Valid values vanquish vulnerability to volatility

No property owner is hoping to suffer significant losses as a result of a perilous event. But if you were to find yourself in that position, and you were prepared enough to have purchased property insurance, you may let yourself feel somewhat… Validated? Vindicated? Like a visionary, perhaps? But be warned – do not vault to visions of victory. You may be vulnerable yet. Underinsurance is a financial risk faced by property owners and that risk is heightened during economic volatility.

This article aims to address the risks faced by property owners in the current environment, where fluctuating supply costs and government restrictions may cause previously reasonable insured values to be insufficient, leaving policyholders out of pocket.

What is underinsurance?

At its simplest, underinsurance occurs when the value that the property has been insured (sum insured) for less than the amount required to repair and/or replace the property in case of an insured event occurring. It can be driven by a number of factors, including:

- An inaccurate initial assessment of the costs of insured items (for example, underestimating the costs required to repair or replace the property).

- An inaccurate or incomplete inventory of the insured items (for example, not thinking to include certain items when considering the sum insured value, or not accounting for later purchases or upgrading of assets).

- A neglect of the additional services involved in rebuilding property compared to the initial build (for example, debris removal and demolition costs).

- An active decision made by policyholders to reduce their insurance coverage in order to reduce their premium.

- A change in the economic environment which means that an initially adequate sum insured value turns out to be inadequate when the claim is made (for example, when new building regulations create greater difficulty for compliance and increase costs, or when the cost of supplies to rebuild the property is significantly higher than it was when the insurance policy was written)

The last of these is of particular interest, because it means that even the most organised and savvy policyholders may be caught out if they take a ‘set and forget’ approach to insurance, comfortable with their belief that they will be adequately insured against all risks.

What changes are we seeing in construction costs?

The cost of property construction generally increases over time due to inflationary increases in goods and services required in a build. Although, only directly relevant for personal lines, we can use the price of new houses as a proxy for the change in price for properties in general. According to ABS data, the cost to build a new house in Australia increased by 74.8% between 2004 and 2018[i]. This averages out to around 4% per annum, with variations expected between states and for houses of different styles and sizes. This level of growth should be enough to make policyholders wary, as it suggests that the insured values in contracts can quickly become inadequate, particularly if construction takes place over a number of years.

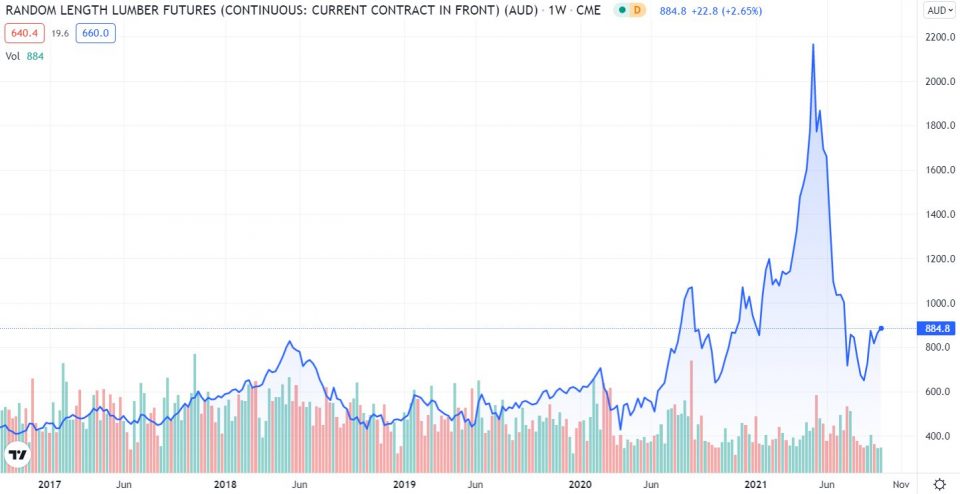

Beyond the general upward trend, events of the past few years have caused the price of construction to increase much more significantly than previously. One of the largest costs in construction is the lumber used for the framing of buildings, and the price has fluctuated hugely in the past year due to restrictions on supply. These supply issues were originally driven by the bushfires of early 2020, which, according to the NSW Forestry Corporation, reduced the amount of available quality timber by up to 30% in key areas[ii]. Flow on effects from COVID-19 have also exacerbated the shortages faced by Australians by reducing lumber imports from the US. This was driven by reduced production during the early months of COVID-19, an increase in US demand as a result of low interest rates, and an interruption of freight and shipping capacity[iii]. Historical US lumber futures prices to September 2021 can be seen in the graph below.

Reports in July suggested that the average price of a new home in US increased by around USD$30,000 (AUD$40,000)[iv], compared to April 2020. Australian house prices have not risen to the same extent, but there are obvious pressures and concerns of which homeowners and policyholders should be aware.

The good news is that lumber prices have reduced from the peak observed in May 2021, and further decreases are expected by the end of the year. Lumber prices in the US have already fallen by 60% from the records reached in May, after they had risen more than 500% through the pandemic. Award-winning portfolio manager Michael Gayed has given a number of reasons why he thinks prices will continue to decrease[v]. These include:

- A slow-down in housing construction;

- An oversupply of lumber in sawmills;

- A reduction in treasury yields; and,

- The possibility of economic downturn related to the debt ceiling in the US.

This should allay concerns of builders and policyholders to some degree, but the fluctuation in costs should serve as a warning to both groups of the vulnerability of construction costs to external factors.

What should policyholders take away from this?

I think the most important thing to take away is to recognise the extent to which the value of an insured property can move over time, and to acknowledge that even well-prepared policyholders may find themselves underinsured if they are not adaptable to the changing conditions.

According to MCG Quantity Surveyors, the cost of building an average home in Australia’s biggest capital cities has risen by more than 10% in the six months to August 2021, which has likely left many property investors underinsured[vi]. Even before the pandemic, they suggest that up to 80% of investors may have been underinsured, which should cause alarm bells to start ringing in the mind of any policyholder.

The key, then, is to stay ahead of the curve – if you wait until you need to claim to realise that you are underinsured, it is already too late. Instead, policyholders should consider the following options available to them:

- Regularly assess the value of their sum insured, at least annually. This assessment should be made with the causes of underinsurance noted in this article in mind, to ensure that it is accurate and accounts for all necessary costs and additional outlays (for example, professional fees and council charges) to the extent that these are able to be covered.

- Do not solely rely on online insurance calculators. Although these tools may be useful in providing a list of items for you to consider, they will not necessarily capture all of the nuances of a policyholder’s situation. As such, the policyholder should not exclusively rely on these to determine the insured value.

- Shop around for insurance options. This will force you to rethink your insured value, and will also mean that policyholders wanting to reduce their premiums may be able to find a different insurer willing to provide the same or higher level of coverage for the same or lower premium. This can mitigate the extent to which financial considerations contribute to underinsurance.

- Consider using an insurance broker, who might be able to assist in a number of ways[vii]. Firstly, for policyholders who are not financially literate or do not have the capacity (in terms of time and effort) to stay on top of their insurance, a broker can assist in taking the onus from you. Secondly, brokers are able to provide advice tailored to the specific situation, working to gain a detailed understanding of the risk exposures, as well as sourcing multiple quotes on your behalf. Thirdly, at the point where a claim needs to be made, brokers are able to negotiate on behalf of the policyholder, which can assist in getting the best settlement. While the broker option does incur a cost, it may relieve some of the burden which policyholders would otherwise face.

By considering these items, policyholders will be able to gain some level of comfort and confidence that the values within their insurance contracts are valid and adequate. And it is only with these valid values that they can vanquish the risks arising from their own vulnerability to volatility within construction prices.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.