Actuaries and data – where do you stand?

In a recent survey of general insurance actuaries from the Asia-Pacific region, Kon Makris and Mudit Gupta noted some interesting results from participants that we wanted to share for comment and discussion.

Actuaries’ influence in data processes

In a recent survey of general insurance actuaries from the Asia-Pacific region, we noted some interesting results from participants that we wanted to share for comment and discussion.

The importance of data processes

Decision-making within an organisation is built on a foundation of data. This means that the way data moves through an organisation is incredibly important. What is collected, how it is checked or maintained, and how it is aggregated, will all affect the quality of information provided to management. This also affects actuarial work, where any advice is only as good as the underlying data available.

Trust issues

Actuaries often find themselves in the centre of debates on trustworthiness or appropriateness of data. Sometimes misunderstandings or disagreements can arise due to the way data outputs has been prepared or used across different contexts. Some common examples include:

- Financial year view vs underwriting year view

- Comparing extracts from different source systems

- Focussing on headline movements rather than the portfolio view

- Results that are materially affected by known limitations of data systems

Such debates prompt a natural question of how involved an actuary should be in the data process, to ensure that they can advise on the appropriateness of data, and also be aware of the potential for misunderstanding.

Influence on data process

As part of a discussion on data trust issues, we surveyed participants in the Singapore Actuarial Society’s 2020 General Insurance Conference held virtually on 25 November 2020.

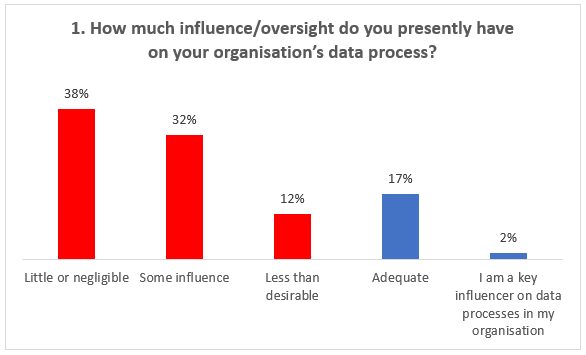

Participants were asked to classify their level of involvement in data process within their organisation (see Figure 1). Participants were asked to interpret ‘data process’ as it means to them from their perspectives in their organisation.

Noting the limitations of this informal survey (with 60 responses), the responses raise some interesting observations. Remarkably, 82% of respondents felt they had little or less than desirable influence in their organisation’s data process. This suggests that most actuaries are ‘acceptors’ of data, rather than being directly involved in what is collected and how quality is assured.

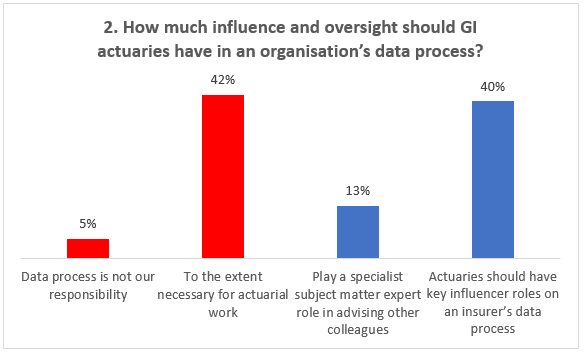

While the level of influence may not be evaluated as high, there was divergence in opinion on what level of influence is desirable (see Figure 2).

- 47% of respondents felt that actuaries’ involvement in an organisations data processes is either not their direct responsibility or only relevant to the extent necessary for actuarial work.

- Roughly similar number of participants (53%) felt that actuaries should have an expert or influencer role to play.

This result suggests that many, but not all, actuaries see their role as helping shape data process in a way that can benefit the organisation more broadly.

Champions for trust

We understand that different respondents will have different roles and perspectives on these questions. Regardless of the level of actual or desired level of influence in data processes, actuaries have deep knowledge and understanding of an insurers’ operations and its data and are in a privileged position to bridge the gap between different stakeholders’ understanding of data in an insurance company. Therefore, whatever the level of involvement, actuaries have a critical role when it comes to increasing the level of trust in an insurer’s data and insights.

We are keen to hear what you think. Do actuaries practicing in Australia feel the same? How much involvement should actuaries have in the development and implementation of new data processes? Also interested to also hear from other practicing areas and whether there are differences in opinion from different industries and practice areas.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.