Impacts of COVID-19 for Private Health Insurance Actuaries

To better understand the uncertainty of COVID-19 on Private Health Insurers (PHI), the Health Practice Committee (HPC) issued a survey to Health Actuaries in July 2021. The survey covered a range of issues, from the impact of COVID-19, how to deal with deferred claims, risks and how actuaries were tackling major assumptions.

The intention is to provide Health Actuaries with greater information in undertaking June valuations, Financial Condition Reports and providing general actuarial advice to private health insurers on how best to manage the implications of COVID-19.

While the focus is for Health Actuaries, those with an interest in the health sector, the impacts of COVID-19 or the HPC’s approach to pooling the collective wisdom of its members may also find value in the views.

The survey was completed by 23 actuaries – six Appointed Actuaries and 17 non-Appointed Actuaries, with around half the respondents working at an insurer and the remainder as consultants.

A common theme seen in the results of the survey, is that there is a broad range of views on how COVID-19 has impacted PHI. The provision of more industry support and guidance may be valuable to assist actuaries in assessing the impact and uncertainty caused by COVID-19.

Thanks to Karl Niemann, Ignatius Li (both members of the HPC) and Nick Stolk (Finity Consulting) for creating this year’s survey.

Perspective on current experience

What are the main reasons that some ‘deferred claims’ will never occur?

The participants had a large variety of views. All response options were considered by at least one respondent to have a material impact on deferred claims never materialising, with the following areas having a relatively high rating:

- Discretionary nature of some extras claims; and

- Those who missed regular/annual scans/check-ups will not have multiple services to make up for it.

All options were also considered by at least one participant to have no impact. This breadth of views highlights the different interpretations of the extent to which COVID-19 has impacted PHI.

Given your answer to the previous question – Why do you think remaining ‘deferred claims’ have not materialised? This includes those being ‘voluntarily deferred’.

Most of the ratings provided by respondents’ cluster at the ‘some’ to ‘material’ impact levels. Some options were viewed as having a significant impact by a relatively large proportion of participants, these are:

- Patients are choosing to defer treatment due to concerns with COVID-19 and possible COVID-19 exposure in hospital treatments;

- New COVID-19 infections undermining confidence;

- New government-imposed lockdowns undermining confidence; and

- Discretionary nature of some extras claims.

What do you think needs to happen for medical services to no longer be ‘voluntarily deferred’?

Many responses have highlighted the importance of the COVID-19 vaccine in reducing the number of medical services that are voluntarily deferred. However, there were several differing views on the level of vaccinations required, whether it be at a nation-wide or state-wide level and, in particular, what the threshold is for a state to be deemed ‘fully vaccinated’. Additionally, a high percentage of participants were of the view that a 3 to 6-month period without any community transmissions would be sufficient for voluntary deferral of medical services to cease being defined as such.

Rebound in claims

When the rebound is fully occurring, how long do you think it will take to complete.

From the 23 responses, 74% are of the view that 12 months is an appropriate timeframe for the rebound to complete and 22% viewed six months. Many participants speculate that the rebound in claims may occur at a staggered rate, with completion time depending on the type of treatment, supply constraints and policy owner behaviour, causing the estimate of when it will be complete to be uncertain.

When the rebound is fully occurring, what do you think is a reasonable rate for claims to be occurring?

The majority of participants are of the view that when the rebound is fully occurring, the claims rate will sit at around 5% to 10% above the normal claim rates. Some participants have noted that this estimate will vary depending on the benefit mix, supply constraints, migration as well as the time horizon (higher claim rates may not be sustainable in the long term).

Based on what you know now, when do you think is a reasonable time for the Deferred Claims Liability (DCL) to be completely utilised? Excluding any further restrictions or increases in new cases.

A large proportion of participants (57%) are of the view that the DCL will be fully utilised by June 2022, with the next most common answer being December 2022 (22%). No participants are of the opinion that the DCL will continue beyond June 2023. It is important to note, that the answers were provided under the assumption that there are no further restrictions or increases in COVID-19 cases. As we now know, for some states there have been further restrictions and lockdowns, and respondents answering this question now (August 2021), their answers may push out to beyond June 2023.

Projections for June 21 Valuations and Financial Condition Reports (FCRs)

COVID-19 has made it difficult to select a baseline for projections FY22-2024. What do you plan on using as the basis for projections?

The majority of participants (52%) have stated that they would use pre-COVID-19 claims rates as their baseline in their projections for FY22 – 24. Many participants that have selected the use of pre-COVID-19 claims rates, commented that an adjustment would need to be made to these rates to account for COVID-19 trends in experience.

Some participants have also stated that a combination of all three claim rates would be required in the projection, to account for both the COVID-19 trends as well as any changes to business mix, product offerings and benefit changes.

Prior to COVID-19, claims increased by broadly 4-5% per year. Given COVID-19, what do you think is a reasonable adjustment to drawing rate growth for projections for FY22 and FY23? This is due to COVID-19 only.

From the 23 responses received, 17% are of the view that no adjustment to the rate of claims growth is required, while many of the responders believe that at least some adjustment is required. This adjustment typically falls in the range of 1.5% higher to 1.5% lower than the drawing rate growth. A few participants have also commented on their methodology for setting the claims growth rate, with many making an explicit assumption for the rate of COVID-19 claims catch-up.

How will COVID-19 impact forecast benefits over FY22 and FY23? For the purposes of this question exclude any DCL impacts, further lockdowns, changes in membership or product mix.

There was a variety of views noted in response to this question, with the expected impact of COVID-19 on forecasted benefits over FY22 and FY23 ranging from significantly above to materially below those expected if COVID-19 had not occurred. However, a slight leaning towards some form of reduction in the forecasted benefits is evident in the results.

DCL Valuations

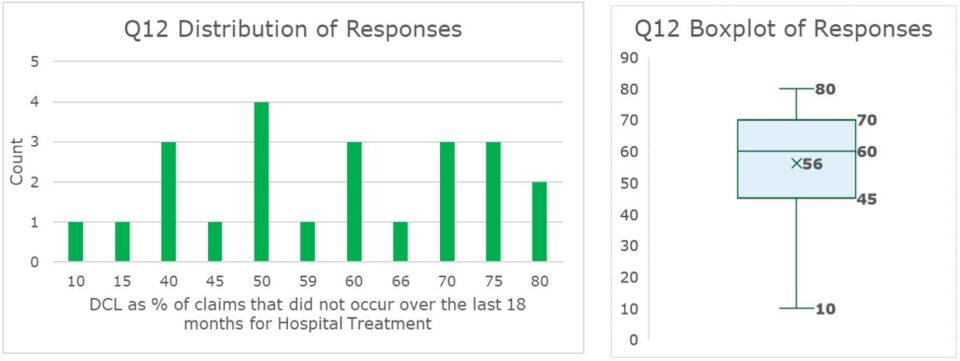

For 30 June 2021 valuations, what is a reasonable estimate for the DCL as a percentage of all claims that did not occur over the last 18 months for hospital treatment? (Noting that this would vary by geography and experience).

We can see that there is quite a large variety in the responses for this question, with the DCL estimates ranging from 10% to 80%. Though, most participants have provided estimates between the 45% and 75% mark. There is no clear trend in the estimates provided, with 50% being the most common estimate.

The large variety of estimates that we have received provides evidence of the difficulty in determining what a reasonable estimate is. Several participants have highlighted additional factors that would need to be considered in this estimate that increases its subjectivity, including the risk appetite, and the probability of adequacy.

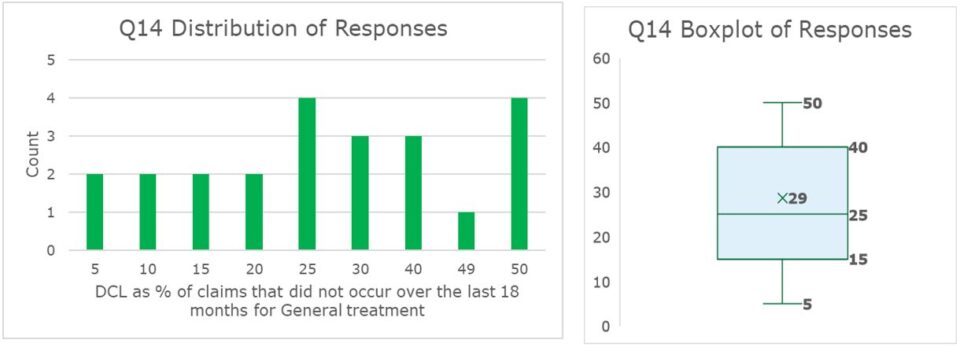

For 30 June 2021 valuations, what is a reasonable estimate for the DCL as a percentage of all claims that did not occur over the last 18 months for general treatment? (Noting that this would vary geography and experience).

The range of DCL estimates vary from 5% to 50% of claims that did not occur over the last 18 months for general treatment. The distribution that the estimate skew slightly towards the higher end of this range. The distribution of results has two peaks, with the most common DCL estimates being 25% and 50%.

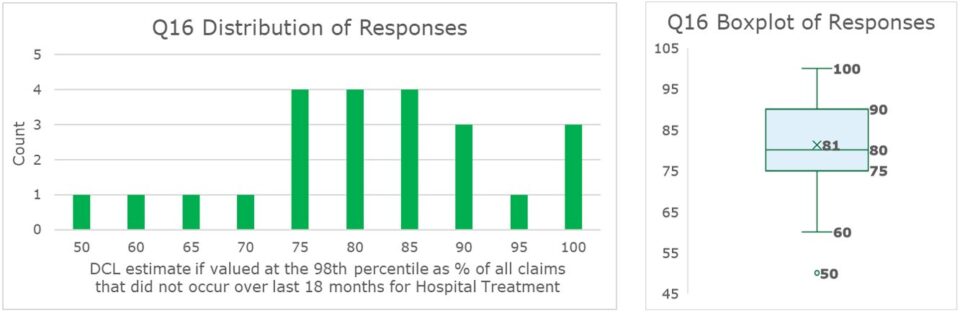

For 30 June 2021 valuations, what do you think is a reasonable estimate for the DCL if it was valued at the 98th percentile percentage of all claims that did not occur over the last 18 months for hospital treatment? (Noting that this would vary by geography and experience).

The range of DCL estimates vary from 50% to 100% of claims that did not occur over the last 18 months for hospital treatment. There is a slight skew towards the highr percentage values, with a relatively high proportion of participants estimating the DCL to be around 75% – 85%. The average estimate of the DCL sits at approximately 81%.

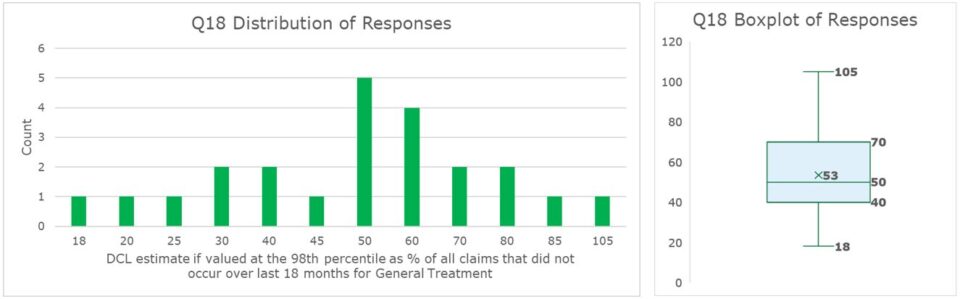

For 30 June 2021 valuations, what is a reasonable estimate for the DCL if it was valued at the 98th percentile percentage of all claims that did not occur over the last 18 months for general treatment? (Noting that this would vary by geography and experience).

We received a variety of responses for what a reasonable estimate of the DCL should be for this scenario. The range of estimates provided span from 18% to 105%, with a slight skew towards the higher ranges. A relatively high proportion of participants have estimated that the DCL sits at the 50% mark, with the average estimate for the DCL sitting at approximately 53%.

What are the main challenges in forecasting claims as at June 2021?

There are three main areas that the participants viewed to be the main challenges in forecasting claims as at June 2021, these categories are:

- Whether there will be more lockdowns and community transmissions and effects thereof;

- Base level of performance to use for drawing rates and;

- Timing of any rebounds.

All the options are considered, by at least one participant, to be a potential challenge for forecasting claims at June 2021.

Uncertainty of DCL

Given the risks and challenges of forecasting while COVID-19 is present, what is your view on the level of uncertainty in reported benefits over the next 2-3 years compared to if COVID-19 had not happened?

A large proportion of participants view the level of uncertainty in reported benefit to be significantly higher (61%) and slightly higher (26%) over the next 2-3 years than compared to if COVID-19 had not happened. However, several participants commented that although the uncertainty will be higher, because of the DCL the net impact of higher claims is reduced.

Where is the appropriate place to capture this increased uncertainty – if any?

The two categories that were most commonly chosen by participants to be the best place to capture the uncertainty in reported benefits are Scenarios (57%) and Stress test amount (57%).

Additional commentary was made about the role the DCL plays in capturing this uncertainty.

Some participants noted that in the short-term, while the DCL still exists and to avoid double-counting, the DCL is the appropriate place to account for this uncertainty. However, in the longer term, and assuming the DCL has been fully run-off, the pre-COVID-19 structure, that is scenario and stress testing, would take its place.

For the deferred claims liability to no longer be necessary on the balance sheet (e.. gvaluation of zero) what do you think would need to be demonstrated?

At least one participant has viewed each option to be somewhat important. A relatively large proportion of participants have rated the following categories as having relatively high importance:

- A material time since the last restriction on surgery and;

- A material time since last lockdown or social distancing restrictions.

Additionally, at least one participant has viewed each option to be unimportant, with the eradication of COVID-19, both globally and within Australia, being the lowest rated options.

Material time for balance sheet valuations is likely to be…?

The majority of participants view that the most material time for the balance sheet valuation will be either six months (48%) or 12 months (39%).

For the deferred claims liability to no longer be necessary for the Capital Adequacy Requirement (at the 98th percentile) – what do you think would need to be demonstrated?

The factors that have been rated the highest in terms of importance are the following:

- Significant time where forecast claims are accurate;

- Reasons for voluntary and involuntary deferrals understood and addressed and;

- Uncertainty of long-term implications of COVID-19 to be clearer.

The following categories have been given the lowest rating, overall, by participants:

- COVID-19 no longer existing;

- 36 months since the start of the liability and;

- 24 months since the start of the liability.

As at March 2021, the DCL was $1.8bn according to APRA statistics. With COVID -19 restrictions in Victoria in May/June and numerous other states in June/July, there is an argument that the DCL would increase in June and possibly September quarter. It is noted that $1.8bn is approximately 8% of annual benefits and there is a limit to the amount of claims that could be ‘caught-up’. Do you think there is a ‘limit’ on the amount of the DCL as a percentage of annual benefits?

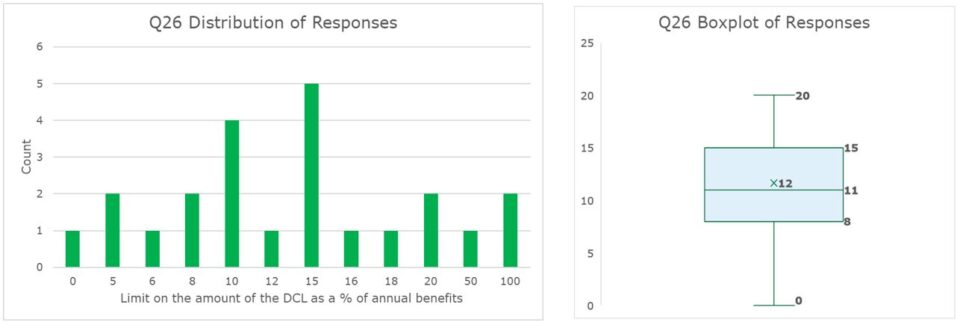

The graphs below show the range of estimates received for what a suitable limit on the amount of the DCL as a percentage of annual benefits could be. The impacts of the outliers (the 100% and 50% estimates) have been removed from the boxplot presented below.

There are several differing viewpoints for what the limit on the DCL should be. There are two participants who take a conservative view that the DCL should be 100% of the annual benefits, whilst, most participants view that the DCL should be limited to below 20% of the annual benefits.

Optional Section: Overseas Students

In respect of Overseas Students who had paid premiums upfront, and were then either unable to travel to Australia to commence or continue study, should a premium liability be recognised?

From the 17 participants that answered this question, 47% agreed that a premium liability should be recognised in respect of overseas students not receiving the PHI services that they paid for upfront. A few participants (11.76%) agreed that the premium liability should be recognised however, only if the premiums paid could not be deferred to a later period. Additionally, some participants have noted that, as the risk has not been incurred, the possibility that policyowner would get a refund.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.