Investing in resilience: A business case for climate adaptation

Concerns regarding climate change currently dominate various conversations in our society. At the 2022 All-Actuaries Summit, Ramona Meyricke, Alison Drill and Sylvia Wang delved into the need for climate change adaptation, but more importantly, whether we have the right tools that decision-makers can use in assessing adaptation decisions.

Ramona Meyricke kicked off the presentation, focusing on the need for climate change adaptation and the various challenges in assessing these decisions.

Unsurprisingly, the costs of climate change are extensive. Deloitte estimates that the current cost of Australian natural disasters is $38 billion per annum, approximately 2% of Gross Domestic Product. These costs are expected to double even under conservative estimates of future climate change.

While the costs are extensive, most current adaptation strategies are reactive rather than proactive. Ideally, these strategies need a combined solution across the public and private sectors as both sectors are impacted. Costs can be split into three categories:

- Asset damages (e.g. commercial and residential property damages) are typically paid by insurance companies.

- Other financial costs are typically borne by the government and include clean-up, emergency services, temporary housing, damage to public assets and infrastructure.

- Additionally, there are social costs such as illness, mental health impacts, high-risk alcohol consumption and disruption to education and economic activity. Typically, this would also be borne by the public sector.

Given the different costs borne by the private and public sector, the two sectors understandably view climate change resilience differently and hence it is not surprising that current strategies tend to not consider all costs.

An effective adaptation strategy needs to focus on all different facets of climate change-related costs. It needs to focus on structural aspects such as more resilient physical structures to reduce vulnerability and non-structural aspects such as having appropriate local decision-making capacity, having adequate community preparedness, and ensuring that broader governance is in place.

Ramona reiterated the importance of having tools that consider the complete set of costs and also ensuring that they are forward-looking. Current tools do not meet this brief as they typically focus on backward-looking probabilities and, social and non-financial costs are typically not considered.

Climate Adaptation – a case study of Brisbane River flood mitigation

To illustrate an example, Sylvia Wang took the audience through a case study of Brisbane River flood mitigation. The Brisbane River catchment is identified to have the highest potential flood damage of any flood plain in Australia. Common flood adaptation options include:

- Land use planning and improving building construction standards.

- Building resilient infrastructures such as dams, levees, flood gates, and flood detention basins.

- Flood retrofitting for buildings and utilities, as well as floodproofing.

No single method can fully achieve flood immunity on its own and the optimal solution requires a combination of methods.

Cost-benefit analysis and limitations

The most commonly used methodology to assess adaptation investments is Cost-Benefit Analysis (CBA). The typical CBA methodology focuses on comparing the Net Present Value (NPV) of two or more alternatives to identify the preferred option

Using the case study of Brisbane River flood mitigation, Sylvia noted that CBA tends to only focus on the economic value of a project, and it tends to prioritize projects requiring lower capital investment which may not provide sufficient resilience against severe events.

Using the case study, Sylvia also noted other limitations of CBA including:

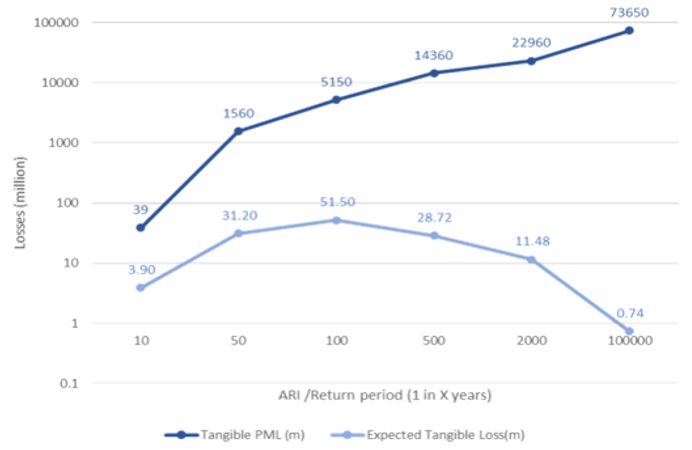

- Using ‘expected loss’ can potentially underestimate the ‘true’ impact of extreme events. As shown in the graph below, when event losses (in dark blue) are weighted by event frequencies to generate expected losses (in light blue), the magnitude of impact from single losses is missed.

Source: Modified from Brisbane River Strategic Floodplain Management Plan, 2019. - Traditional CBA captures a single economic scenario which does not consider uncertainty in costs and benefits, such as increasing repair costs, demand surges driven by correlated catastrophic events, population growth etc. Additionally, it tends to focus on economic measures and some of the non-financial costs and intangibles are not considered.

- As expected, CBA is sensitive to selected discount rates, especially for projects covering lifetime of assets. The 7% social discount rate typically used by Australian government agencies is higher than the rate adopted by peer countries such as UK, France, New Zealand, and US, resulting in lower estimated value for climate adaptation projections.

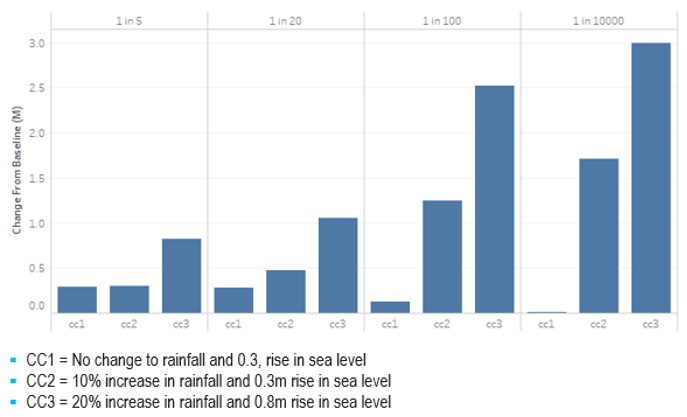

- Absence of climate risk scenarios in CBA analysis could expose communities and infrastructures to unexpected consequences. As illustrated in the graph below using an example of peak flood levels, the impacts vary materially by the climate change scenario and hence appropriate adaptation strategies will change depending on the scenario.

|

Alternative assessment methods

Due to the limitations outlined above, the approach to assessing adaptation strategies needs to evolve to ensure it can consider various sources of costs, the uncertainty in future projections and the long projection period. Alison Drill concluded the presentation by noting potential alternative that could be utilised.

A range of alternatives are possible but the work to date is pointing towards using a multi-criteria analysis. Under this approach, rather than just using one decision point (e.g. the NPV of economic value), investments would be evaluated using multiple criteria. An example of this would be where in addition to NPV of avoided loss, we also consider other costs through metrics such as net employment effect, alleviation of anxiety or mental health impacts and protection of rare species. This would allow consideration of a broader set of financial and non-financial costs, and adaptation decisions could then involve decision makers from multiple sectors.

Multi-criteria analysis is useful as it provides a tool that allows consideration of factors beyond economic value, such as equity, flexibility, robustness, and synergy with other strategic objectives. Whilst it has its benefits, to utilise this approach, several challenges would need to be resolved including how many different criteria are included, how would the more subjective elements be reliably measured and how much weighting would be given to each individual criteria when assessing different adaptation strategies.

Additionally, a key consideration needs to be the use of future climate change scenarios rather than the current state. Assessing strategies under a range of scenarios would be an option given the inherent uncertainty in climate change projections.

Adaptation strategies to tackle climate change will be topic of great interest for the near future, and the climate risk research group will be exploring different methods and combining different tools. It certainly is expected to be a challenging space and anyone with an interest in this area should look to get involved to assist in tackling this challenge.

| Read further coverage from the 2022 All-Actuaries Summit. |

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.