PYSP/PMIF – Implications on TPD notifications

Jeff Humphreys and Caroline Chikomba summarise the 2021 All-Actuaries Virtual Summit Concurrent session which explores the implications on TPD notifications of the new legislation Protecting Your Super Package (PYSP) and Putting Members’ Interests First (PMIF).

In the past few years, the Australian group life insurance industry has seen multiple market and regulatory events that have boosted awareness among members. The most recent legislation changes were Protecting Your Super Package (PYSP) effective 1 July 2019 and Putting Members’ Interests First (PMIF) effective 1 April 2020. With the PYSP communications being rolled out starting from around April 2019 onwards, multiple funds in the industry have observed an increase in TPD claims notifications in Q2 and Q3 of 2019.

Depending on the fund, the increase in awareness has brought about a mix of higher reporting at early durations as well as at longer durations. For the increased reporting at early durations, actuaries would need to decide if the higher reporting is an increase in ultimate claims costs, or if it is speeding up in reporting of claims that would have been notified at a later point in the future, or a mix of both. On the other hand, for claims that were reported at longer durations, actuaries would need to decide if the lengthening of average delay represents a permanent shift for the portfolio.

In summary

The session, presented by Phin Wern Ting (Group Pricing Actuary, Hannover Re) and John Walters (General Manager – Group Business, Hannover Re) kicked off with a setting of the scene with the current market landscape of the group insurance market including impacts of lawyer involved claims – leading to reserve strengthening and some higher premium increases and withdrawal of reinsurance support, the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, Protecting Your Super / Putting Members’ Interests First legislation. All this led to an increase in media attention and publicity of insurance within super. This has been observed in the rise of TPD claims being notified with a sample of four funds insured by Hannover Re observing more than five years delay in claim notifications. There has also been an increase in the reporting of recently occurred events.

Phin and John discussed the two implications from increased notifications on IBNR estimates:

- Increased notifications at early durations leading to an increase in ultimate claims cost, or speeding up in reporting.

- Increased notifications at later durations with a permanent shift or temporary change in reporting.

Observations of the application of the unadjusted chain ladder method of one of Hannover’s clients (Fund A) included:

- Higher development in the recent notification periods;

- Weighted more heavily in the CDF selection;

- Late duration claims extend the tail IBNR development; and,

- When combined and applied to higher than usual reported claims, this could lead to a blow up in the IBNR.

Phin and John discussed their back testing case study to observe the Actual versus Expected (AvE) claims reported for a sample of four funds using claim notifications from Jan 2014 – Dec 2020 over the incurred period of January 2011 – December 2013. A pre-PYS/PMIF, all lives IBNR triangle was used.

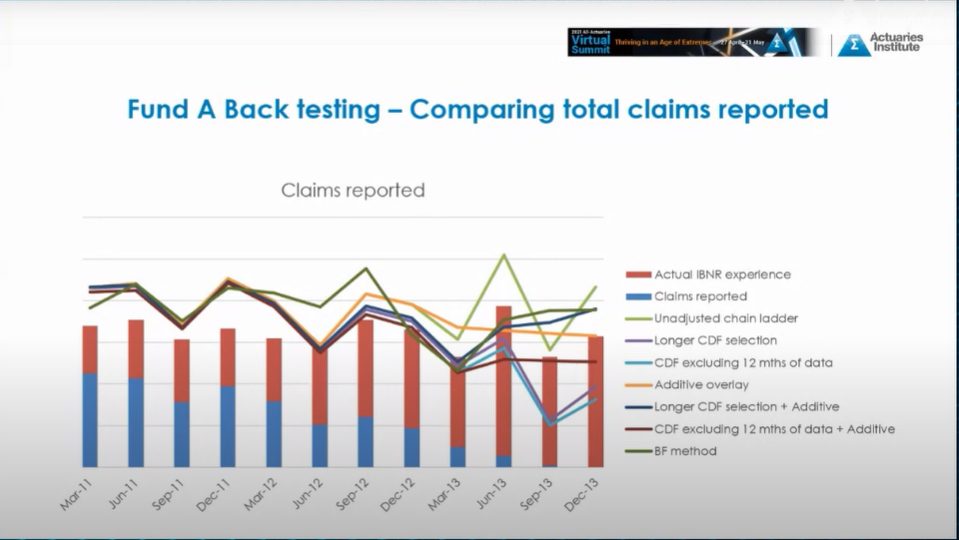

Seven back testing approaches were tested: Unadjusted chain ladder, Longer CDF selection period, CDF selection excluding 12 months of data, Additive overlay, Longer CDF selection period + Additive, CDF selection excluding 12 months of data + Additive, BF method. The results based on the approaches varied by fund with two funds observing a range of 75% to 97% and 87% to 104% of AvE claims reported.

The graph below outlines the results for Fund A back testing and shows the various outcomes for each back testing approach.

Conclusions from the case study included:

- When there is a spike in notifications, an IBNR approach that excludes notification pattern from the spike produces the most accurate projections;

- When there is no distinct spike in notifications, the chain ladder approach still appears to be appropriate; and,

- When the increased notifications do not return to prior levels, IBNR will be underestimated in the most recent periods. This brings about the questions:

- How long will this increase last?

- Is this a sign of an increase in ultimate claims?

|

Read further Actuaries Digital coverage of the 2021 All-Actuaries Virtual Summit. |

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.