2020 University Student Survey – Insights into the actuary of the future

A survey of universities and university actuarial students, as recognised by the Actuaries Institute, was conducted last year to identify the composition of university actuarial students and their views.

As of late 2020, there were:

- approximately 3,000 university students studying in actuarial programs;

- male students made up 62% of that figure, making the profession likely to stay male-oriented into the future; and

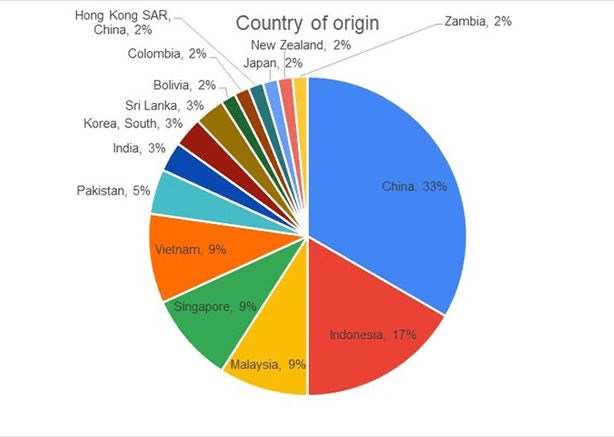

- it is estimated that international students made up 44% of the university students and are primarily from China (33%), Indonesia (17%), Malaysia (9%), Singapore (9%) and Vietnam (9%).

International students represent a significant potential future source of Members for the Institute who will be almost wholly located in Asia. They indicate a strong willingness to join the Institute. Thus, the Institute should be encouraged to continue investments into Asia with tailored strategies by jurisdiction e.g., retention in China, Hong Kong, Singapore, Malaysia and increased engagement in Indonesia and Vietnam where we currently have limited activity.

Propositions for international students include:

- information and networking opportunities;

- support for the examination and qualification process overseas to gain full qualification; and

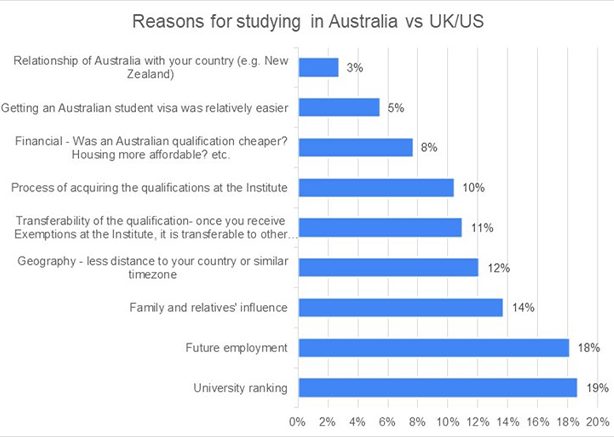

- and competitive membership fees vs other actuarial bodies. They value ‘quality’ factors (university ranking, employment prospects) more than ‘convenience’ factors (geographic proximity, visa, tuition fees etc) – so we can emphasise the former in our marketing and conversations.

Engagement with domestic and international students could be improved despite a free University Subscriber category. Increased communication about the new Part 2 qualification process could be a good starting point to encourage greater take-up of the University Subscriber category. It would also be a good time to communicate potential career pathways to engage with those not planning to proceed to fellowship.

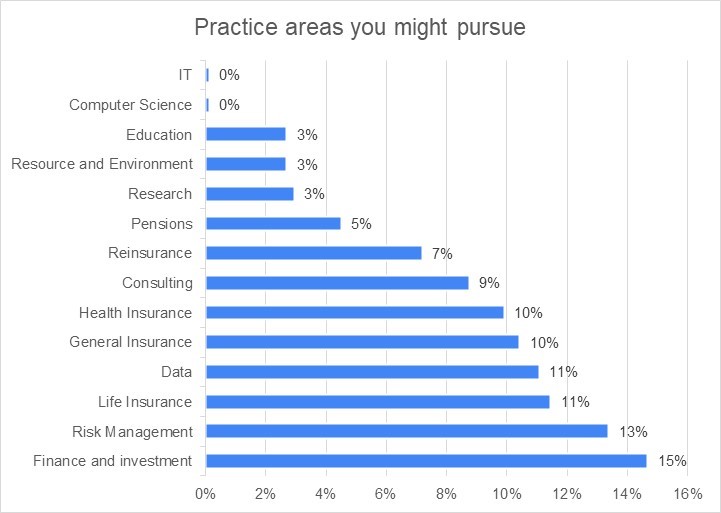

The students’ outlook for future practice areas differs to that of our current membership – three of the top-five anticipated practice areas are non-insurance or pension-related. Whether this will be borne out is unclear. However, as a progressive profession, there is merit in constantly broadening and reviewing our horizons in tune with the times, debate and update the definition of what the profession represents and evolve our education and services accordingly.

We hope to run this survey regularly, as it can help future planning and resource allocation. Perhaps formally in conjunction with the Institute and the universities.

Acknowledgements

We thank all the university lecturers and actuarial student societies for providing the information and/or promoting the student survey. We also thank Andrew Tang for his comments on the article.

Introduction

For the survey, six students from Australian universities volunteered. Their names are Ali Charolia (Macquarie University), Alex Colbert (Monash University), Simon Lee (University of New South Wales [UNSW]), Rose Lin (University of Melbourne), Jennifer Ting (Bond University), and Jasmine Wang (Australian National University [ANU]). We were not able to find contributors from Victoria University of Wellington (VUW) or Curtin University.

For the survey:

- the volunteers built a Google Forms survey and designed the questions;

- the volunteers also contacted their lecturers to get some data directly from the universities and to distribute the survey to the students; and

- the survey opened in mid-September 2020 and was closed at the end of 2020.

This article is a summary of the results and we intend to also produce a podcast of the experience of the participants of this survey.

Survey of the universities

The universities were asked to provide demographic data of their actuarial students. However, due to privacy concerns and university policies, it was requested that we only show the information in aggregate. Furthermore:

- estimates were also made, as one university asked us to use only publicly available information on its website. But this is not expected to materially change the overall picture;

- Bond University chose not to take part as it is a private university;

| Cohort | Total across seven universities |

| First-Year | 891 |

| Second-Year | 928 |

| Third-Year | 803 |

| Honours | 21 |

| Masters (Part 2) | 298 |

| PhD | 10 |

| TOTAL | 2,952 |

- the total is an underestimation, as if Bond University were included, there should be about 3,000 students in total;

- interestingly, there are fewer first-year students than second-year students. This anomaly might have been caused by the COVID-19 pandemic;

- the weighted average of males and females are 62% and 38% respectively; and

- the weighted average of international students is 39% (1,159 students).

Using third-year students as approximation of students leaving universities each year, we estimated that in 2020:

- 466 students could enter the Australian workforce

- 22 students could enter the NZ workforce

- 315 international students to return home and enter the workforce in their home countries

This may be an underestimation of the actual number entering the workforce (due to graduating Honours, Masters, and PhD students). However, there will be third years opting for higher studies (either part time or full time). There may also be some who enter other fields after their degrees, so this was thought to be acceptable as a first estimate. We hope the Institute can encourage as many of these students to join and stay engaged with the Institute throughout their careers. We note that COVID-19 is likely to impact the actual numbers of students entering the workforce.

Survey of the students:

The student survey received 153 responses (5.2% of 2,952). Although relatively small in relation to the total population, we believe the results (if read with care) is broadly representative as the gender and international student mix is not directionally dissimilar with the total population. The small response may have been caused because:

- the Google Forms survey required students to have a Google account (to try to cater for multiple entries) and this may have dissuaded some participants;

- Google is not available in China, meaning Chinese international students may be under-represented;

- the survey was carried out just before the university examination period, which may have reduced participation; and

- finally, some students may not have known about the survey due to a lack of social media usage or attention to university emails.

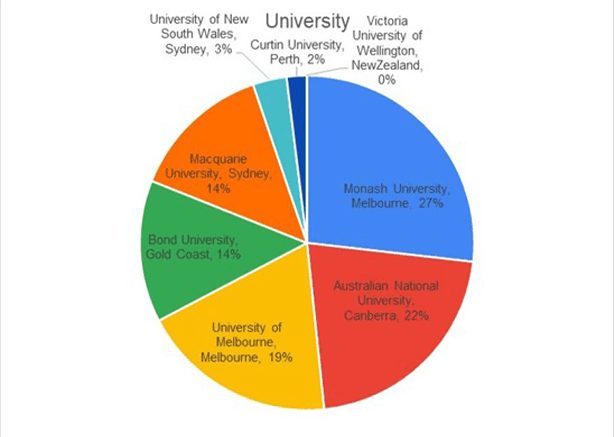

As shown below, there were participants from all the universities (in order of participants) except for VUW. The representation from Curtin and UNSW were far lower than the rest.

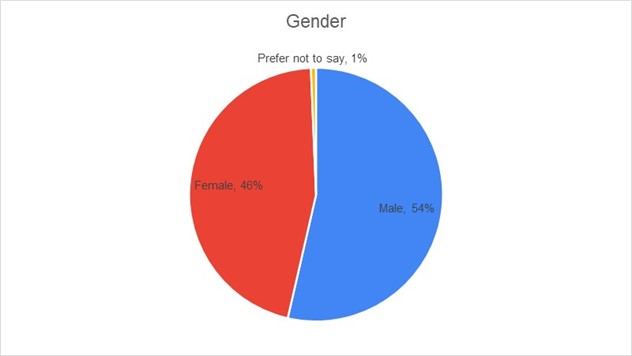

The gender mix of this sample is as shown below, where there are more females than the entire student population. As gender is a subject in which societal norms are beginning to change, future surveys could be better designed or worded in order to reflect this.

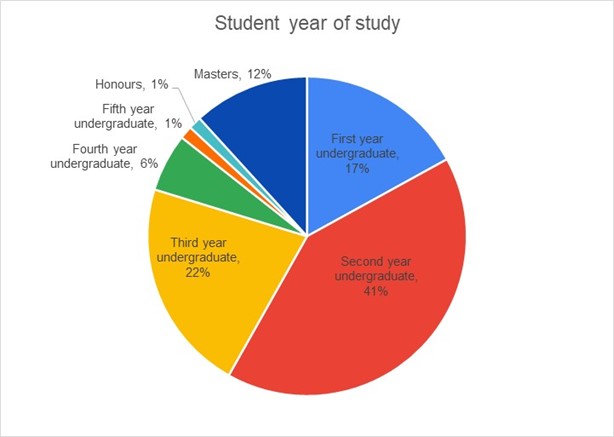

Student categories, as shown below, have higher participation from second year students. This is likely due to a large number of second year volunteers involved in this paper – thus forming a stronger connection with this particular cohort. From our understanding, the relatively large number of responses from Masters students is related to the number of domestic and international students working to complete their Part 2 requirements.

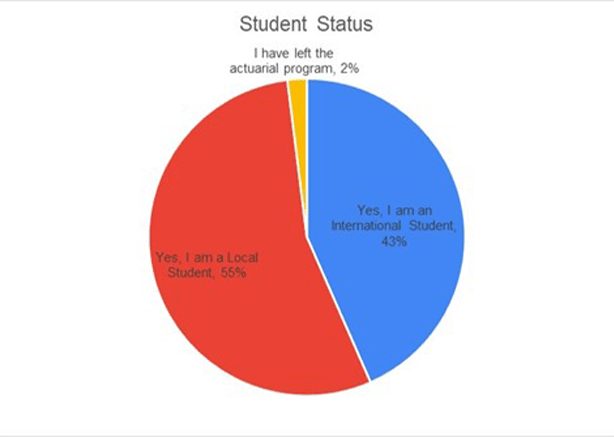

International students represent about 43% of the students, domestic students represent about 55% and those who have left the actuarial program represent about 2%. Excluding those who have left, international students are 44% of the overall student body.

For the three students who left, the reasons include:

- concerned about employability prospects after graduation (one response);

- found interest in other areas (two responses); and

- lost interest in the profession after finding out more (one response).

And they went on to study:

- Arts/Music/Languages/Humanities (one response)

- Data Analytics/ Statistics/ Mathematics (two responses)

However, all three would like to stay connected with the Institute. So we could promote our affiliate membership category more effectively.

International students are mainly from Asia, comprising of China (33%), Indonesia (17%), and 9% each for Malaysia, Singapore and Vietnam. Our current members in Asia are mainly in Hong Kong, China, Singapore and Malaysia but this could vary over time given the mix of international students, and assuming they join the Institute as full member, with a increasing representation from Indonesia and Vietnam, more support for actuaries in those countries may be needed.

We tried to track our students in China, applying 33% (Chinese students from the chart above) to the estimated 315 international students, meaning about 103 Chinese students return home each year. We believe the number of new Chinese students enrolling at the Institute is substantially below this figure. We also observe some Chinese student members discontinuing their student membership. So there are two stages where actuarial graduates from Australian universities might join other international actuarial bodies. A greater effort possibly including incentives, could be made to encourage the Chinese students to join, and stay.

Reasons for studying in Australia varies, but the top two reasons are ‘university ranking’ and ‘future employment’ (as shown below). While university rankings are not something the Institute can change, it is worth looking into arranging seminars and volunteers to speak to students about employment within the industries where actuaries work.

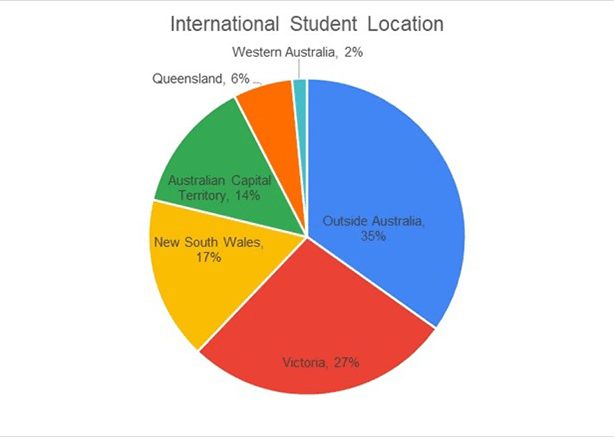

Due to the COVID-19 pandemic, we asked how many international students had returned home and how many had stayed in Australia (and in which state).

Due to COVID-19, the international students said:

- 33% are experiencing financial hardship and need financial support

- 32% have experienced financial hardship and have overcome it

- 35% had not experienced financial hardship

When asked if international students are planning to join the Institute:

- 71% plan to join the Institute

- 26% said maybe

- 3% said no

International students would be keen to remain connected to the Institute for the following reasons:

- Information

- Networking

- Future prospects/employment

- Flexibility to continue with examinations overseas

- Lowered member fees

- Friends to study with

- Qualification

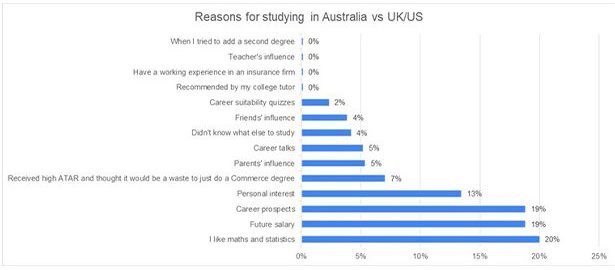

Looking back at the entire student population, we asked what made them consider actuarial studies (multiple responses were allowed). As shown below, the decision to study actuarial appears to be mainly self-driven although prompts from teachers, tutors, parents and friends do help.

Only 38.3% of students were university subscribers to the Institute. This is free for university actuarial (as well as mathematics/statistics) students and provides access to our CPD. We suggest greater promotion of this benefit to students so that we can engage them earlier and encourage them to progress to Part 2 and 3 examinations, or to remain connected as they move to other fields of work.

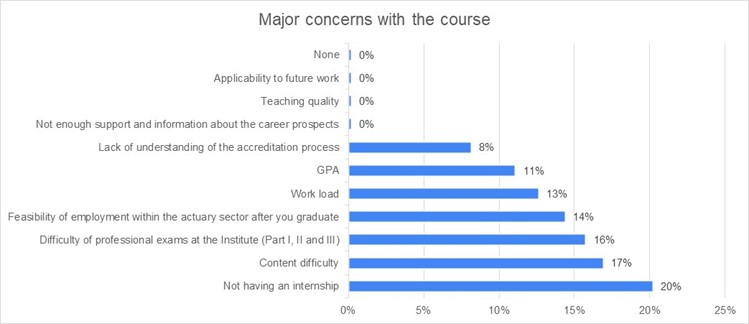

When asked about their concerns with the course, and the students’ responses are shown below.

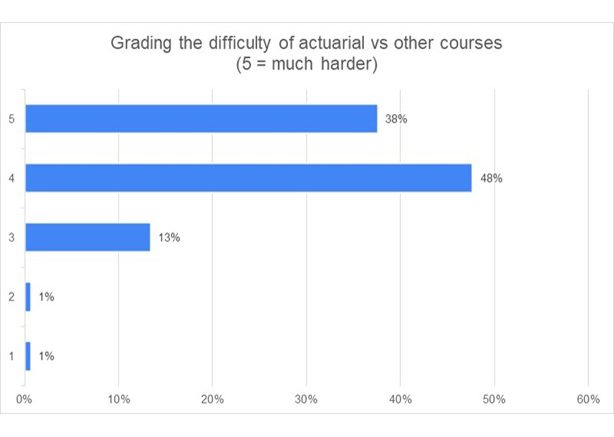

When asked about difficulty, and the students found actuarial grades are relatively harder than other tertiary courses they have taken (as shown below).

When asked about fellowship with the Institute:

- 45.6% said they want to work towards FIAA status

- 12.1% said they did not think they would work towards FIAA status

- 42.3% thought “maybe”

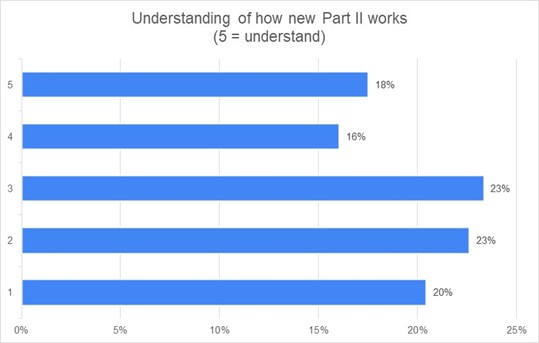

When asked about how well they understand the new Part 2 pathway, the responses were mixed, so more explanation how the new Part 2 subjects could be improved:

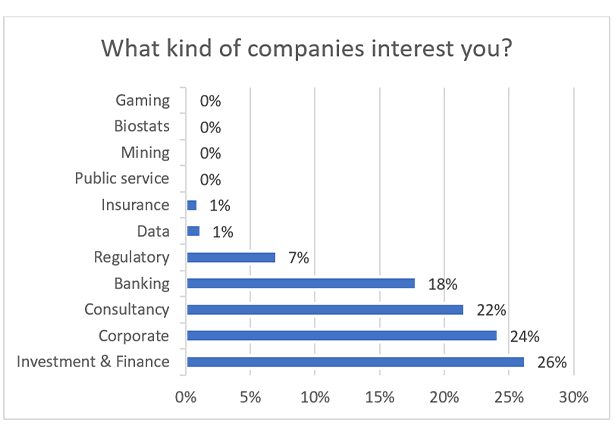

When asked which kind of companies that students were interest in. It received a mix of ‘type’ of companies and practice areas (as shown below). This may be caused by allowing free-form answers, as displayed below:

When asked about practice areas they are interested in, the responses are as shown below

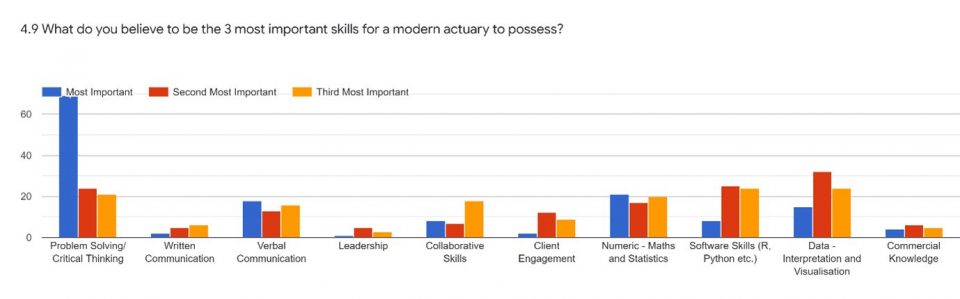

When asked about to choose three most important skills a modern actuary need to have, the responses are shown below:

When asked about plans after graduating from their Bachelor degree, the responses were:

- 28% would continue to Part 2 exams via distance learning, and work full-time in Australia

- 21% would continue to Part 2 exams via a Masters degree or Honours degree in an Australian university

- 21% were undecided

- 11% would take further postgraduate studies

- 6% would continue to Part 2 exams via distance learning, and work part-time in Australia

- 3% would switch to the IFOA examination process

- 3% would continue to Part 2 exams via distance learning, and work full-time outside Australia

There were also a small number of other responses including:

- Switching to another examination process

- Take Part 2 but work part time outside Australia

- Defer Part 2

- Change work field

An open-ended question asked whether the students would like to find out more about the Institute and the answers were positive. Some more nuanced responses for more information included:

- how studies apply to practice;

- how to navigate the industry and find entry level jobs as an international student;

- careers and paths;

- accreditation process;

- process to become an actuary; and

- number of exams for each parts of the education program

Based on the responses, we encourage more actuaries to speak with the students whenever possible. Communication, relationship and community is helpful.

Conclusion

We hope that this survey has been of interest to you. We believe it will be useful for the Actuaries Institute (and the universities) in planning for the future and be an important input to the ongoing Horizon Scan 2035 review.

International students (who are mainly from Asia) represent a significant potential source of membership and the Institute should be encouraged to invest in developing tailored engagement in Asia. Developing a value proposition would be helpful.

Engagement with university students can be improved, particularly in relation to career pathways, explaining the new Part 2 process and to encourage greater take-up of the University Subscriber category.

The students will become the actuaries of the future and is thus important to understand what they think and how things change, so that the profession remains relevant to society.

We hope that this survey can be carried out again in the future in conjunction with the Institute and the universities so that developing trends can be identified.

Special thanks to the student volunteers for their contribution in this survey and co-authoring this article!

Ali CharoliaFinal-year student at Macquarie University

|

Alex ColbertFinal-year student at Monash University |

Simon LeeFinal-year student at University of New South Wales |

Rose LinFinal-year international student at the University of Melbourne, Bachelor of Commerce, majoring in actuarial science |

|

Jasmine WangThird-year student at Australian National University, studying Actuarial Studies and Statistics. |

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.

Jennifer Ting

Jennifer Ting