How can actuaries play a role to build a more resilient future for Australia? Part 2

To recap from Part 1 of the article, the Department of Home Affairs’ National Resilience Taskforce (NRTF) focusing on natural disasters concluded on 28 June 2019. The Taskforce has delivered a National Natural Disaster risk reduction framework which sets out the agenda and a report ‘Profiling Australia’s Vulnerability’ analysing the situation we are in and helping all sectors to better understand the risks we are facing. This article explores how actuaries can be involved.

The third deliverable of the NRTF is a knowledge hub to help decision makers of all sectors consider and take actions on climate and disaster risk.

Deliverable 3: The first tranche of Guidance for Strategic Decisions on Climate and Disaster Risk

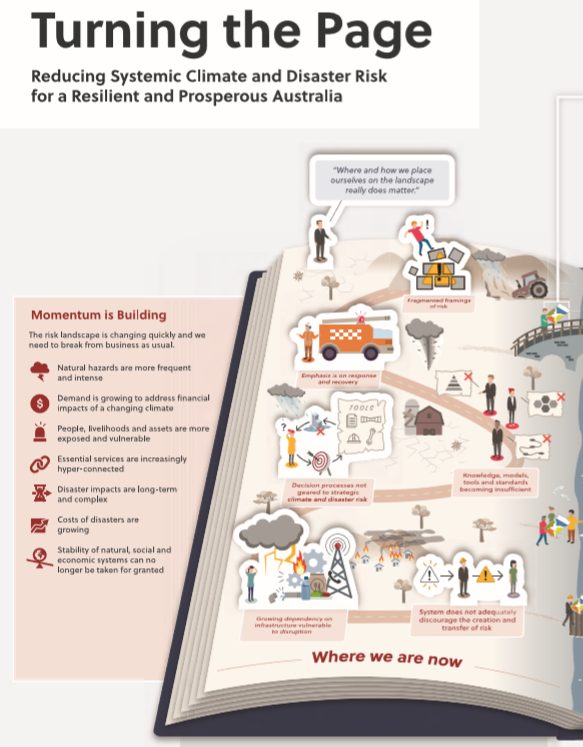

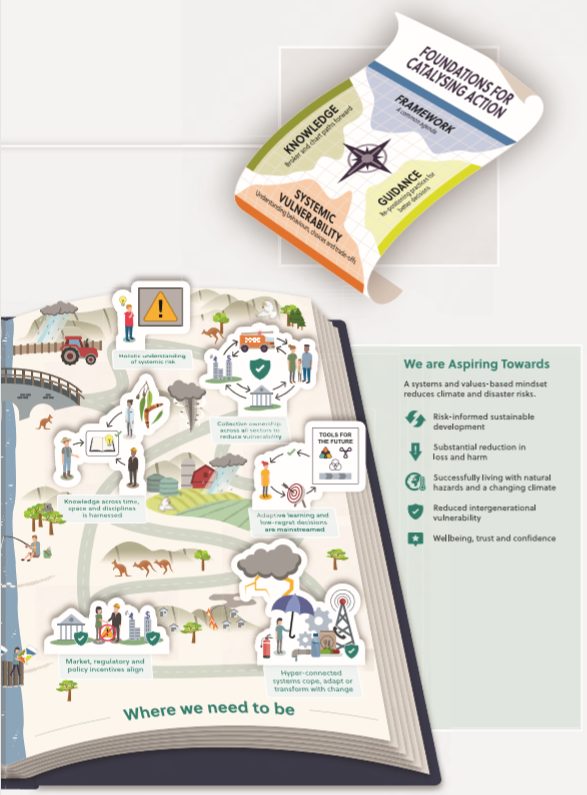

This knowledge hub has an introduction section which reminds us of where we are now at with respect to climate and disaster risks and where we need to be so our country is resilient towards such risks.

The following infographics from this Introduction section, summarise this message.

Guidance on Governance

This Guidance introduces the concepts of ‘systemic risk’ and ‘systemic risk governance’. Systemic risks are risks that could trigger severe instability or collapse of an organisation, industry, economy or system. ‘Systemic Risk Governance’ refers to the rules, norms, routines and practices that enable and constrain individuals and organisations to recognise, assess and manage the causes and effects of systemic risks. One of the challenges identified is the existing governance approach is decentralised – three levels of government (federal, state and local), private sector and not-for-profit organisations. When we live in a world of growing interconnectedness, such decisions and consequent actions are not holistic enough and lack depth.

“If I had to select one sentence to describe the state of the world, I would say we are in a world in which global challenges are more and more integrated, and the responses are more and more fragmented, and if this is not reversed, it’s a recipe for disaster.” António Guterres, United Nations Secretary-General, January 2019 (source: UNDRR. 2019. Global Assessment Report on Disaster Risk Reduction)

The guidance goes on to discuss the roles and responsibilities of each sector. Though it should be noted that responsibilities for climate and disaster risk reduction cannot be equally shared due to imbalances in capabilities, capacity, agency and mandate to take actions to manage these risks.

There was also commentary on the suitability of the use of traditional risk matrices, which actuaries are familiar with and often adopt when it comes to qualitative risk assessment, but also to include some quantitative elements through likelihoods and loss amounts (which can be financial losses). There are usually visual depictions using colour coding to draw attention to risk ‘hot spots’ created by the combination of different likelihoods and loss amounts. Based on such analysis, decision makers have a choice to accept or mitigate or transfer the risk. However, unlike in investment finance, there is no specification of the decision makers’ appetite for disaster and climate risk. Perhaps actuaries can assist in this area by using their expertise in data, knowledge of new data, ability to convert data into key messages and new visualisation techniques to develop new risk management tools suitable for collaborative action on disaster risk.

Guidance on Vulnerability

The note provides guidance on how to assess vulnerability, understanding ‘why’ and ‘how’ naturally occurring events can lead to devastating loss and suffering, when they impact upon, what people and society value. It involves “Deconstructing Disasters Workshops” for relevant stakeholders, performing values analysis to understand preferences and priorities (both before and after disasters) and systematic thinking to map out all causes and effects as well as relationships.

Guidance on Scenarios

This is something that most actuaries can relate to – scenario analysis or “stress testing”. Scenarios help visualise different ways the future could unfold. They can be thought of as possibilities to stretch people’s thinking and to help people’s imagination and explore plausible futures that could be radically different from the present.

Decision makers need to recognise and possibly reframe their understanding of the scale, nature and opportunities that this rapidly changing environments present. They will need to revisit values, objectives, assumptions and approaches underpinning strategy development, planning, risk management and economic assessment to be compatible with large-scale change and high uncertainty. With skillsets to navigate through uncertainty (at least quantitatively), actuaries can add value here by developing methods which weave consideration of climate and disaster risk into decision-making processes in a meaningful way. The challenge here for actuaries is to grasp the scale of scenarios required for decisions can be extending to decades and centuries, as well as the massive uncertainties inherited. At the same time, actuaries must also recognise the gap in knowledge arising from these uncertainties.

Quantitative and qualitative methods or a mix of both can be used for exploratory scenario analysis. Two quantitative methods are:

- Global and downscaled climate model projections

Statistical or mathematical models are useful for high-level assessments of changes in the trends and shocks of weather-related events. Currently, there is no authoritative consistent set of climate change scenarios for Australia, with standardised guidance on how to consistently apply these across scales to serve as a point of reference.

In absence of such, recommendations for climate scenario modelling include:

- Stress testing using the greatest plausible change based on a climate change scenario with Representative Concentration Pathway (RCP) of 8.5 to assess physical risk. (e.g. Climate Compass: a climate risk management framework for Commonwealth agencies)

- Use of scenario analysis in the technical supplement of The Task Force on Climate-related Financial Disclosures (TCFD). It recommends using a 2°C warming (between RCP 2.6 and RCP 4.5) scenario when assessing ‘transition risks’ and using both the RCP 4.5 and RCP 8.5 when assessing exposure and vulnerability to the physical impacts of climate change. This is to ensure robust responses to the range of potential futures are identified and considered in long-term strategies and plans.

- Numerical simulation models

These statistical or mathematical models consider a combination of physical processes to inform more detailed local planning and infrastructure investment decisions. Modelling tsunami, tropical cyclone, flooding, landslide and bushfire often require some datasets on the characteristics of the landscape (i.e. topography, geology and bathymetry), the atmosphere and the antecedent conditions (i.e. temperature, rainfall, shaking, tides, wind speed, soil moisture). A number of government research centres and commercial vendors develop these models.

Guidance on Prioritisation

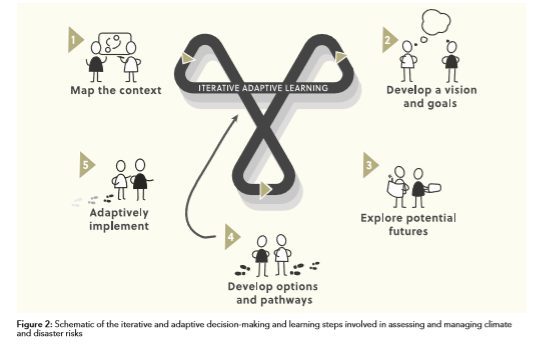

Currently, responses to climate and disaster risk tend to be reactive in the form of recovery from disaster events. Coupled with the decentralised decision making and action taking system, it is not easy to collectively plan for a more resilient future community in an all-inclusive and sustainable manner. Under the given constraints, the knowledge hub aims to expand the focus and intent of current prioritisation approaches to consider the cross-scale, uncertain, and systemic nature of the causes and effects of societal vulnerability in the context of rapid changes to population, the economy and climate. It encourages decision makers to be more proactive and adaptable in response to the changing environment/threats.

Decision making can be based on ‘optima criteria’ (e.g. Cost-Benefits analysis), ‘low-regrets criteria’ (e.g. strategies that yield benefits even in absence of change or disruption or strategies that avoid very negative outcomes) or ‘robustness criteria’. Quantitative measures could be a component of such criteria such as Value-at-risk and Value potential (from investment in climate and disaster risk reduction). However, it was highlighted that relying on traditional methods and historic data alone is not adequate for such long-term decision making. Actuaries have the know-how to design new frameworks and approaches using available data and knowledge to provide leading indicators to systems which are needed rather than relying on old assumptions.

Conclusion

Within the last 14 months, the Taskforce has produced these reports to help all sectors to understand climate and disaster risks as well as guidance on how to re-think their institutional strategies to be more resilient. The Taskforce is drafting a blueprint for a new national information capability on climate and disaster risk, in response to the significant need to equip decision makers with the information and services they need to coordinate efforts, confidently plan for uncertain futures, and credibly take actions.

Quoting from the guidance: “We still need to do the sums right, but we also need to do the right sums.” More importantly, to make decisions and steer actions, we also need to interpret sums rightly. Actuaries happen to know how to do all three – and can definitely apply their expertise to make our country more resilient for the future.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.