April Data Science Sydney Meet-Up: Active Learning for Risk Mitigation, Creative Property Analytics, and Pizza

Data Science Sydney Meet-Ups returned in April with Luke Metcalfe, founder of Microburbs, and Tom Osborn, Chief Scientist at Epifini, sharing how they leveraged data science to create successful businesses.

What are Data Science Sydney meetup events?

These meetups are a monthly gathering of the Data Science Sydney community, consisting of actuarial and non-actuarial data scientists who are interested in extracting value from data using advanced statistical, computational, and analytical tools. Attendees get the opportunity to network with others across the industry and share perspectives and experiences using data science. And of course, they enjoy complimentary pizza and drinks!

Luke Metcalfe and Microburbs

Luke Metcalfe, a successful data scientist and entrepreneur, spoke about his career history and current venture, Microburbs, a website that provides users with liveability scores, among other creative and insightful metrics for any suburb in Australia. During his presentation, he referenced techniques that have led him not only to succeed but also believes are key for data scientists to adopt when competing with generative AI.

Luke Metcalfe opening his presentation on how he plans to compete with generative models (such as Chat GPT)

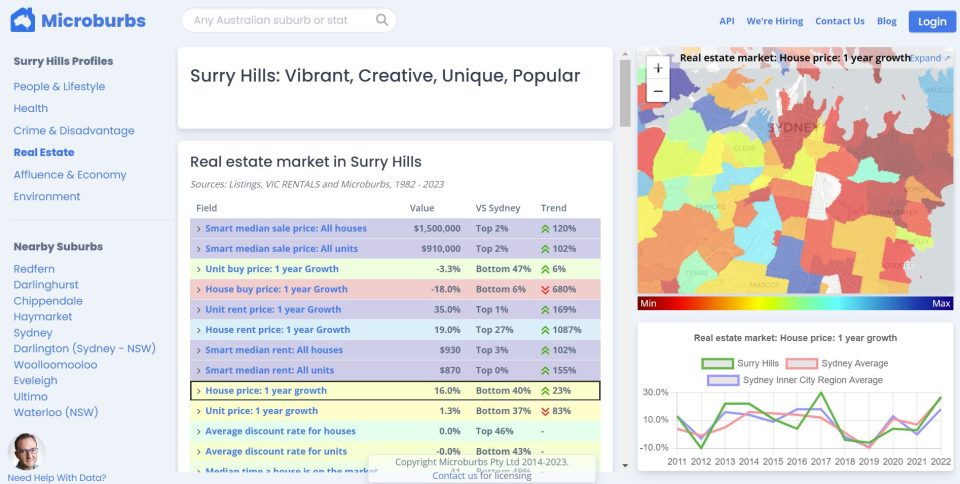

Luke loves collating data from many different sources, which is a driving factor for his success in data science. Through amassing a great deal of data from various sources, Luke has been able to create models that are accurate enough to provide powerful insights to businesses. This can be observed in the wide range of statistics and visualisations available on Microburbs. It can provide information on how ‘hip’ your suburb is, the names of exotic restaurants in your area, or the type of crime that is most prevalent in your neighbourhood. This information holds commercial value, from helping guide property purchasing decisions to deciding where to open a subsequent store in a franchise. Shown below is a search for ‘Surry Hills.’

Luke’s approach to problem-solving is not to work harder or longer but to take breaks when faced with an insurmountable task. He finds that going for a walk helps him take his mind off things and come back to the task with a fresh perspective. Another secret to his success is getting to know his clients’ problems better than they do. He believes that often, a company’s understanding of an issue, such as its target market, is over-generalised and misunderstood. By gathering many different data points, he builds models that tell compelling stories that captivate his clients and illustrate the solution to their problems.

Tom Osborn and Epifini

Tom Osborn, Chief Scientist of AI Risk Mitigation start-up Epifini, talked about how he leveraged Active Learning, an AI technique with similarities to generative AI, to measure the cultural and performance barriers and help mitigate the risks of business failure for large corporates.

Tom Osborn introducing the concepts behind AI Risk Mitigation Start-up Epifini

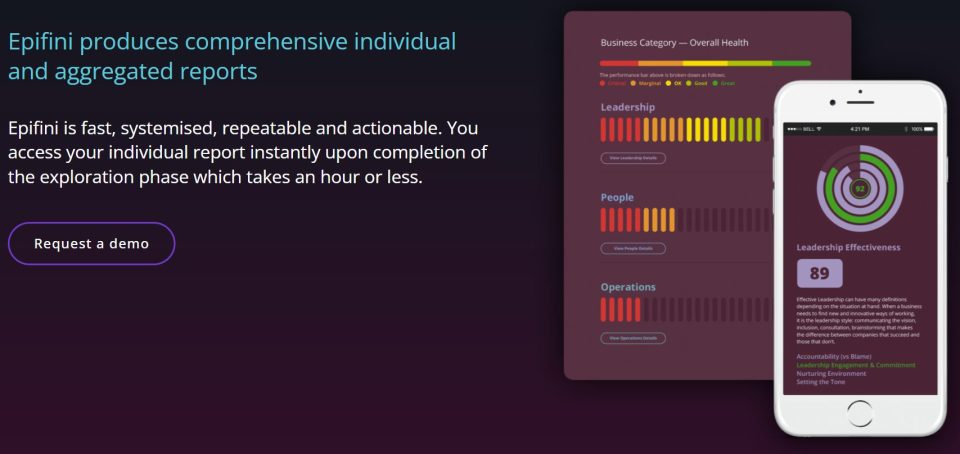

Epifini leverages active learning in its questionnaire algorithm for C-suite executives. The executive will answer one question about a certain facet of their business, and based on their response, the model will provide a different follow-up question. This process will repeat itself until the model is satisfied it has enough information to make a risk assessment. This information is then aggregated across all executives and highlights key risks and divides within the company. This system has already produced some very interesting results for corporations around the world. The resulting report contains visualisations like those shown below on the right.

Wrap up

Overall, the event was insightful and inspiring. Attendees got to hear how Luke and Tom leveraged data and AI to build successful businesses. If you are an actuary curious about data science, these events are for you. Don’t forget to join the Data Science Sydney meetup group to keep up-to-date with future events.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.