Understanding long-term risk for superannuation members

Superannuation is a long-term investment for most. However, the focus remains on short-term returns and risk is measured as the chance of a negative return in a single year. Is it time for another lens, considering the long-term objective?

Framing the objective

When choosing the investment strategy which is most suitable for them, investors need to understand both the likely return and associated risks. The lure of potential higher returns needs to be balanced by the risk of not achieving those returns over a certain period.

In this respect, superannuation is no different from other investments. If they weren’t aware of the risks before the impact of COVID-19 on markets, superannuation members will be all too aware that their superannuation balances can fall – the average MySuper product was down around 10% in the March quarter.

However, superannuation is different from other investments in that most members don’t have access to their money until retirement. As long-term investors, superannuation members can ride out the bumps of market downturns in the knowledge that in the long term their balance will grow.

It is important to disclose to superannuation members the risk of a particular investment strategy, rather than just focussing on its performance. The difficult part is of course that risk has many faces – volatility, fall in investment value, not meeting objectives etc. While volatility has often been the main ‘technical’ measure of risk, the risk that members seem most concerned about is ‘losing money’, which may not even be the most important risk when thinking about retirement outcomes.

Short-term focus, long-term focus or both?

It is for this reason that the main risk metric currently disclosed to members is the Standard Risk Measure (SRM). This is shown in Product Disclosure Statements, MySuper Product Dashboards and on fund websites. The SRM shows the expected number of negative years in a 20-year period.

2019/20 will be one of those negative years for many MySuper products. Before this, the last negative year for the average balanced superannuation fund was during the GFC in 2008/09 (although a few funds had small negative returns in 2011/12).

Superannuation members pay attention to this risk; its real and they can see its effect on their balance. However, any loss only impacts a member if it persists until they need their money, which is either at or after retirement for superannuation.

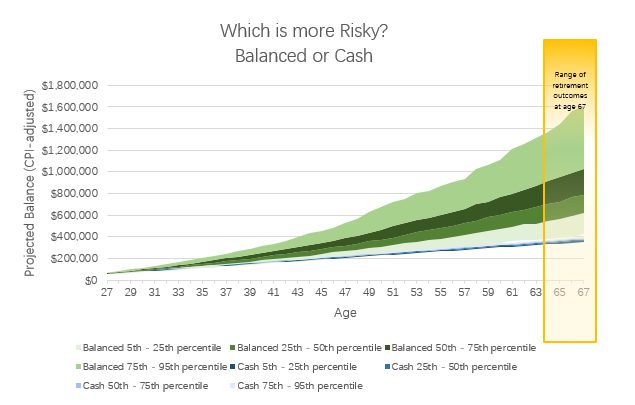

The ultimate risk superannuation members face is the risk of an inadequate income in retirement. There is the danger that focussing on the short-term risk of loss actually encourages members to choose investment options such as cash that will make it very difficult to meet their retirement goals.

The risk of investing in cash, a low risk option based on the SRM, is illustrated below.

Making long-term decisions based on a short-term risk measure will make it difficult for members to meet their retirement goals. Research, and experience from the GFC, shows that members moving into cash after a market crash are generally worse off than members who stay invested.

Given superannuation is a long-term investment, it is problematic that the only risk metric disclosed to members is short-term. In fact, it can be that the focus on short-term risk alone increases the long-term risk for a member.

We are proposing the introduction of a Long-term Risk Measure (LTRM) that could potentially be used alongside the SRM. The aim of this measure is to provide another dimension through assessing the risk of not meeting a certain long-term performance and therefore potentially failing to meet the objective of a member being able to meet their goals at retirement. This would guide members to choose an appropriate investment strategy from a menu and/or help them review their original retirement income goal(s).

Conclusion

For members who will access their superannuation in say the next 5 years, the SRM is probably still the most relevant risk measure. But for members who won’t access most of their superannuation in the next 10 years, the LTRM is more relevant. Members who will access their superannuation in the next 5-10 years could be encouraged to consider both metrics.

The primary author of this article is David Carruthers, with the assistance of the Long Term Risk Management Working Group, a Working Group of the Superannuation Projections and Disclosure Subcommittee.

Long Term Risk Metric Working Group

- David Carruthers

- Estelle Liu

- Ian Fryer

- Rein van Rooyen

- Young Tan

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.