Opinion – Disrupting the Disruption Industry

Eric Ranson shares his views on the difficulties start-up founders and investors face. His experience working with start-up ventures and promoting funding for innovation in this niche market was shared at the recent Actuaries Summit.

Start-ups are very risky, so it makes sense to spend a lot of time and effort on analysis before investing. But because start-ups are very small, it doesn’t. This dilemma makes big money look elsewhere, and has left a niche market that is generally failing both founders and start-up investors.

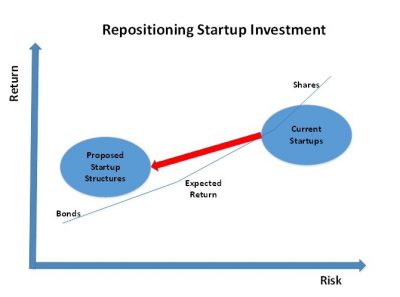

Could the start-up industry benefit from disruption? We can structure start-ups efficiently and reduce investment risk to re-engineer the funding process. This creates a more inclusive and effective marketplace. Importantly, these efficiencies could maintain or improve expected returns while the structure reduces risk so that start-ups become more attractive investments on the risk vs return comparison. That alone could attract 1,000 times the current funding to early stage start-ups.

As JM Keynes said, “The difficulty lies not so much in developing new ideas as in escaping from old ones.”

Escaping the Status Quo

The start-up sector’s preoccupation with risk is justified by old (and very reasonable) ideas: – Every start-up is different, nine out of 10 will fail, we need 20 times our investment to cover losses, etc. This bias has ensured that millions of hours are wasted preparing, delivering and absorbing pitches for start-up funding that won’t happen. The few that progress must negotiate the equity split and other details. Both the risks and the inefficiencies have ensured that large investment pools keep their distance from start-ups.

Start-up Funding – Negative Loop

Perception of risk ⇒ Analysis/Pitch overload ⇒ Cost & Distraction ⇒ Lower returns ⇒ Perception of risk

By making start-up investing more efficient and less risky, we could slash the hours wasted on pitching and analysis and increase early stage start-up funding 1000 fold. A win for start-ups and a win for investors.

Structure Matters – Production Line

Efficiency is greatly improved by a production line. A start-up production line should simplify the funding process and create a more consistent product to wrap each start-up idea and founder. Adding a lower risk (investor friendly) structure leads to more efficient start-up funding.

Opportunity – Virtuous cycle

Lower risk ⇒ Efficient fundraising ⇒ Focus on ideas & self-selection ⇒ Greater returns ⇒ More investment

Efficient Fundraising with a Lower Risk Structure

Every start-up is different, but that doesn’t mean that every start-up company should use a bespoke structure and equity split – especially in the early stages. Using simple and consistent arrangements that align interests and maximise the gross potential economic upside of start-ups would almost certainly improve outcomes. By prioritising efficiency over individuality, we commoditise the process and allowing start-ups to focus on growing a business rather than spending a lot of time determining and selling equity structures for their businesses.

The lower risk structure is created with conditional equity that suits early stage start-ups – equity with a plan. Most start-ups could work with $100,000 budget to create their minimum viable product (MVP) and to validate it. The growth phase is considerably more expensive and may require a $900,000 budget to market and prove the business concept. The start-up could raise $1 million but only risk $100,000 because the plan requires investors’ approval before moving to the marketing/growth stage (spending the $900,000). Ensuring that shareholders can extract the excess capital if they are uncomfortable with progress, means that the investor is only risking 10% of their investment. Investors do need to manage the start-up risk once they endorse the extended budget.

A lower risk investment structure in combination with the consistent business structure should make it much easier for investors to support ideas and founders.

Ideas & founders can be presented on simplified crowd funding platforms providing investors with reasonable risk/return opportunities. Funding could flow quickly to exciting ideas and the founders could spend their time making their ideas work. Large pitch decks are deferred until the founder is confident in the MVP and their market. Far less resources are consumed pitching, filtering and negotiating.

Figure 1: Repositioning Start-up Investment

The friction between founders and investors is minimised by standardising and reducing the transfer of upside (positive start-up returns) over the first two stages of funding when opinions about valuations might be at their most diverse. The investor has less work at the outset and a pressure valve to compensate for the lower share of equity. The founders’ increased equity is based on a better alignment of their interests with their business and their investors. Their rewards are biased away from successful pitching and towards value creation.

Type I errors (investing in a poor business) would increase but Type II errors (not investing in a great business) would largely disappear. Businesses in the middle – worthwhile opportunities that are definitely not unicorns – may be the biggest beneficiaries. The number of successful start-ups would flourish.

Simple Platforms for Early Stage Start-ups

Simple platforms allow investors to focus on the key drivers:

- The Idea (issue, solution, market potential); and

- The Founders (skills, track record)

A well understood corporate structure that rewards founders for their successes and focuses on minimising investor losses otherwise makes it easier for investors to support founders and business ideas that they liked without the cost, uncertainty and noise of underwriting, bespoke negotiations and short term planning. The consequences of this structuring is more acceptable risk/return outcomes with far less time spent pitching and reviewing. This leads to more early stage funding, less funding rounds, less adjustments to equity interests and quick, agreed shutdowns when businesses are not progressing. The savings in costs and time (both investors and founders) should overwhelm any unfairness in the equity allocation – ensuring that everyone is better off.

The various forms of government support for the start-up industry can become a game changer.

A simple example is that Australian taxpayers are eligible to receive tax offsets of 20% of their investment in an early stage innovative company. The support turns start-up investments with 10% downside risk into investments with upside and virtually no risk.

This creates a world where founders can focus on making their ideas work and investors can take on portfolios of exciting, early stage ideas. Investors can decide, based on progress reports, if the start-ups are shut down or if they can use their significant reserves to really grow.

Realistically, a world where every inspired founder with a great idea gets the early stage funding they need.

Eric Ranson delivered an insightful presentation ‘Creating Value in Start-ups’ at the 2019 Actuaries Summit. View the slides or listen to the audio.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.