Actuaries called to reduce complexity for better consumer outcomes for disability income and support services

Annette King, Actuaries Institute Senior Vice President and Chair of the 2021 All-Actuaries Virtual Summit Plenary session ‘Disability, Support, Services and Income: ‘I wouldn’t start from here’, opened with the comment that the complex problem of disability income and support “won’t be solved by brilliant people working in silos.”

Speaking on Wednesday 29 April, presenters proved that point, delivering a collaborative review of the current system and thoughtful suggestions for change to sustainably deliver income replacement and rehabilitation programs.

Annette said that vexed issue of support services and income needs reimagining. Some of the current systems are not profitable and do not deliver the best outcomes for the consumer. The system’s complexity is compounded with multiple levels of government, private insurance, superannuation and health and legal services, adding regulation and unnecessary expense when delivering income support and rehabilitation services.

Jim Minto, Chair of the Board of Directors at Swiss Re Life & Health and Board Member of the National Disability Insurance Agency (NDIA), shared his experience working in this sector over many years. Jim said balancing the needs of stakeholders added complexities for actuaries working in this sector to design products attractive to consumers and providing capital stakeholders with suitable returns. Jim noted that actuaries had an important role in ensuring the sustainability of the disability income sector. He said the opportunity to play a positive part in someone’s life was very satisfying, ensuring dignity and choice for policyholders and beneficiaries during times of illness and bereavement.

Change is needed to ensure capital flows to support these products sustainably. Current unprofitable products are not meeting the needs of capital investors in the Australian sector, and it is becoming difficult to fund. Other countries offer simple income support products that are easy to understand, reliable for the consumer, and profitable for the insurer. Australia should head towards simplicity where income support products encourage rehabilitation and return to work, where appropriate, to ensure that lifetime reliance on income support does not become the norm.

Jim outlined the standard design principles for the creation of sustainable disability income support payments and services, including:

- Products should be understood and trusted by consumers to deliver support when needed

- Standard terms for core benefits to enable comparison across products

- Indemnity only products

- Delivery of community benefits – price products for offsets to occur in the system

- Automatic update of medical conditions to ensure that payments relate to current conditions

Chair of the Actuaries Institute’s Taskforce on Disability Insurance, Ian Laughlin, said a disability income system is essential, but the current system needs urgent change, notwithstanding the difficulty of making these changes. The Taskforce has made several recommendations in its recent report, including simplifying the claims process and regulation review to allow life insurers to cover rehabilitation services, which will deliver a healthier income support system and better rehabilitation outcomes.

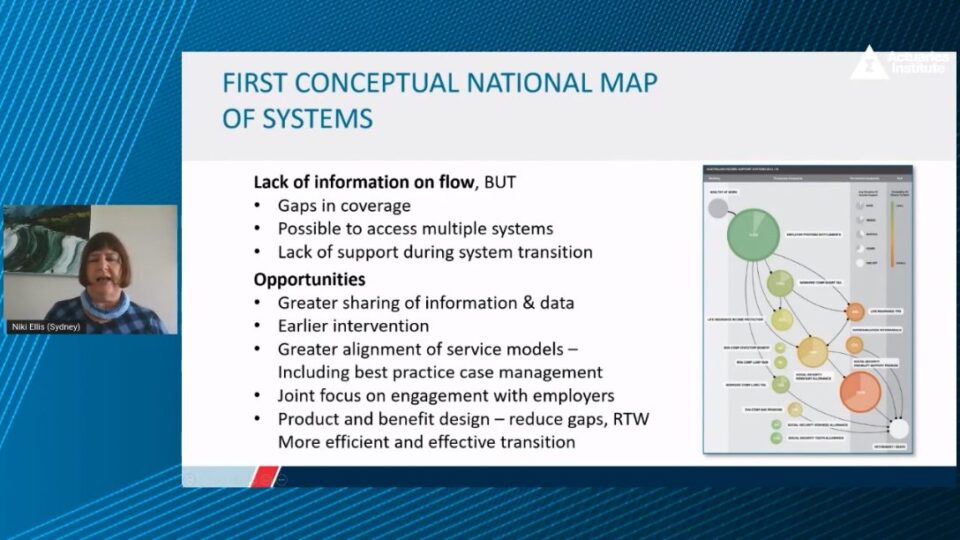

Professor Niki Ellis, health consultant and Non-Executive Director, outlined the purpose of Comcare’s Collaborative Partnership, a system of stakeholders in the disability sector whose aim is to improve workforce participation. Niki praised actuaries in the disability system and added her voice to the discussion around complexity, saying that systems, be they private, government or not for profit, should be integrated to reduce fragmentation and encourage rehabilitation and wellness to make returning to work a positive outcome. Niki would like to see additional industries represented in the Collaborative Partnership, including superannuation and life insurance, both significant players in the disability income sector.

The Collaborative Partnership has outlined the current disability support sector, which shows how consumers flow through the system, where coverage gaps exist, and identify at what stage the best opportunities to return to work occur. Further collaboration, including data sharing, can assist early intervention supports and provide better outcomes for consumers and reduced costs throughout the system.

The panel session asked views from all presenters, including Nicolette Rubinsztein, Non-Executive Director and Estelle Pearson, Principal at Finity Consulting and NDIA Board member since 2017. Estelle pointed out that complexity, gaps and overlaps, and managing the claims process means that injured or ill consumers spend too much time managing the claims process at the expense of their recovery.

Nicolette said that the system around mental health has several positive features, including coverage for most Australians, recognition and awareness of mental health problems and the correct application of compensation offsets within the superannuation system. However, consumer experience can be challenging with the complexity of the system, poor clarity in diagnosis, in particular, long wait times to see psychiatrists, and long-term payments can inhibit rehabilitation and recovery.

A final question to the panel asked for one constructive idea to improve disability support services. This was answered initially by Ian with a controversial ‘Medicare Plus’ option as a possible solution for optional extra disability coverage. Estelle offered the example of Nordic countries, in particular Sweden, where an integrated system of social insurance for sickness and workplace injuries provides benefits with reduced complexity and wondered if the ‘at fault’ provision in some insurance policies added more stress to the system leading to disputes and dispute management. Jim wants actuaries to be more vocal and use their expertise to solve this complex problem with their analytical and social benefit lens.

Awareness of inadequacies of the current system and a desire to change the system to benefit all stakeholders is important. A related session covering this important topic, among other things, is scheduled for Wednesday 19 May at 1:30pm, titled ‘Disability Insurance Task Force. The hard part: making it happen’.

|

Read further Actuaries Digital coverage of the 2021 All-Actuaries Virtual Summit. |

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.