Industry climate risk practices self-assessment: A glass half full or a glass half empty?

In August, the Australian Prudential Regulation Authority (APRA) published the findings of a voluntary survey of medium-to-large banking, superannuation and insurance firms that it supervises.

The survey enabled entities the opportunity to self-assess how their current practices align to CPG229, APRA’s guidance on managing the financial risks of climate change[1].

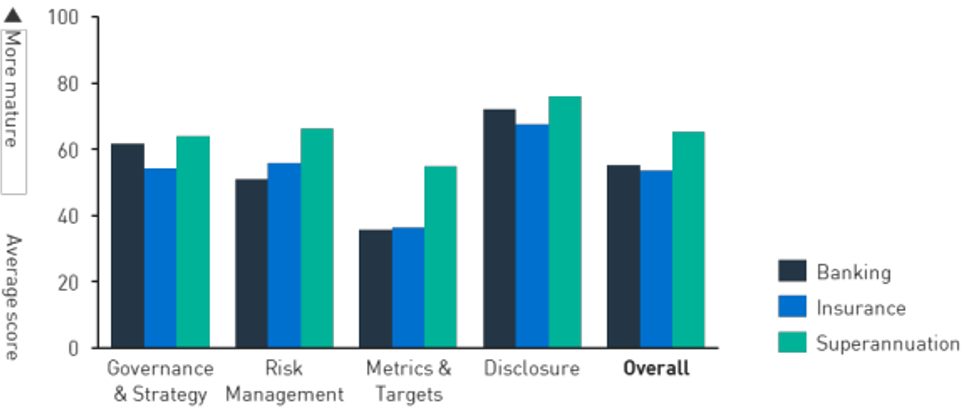

The APRA headline was that responses indicated ‘good alignment to CPG 229, reasonable cross-industry alignment, but room for improvement’. However, these overall industry average ratings (as shown in the chart below) mask a large amount of variation within each industry group and between industries on specific elements within each of the four main guidance pillars.

Despite the limitations of the survey[2], the results provide a number of potentially valuable insights into the progress financial institutions are making in understanding and managing Climate Risk, as well as a sense of APRA’s likely future areas of focus.

Observations

1. Board vs Management engagement

Perhaps the most striking observation was that while around three-quarters of boards regularly oversee climate risk, there are significant gaps in how this translates into measurement and action at management level. Given the reliance of the Board on information from management to enable their oversight and approvals, this presents challenges to Boards in discharging their climate-related responsibilities.

Four specific examples of this are:

- The limited extent to which climate-related considerations inform strategic planning – institutions reported that while around two thirds included climate risk in their strategic planning process, the focus of this was on a 1-5 year timeframe, rather than longer timeframes over which chronic physical and transition risks will play out.

- The lack of formal processes to regularly identify/assess climate risks – less than 50% of respondents had such a process, and for banks < 20%.

- The prevalence of qualitative rather than quantitative assessments of climate risk – the majority of institutions make greater use of qualitative assessments, and for those where quantitative assessments are made, banks and insurers are less progressed than superannuation funds.

- The lack of comprehensive embedding of climate risk across the three Lines of Defence risk management model – only a third of institutions had embedded into all three lines of defence, and a third had not embedded into any of the three lines. Again, banks and insurers lagged superannuation funds.

2. Integrating climate risk into the Risk Management Framework

Two noticeable challenges were evident in responses relating to climate risk integration:

- Only a third of respondents have climate risk as a risk driver of other risks – and around a third of insurers do not have climate risk in their risk taxonomy at all. Given that many general insurers are heavily focussed on the impacts of climate change, does this indicate that the life insurance market has yet to embrace the impacts of climate-related risks? As the future credit, underwriting and investment experience of organisations will be impacted by physical and/or transition risk outcomes, integrating them into decision-making is a critical capability that financial firms will quickly need to build.

- Around 30% of banks and insurers are not able to assess climate risk either quantitatively or qualitatively, with only two thirds of all institutions (and half of banks) able to measure climate risk quantitatively.

3. Emissions quantification

Another key observation is the immature state on measuring financed emissions – a key indicator of transition risk for institutions and clients in their portfolios. APRA have noted the potential impacts on firms’ access to capital if their emissions financing activities are out of step with international ambitions or if their disclosures are misaligned with global standards.

The survey responses show firms are part-way through a screening process, with many taking initial steps to understand the highest emissions sectors – although a third haven’t started to quantify the emissions from their clients at all. Superannuation funds appear to be leading the way here, perhaps not surprisingly given their greater use of listed investments where data is more readily available.

Where to from here?

It is clear from the report that APRA is keen for firms to develop reliable, timely and sophisticated climate risk measures, and incorporate them into their disclosures. While firms have progressed in introducing climate into their governance and risk management practices, this must be supported by meaningful metrics and integrated into the broader risk management framework.

Firms should now be benchmarking their practices against those of their industry peers and take steps to ensure that they are not outliers if they want to limit regulator or stakeholder scrutiny. More importantly, these actions are needed to ensure that their business is resilient to the new challenges posed by climate-related impacts.

Many firms will lack the in-house expertise to make this happen and will need to partner with experts to build these capabilities. This is nothing to be ashamed of – almost 90% of institutions in the survey reported having sought assistance from external experts or bodies on climate risk. What is important is that firms don’t get frozen in the headlights – where lack of movement can lead to severe unwanted consequences!

This article was written in consultation with Stephen Catchpole, Finance Sector Lead at Energetics, the climate risk and energy transition expert. Please visit www.energetics.com.au for more information and insights on climate-related risk and the transition to net zero.

|

References

|

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.