The state of property insurance affordability

The affordability of property insurance premiums is an ongoing concern in Australia.

Following numerous inquiries and recommendations from various stakeholders, the government recently announced its intent to create a reinsurance pool to improve the accessibility and affordability of insurance for households, small businesses, and strata buildings in cyclone-prone areas (which are mainly located in northern Australia). The pool is set to operate from July 2022 and will be administered by Australian Reinsurance Pool Corporation (ARPC).

The Actuaries Institute has been a thought leader in this area for some time, so it’s a good time to re-visit some of the concepts and key takeaways from the paper Property insurance affordability: Challenges and potential solutions.

The paper was launched last year by the General Insurance Affordability Working Group. The purpose of the paper was to assist public policymakers and other stakeholders in considering the issue of affordability.

Whilst the paper starts by introducing affordability and describing a proposed measurement framework, the latter sections explore some of the options to address it, including pool and non-pool mechanisms.

What are the root causes of property insurance affordability and its implications?

Risk address pricing in the property insurance market (i.e. location-specific pricing at a very granular level by the property) has naturally led to the identification of high natural hazard risks. This often combines with economic factors that impact an individual’s ability to pay or absorb the changes in risk, and as such affordability pressures arise. Often locations at greatest risk of natural hazards are populated by those with lower incomes with existing housing cost stress, which can lead to underinsurance and/or no insurance as policyholders decide to either reduce the sum insured or lapse their policy. This then gives rise to what is considered a ‘Protection Gap’ – property owners without sufficient insurance protection to recover well from loss events.

Protection gaps are a concern for individuals, communities, governments (taxpayers) and charitable organisations as they are called upon to bridge the gap after a disaster to restore and recover both property and livelihoods.

Property insurance affordability is an issue that’s broader than just insurance risk alone and encompasses social and economic issues. It’s an issue for communities, businesses, insurers and governments who all have a role to play after a community is affected by a disaster.

Knowing that there are many factors coming into play and many stakeholders in the equation, when it comes to solving the problem of affordability, where do we start?

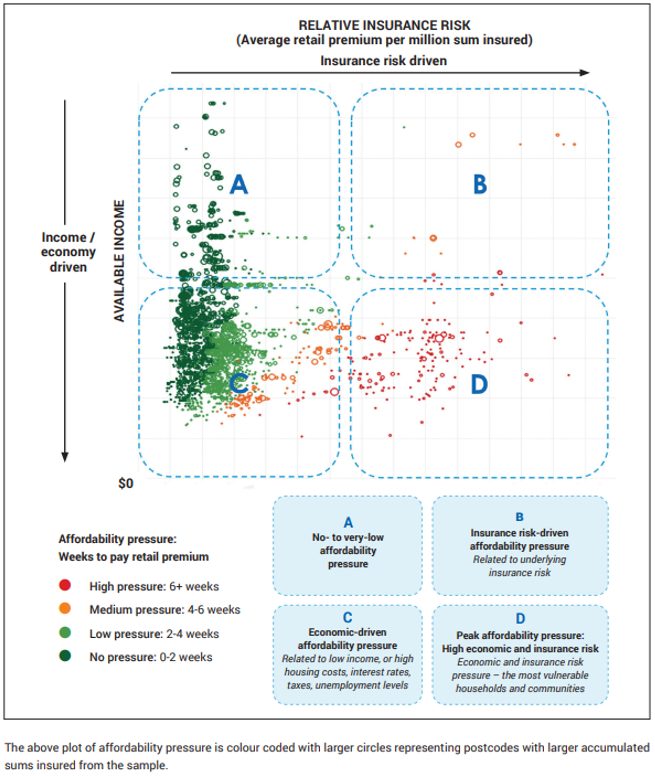

What gets measured gets managed. The paper developed a measurement framework that accounts for a household’s available income, relative insurance risk and an affordability measure expressed as the number of weeks of income required to cover the retail premium. Figure 1 below provides an illustrative example of the proposed measure, where postcodes are plotted based on the extent and drivers of their affordability pressure. The high affordability pressure postcodes are spread across three quadrants (B, C and D) and larger circles are emphasised as targets for prioritisation.

Figure 1: Insurance affordability pressure (illustrative example)

Based on this measurement framework, the paper identifies 12% of postcodes that have medium to high affordability pressure across the country. These represent 7% of the Australian population.

The measure is based on a sample of new business quotes but it illustrates the benefits of a measurement that identifies where the pockets of affordability pressure are and the corresponding drivers (natural peril risk and/or economic). This in turn will allow decision-makers to assess the cost/benefits of risk mitigation measures and target areas where to spend money to have the best impact. The measurement framework can then be refined further with more granular data.

Another core driver that influences affordability pressure is a consumer’s perceived value of insurance. This is difficult to quantify and requires research into consumer behaviour. It is expected to be correlated with the understanding of risk, the annual premium level, insurance industry reputation, successive premium increases and the level of household income.

What are the potential mechanisms to address affordability pressure?

Pooling mechanism

Pooling usually involves cross-subsidising risk among policyholders, something which is difficult in a private insurance market absent government intervention. One approach involves transferring risk into a government or government-sponsored entity or across a wider pool of policyholders through market rules, thereby reducing affordability issues for policyholders with higher insurance risk. Unlike private sector insurers which must fund losses temporally (i.e. at the time of loss), government-sponsored pools can defer part of the cost of current risk into the future through capital market financing, direct support from government revenues or similar mechanisms.

There are clear operational advantages of government-backed pools as they have lower capital requirements and the flexibility of tapping into other capital markets, including borrowing from the government. The pools can be more financially resilient in the event of extreme natural catastrophes.

The paper has an extensive survey of re/insurance pools around the world, discussing their pros and cons, structures, and efficacy on achieving their objectives.

Risk Mitigation and concept of a Mitigation gap

‘Mitigation gap’ refers to a situation where buildings have not been constructed to reflect today’s understanding of risk, or to a standard that meets future risk over their design lifetimes. This can lead to either large increases in the cost of insurance coverage or a need for expensive retrofit, both with consequential affordability pressures.

A key part of addressing the affordability pressures created by mitigation gaps and economic challenges involves increased mitigation and revisions to building codes. This however may take many years and sustained funding to see its benefits. Recognising that protection against future costs generates long term benefit with short term cost, it is essential that cost-benefit analyses take a multi-decadal view.

Some of the examples of risk mitigation include community level infrastructure funded by governments (e.g. flood levee development in Roma, QLD), land use planning that includes local councils incorporating natural perils risk in their zoning process (e.g. not allowing building development on land exposed to high levels of flood risk), stronger building standards, and household level retrofitting on existing properties.

Other non-pool methods discussed in the paper include reducing taxes on insurance premiums, targeted subsidies to individuals with low income and high premium, and insurance product and premium design through community rating, risk equalisation, base-level compulsory products, changing premium payment frequency and parametric insurance.

What does success look like?

There are multiple stakeholders to consider in the home insurance affordability equation. These stakeholders have some common and unique interests and may view ‘success’ differently.

Consumers, as well as parties that advocate consumer outcomes, are more concerned about the quantum of the insurance premium and the value that they get from it. For this group, the availability and affordability of cover is more important. However, insurers, APRA, and the government are more focused on ensuring longer-term sustainability of the home insurance market and industry in terms of suitable products, fair pricing, access for consumers and appropriate consideration of risks, so that the costs of disasters are mitigated and managed appropriately.

A mix of methods that address both short term concerns and long term focuses are required to meet both groups of stakeholders’ objectives.

Some guiding principles in determining the mix of solutions include:

- Ability to target the vulnerable/affected consumers.

- Creating proper incentives for risk mitigation to lower overall losses over time is fundamentally important.

- Sending of economic signals to consumers as to their underlying risk through pricing and other means; Identification of what changes in behaviour are being encouraged, if any, and what cost that may have for the communities and governments.

- Ability for maintenance, monitoring and smooth exit of the arrangements as the benefits of any interventions are realised; As conditions change over time, any solution framework needs periodic review.

- Generally well-functioning competitive private insurance markets which limit government interventions are desirable in an economy such as Australia.

- All else being equal, robust private markets and risk-based pricing support long term public policy goals.

- Temporary and targeted government intervention can be useful to manage affordability issues until mitigation and other measures address the issue.

References

|

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.