Choosing a healthy lifestyle for the planet

Sustainability is a key challenge facing countries around the world. The term has become a common part of environmental debates and C-suite job titles, and was the word of the day on dictionary.com on 22 April 2021. But exactly what is sustainability and how does it relate to actuaries?

I think of the relationship between extreme weather events, climate change, and sustainability by way of an analogy to health. Events like the recent flooding in eastern Australia are similar to an acute medical episode (such as a heart attack) which is a symptom of an out of balance climate (a chronic problem like cardiovascular disease) which in turn reflects unsustainable practices by the human race (an unhealthy lifestyle which triggers disease). Improving our planetary health involves making some changes which may be disruptive but which will pay great dividends in the long run, just as eating smarter and going to the gym help people live longer.

Thinking of climate risk as one component of a much wider sustainability challenge can help us understand that solving the problems we face involves changing destructive habits, including wasting scarce water resources, polluting the oceans with plastics, raising carbon dioxide in the atmosphere to levels not seen in hundreds of thousands of years, or poisoning soils with nitrates which degrade biodiversity.

Sustainability is commonly defined as “meeting the needs of the present without compromising the ability of future generations to meet their own needs”, where human needs include a sound environment, a just society, and a healthy economy[1]. Environment, society, and economy are commonly referred to as the ‘three pillars of sustainability’. This definition emphasises the global, multi-faceted, long-term, and intergenerational nature of sustainability.

The climate challenge is rapidly becoming redefined as a sustainability one. The change in terminology is not just semantics; it reflects a significant shift in thinking to a more holistic view. Significantly, the IFRS Foundation chose to create the International Sustainability Standards Board (ISSB) to drive more robust financial disclosures based on the TCFD framework. The IFRS Foundation’s name choice indicates that in the future new disclosure standards will include not only climate risk (and opportunity) but also broader sustainability topics.

The Institute’s Climate Risk Working Group (CRWG) has just changed its name to the Climate and Sustainability Working Group (CSWG) and will broaden its focus accordingly. The change was a result of a strategic review led by Ramona Meyricke which made three basic recommendations that:

- The Actuaries Institute consider how sustainability fits within its practice areas.

- The Actuaries Institute develop a strategic position and public policy statement on the topic of sustainability. This could be done in conjunction with an update to its public policy statement on climate change.

- The Actuaries Institute develop a staged plan to enable sustainability training for Actuaries.

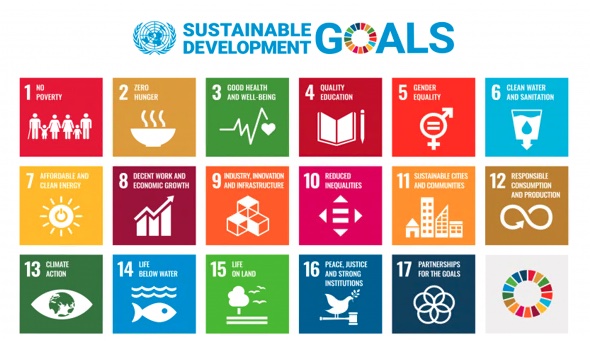

As the Institute builds out its capabilities in sustainability it will consider the United Nations 17 interlinked Sustainable Development Goals (SDG), summarized in this table:

(Image sourced from: UN Sustainable Development Goals)

While not all of these SGDs are directly connected to insurance and financial services where most actuaries practice, they generally align with the Institute’s priorities, such as promoting education or good healthcare. There are aspects of most SDGs relevant to our work.

Clearly, the sustainability space is a big one and the Institute cannot tackle all of these challenges in the near term. A key priority in the coming months will be to prioritize which areas we should focus on first, such as food security, water management, or biodiversity. Our overarching aim is to position our profession to be a part of this movement towards a more sustainable world, something many of our fellow actuarial associations across the world are also working on. We look forward to discussing this with them at the upcoming ICA 2023 meetings in May and June.

I am pleased to have helped launch the Institute on this journey during my term as Chair of the CRWG and now the CSWG. I will be stepping down as Chair in April and will be succeeded by Ramona Meyricke.

Ramona Meyrickle

Ramona has been a valuable contributor to the work of the group in recent years and it will be in good hands. I am looking forward to seeing Ramona help the Institute maintain its leading position in this space, both in Australia and among global actuarial associations.

References

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.