- Lloyd’s of London suggests “Black Swan” reinsurance schemes, backed by governments, could help businesses get insurance pay-outs after pandemic-like shocks.

- The pandemic will hit insurance premium growth three times harder than the 2008 financial crash did, forecasts Allianz’s latest Global Insurance Report. The report also predicting a 3.8% reduction in global premium income, compared with 4.4% growth in 2019.

- Travel insurance dominates the 4,773 COVID related complaints to AFCA, with more than 1,500 of these relating to travel insurance.

- The 2021 Australian Open will not be protected by pandemic insurance as the cover is set to expire before the next tournament, and organisers concluding “Pandemic coverage will not be viable to include for 2021”

- ABS Retail Trade figures show Australian retail turnover rose 16.9 per cent in May (vs 17.7% fall in April), seasonally adjusted.

- Cybersecurity spending will receive a $1.35 billion boost, just weeks after the Prime Minister revealed Australia had been experiencing a significant rise in cyber-attacks from a “sophisticated state-based actor”.

- ASIC is working to provide superannuation trustees with clarity on regulatory issues that have arisen from the COVID-19 pandemic. Superannuation trustees must continue to comply with the law and act in the best interests of their members.

New COVID-19 research this week

- A potential coronavirus vaccine developed by Adelaide-based company Vaxine began phase one human trials. COVAX-19 is one of more than 100 vaccines under development, and one of just 16 to make it to human trials so far.

- Patients with COVID-19 appear to have a heightened risk of acute ischemic stroke. 1.6% of 2000 adults treated for COVID-19 in two New York hospitals experienced an ischemic stroke, compared to 0.2% of influenza patients between 2016 and 2018.

- In a Belgian study, health care workers (HCWs) who worked on COVID-19 wards were no more likely to have the disease than those who did not. Belgian HCWs have had access to filtering facepiece respirators since April 3. In contrast in the UK, where access to personal protective equipment has been problematic, higher rates of COVID-19 were found amongst HCWs working on COVID-19 wards. The UK study also found some evidence of HCW to HCW transmission. Around 3% of asymptomatic HCWs tested positive for COVID-19.

- Decreases in mobility, quantified through mobile phone data, have been correlated with decreases in COVID-19 case growth in the US.

- Step count activity of 455,000 users of a smartphone wellness app across 190 countries declined 6% within 10 days of the pandemic being declared, and 27% within 30 days.

- Two U.S. studies (1, 2) show the severity of multisystem inflammatory syndrome in children, a condition similar to Kawasaki disease which has been linked to COVID-19. Roughly 80% of patients needed intensive care, the mortality rate was 2%, and there was greater heart muscle injury compared to Kawasaki disease.

- Researchers have tested sewage to confirm Canberra had no traces of COVID-19 throughout May.

New on the Actuaries Institute website this week.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.