The future of travel insurance

In response to COVID-19, the Australian Government introduced an indefinite ban on all overseas travel in late March 2020. With major Australian airlines speculating international flights won’t resume until at least July 2021, the travel industry is likely to endure long-term ramifications. Danielle Casamento considers the impact that changing customer expectations and travel behaviours might have, and what the ‘new normal’ might be for the industry in a post-COVID-19 world.

This is the second part of Finity’s series. The article first appeared on Finity’s website on 9 July 2020.

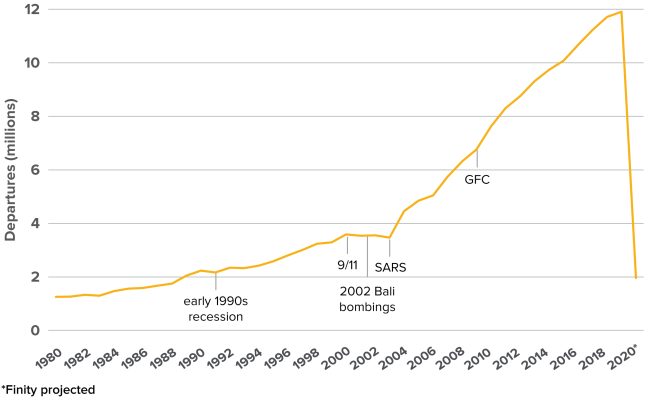

How long will it take for travel to return to ‘normal’ after this global pandemic is over? If we look to Australian Bureau of Statistics (ABS) departure figures over the last 40 years there’s a rare few global ‘events’ that have caused the number of Australian international traveller departures to plateau or drop before returning to ‘normal’ within one to two years.

If the international travel ban continues for all overseas destinations until the end of the year the total number of departures for 2020 is projected to be at the same level as the early 1990’s. As a result, a sustained reduction in travel insurance premium volume is expected across this year and well beyond the lifting of the travel ban restrictions as the public and businesses slowly gain the confidence and financial ability to travel again.

From mid-June, the EU has eased travel restrictions across internal borders. The recovery of intra-Europe travel over the coming weeks may provide insight into the return to ‘normal’ trajectory globally. While the international travel ban in Australia won’t be lifted for some time, interstate travel has recommenced and it’s possible New Zealand travel will resume sooner.

Changing travel behaviour

Domestic & Trans-Tasman bubble

There is likely to be an uplift in domestic travel in the short-term as people take shorter trips in their home country once some restrictions are lifted and state borders reopen. Qantas CEO, Alan Joyce, predicts that domestic travel might be 70% of pre-COVID levels in 2021 before reverting back to 100% of pre-COVID levels by 2022. Generally, most interstate travel is uninsured – while 90% of overnight trips are domestic, only about 10% of policies sold online are for domestic travel. Given a high proportion of domestic trips are uninsured and domestics trips are generally low value, the return of domestic travel will mean travel premium volumes will still remain a small fraction of pre-pandemic levels.

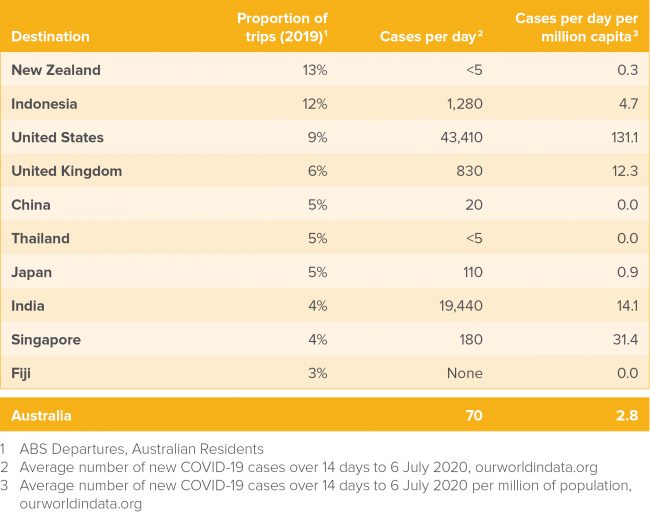

It’s likely the proportion of travellers electing New Zealand as their overseas holiday destination might increase as restrictions lift and travellers want the safety of somewhere ‘close to home’. New Zealand is already the most common destination for Australian overseas trips – representing 13% of overseas trips in 2019 (ABS).

International destinations

Beyond the Trans-Tasman bubble, like the lifting of other restrictions, the Government might adopt a staged approach to travel, opening access to some ‘safer’ destinations which don’t require layovers first. Looking at the COVID-19 ‘status’ for each of Australia’s top 10 most common travel destinations there are areas of high and low COVID-19 activity.

In addition to New Zealand, destinations like Thailand and Fiji, which have a low prevalence of COVID-19 and are accessible via direct flights, might open to travel earlier than the rest of the world. The three most common destinations aside from New Zealand (i.e. Indonesia, United States and United Kingdom) which together make up 27% of overseas trips, have high infection rates and therefore, might open up later.

From 1 July, the EU opened its external borders to 14 ‘safe’ countries (Algeria, Australia, Canada, Georgia, Japan, Montenegro, Morocco, New Zealand, Rwanda, Serbia, South Korea, Thailand, Tunisia, and Uruguay). Considering the ‘safe’ countries identified by the EU, if Australian travel was to open up to these locations, this would reinstate less than 25% of Australian trips.

Business travel

The recovery of business travel is likely to be slower than leisure travel, possibly taking years to return to pre-COVID-19 levels. Business is a small proportion of the travel insurance market accounting for around 8% of Australian overseas trips. As the pandemic places pressure on company budgets, the business world is growing accustomed to technology solutions and with employers having a duty of care to their employees, most meetings will continue to be run remotely rather than in person.

Customer needs

Travel insurers might need to reconsider their offering, product design and coverage in response to short-term changes in travel habits and longer term market expectations. Is there a domestic or New Zealand travel product that might suit customer needs during this time? Since medical costs for essential treatment are covered by the reciprocal health care agreement between Australia and New Zealand, focus might be on cover for non-essential medical expenses and extreme sports/ski. How can product design help travellers feel safer when overseas travel to nearby destinations starts to open up?

Attention on insurance coverage caused by the pandemic might see a higher demand for ‘cancel-for any reason’ cover. A travel insurance comparison site in the U.S. has indicated that interest in ‘cancel for any reason’ policies jumped from just 5% to more than 50% after the pandemic (Aardvark Compare). Only a select few players in Australia offer ‘cancel-for any reason’ cover and many have ‘temporarily’ withdrawn these policies from the market. After the pandemic, it’s likely the ‘cancel for any reason’ cover will be less generous – insurers and reinsurers globally are paring back their offering and tightening policy wording.

While price will always be a consideration for customers, COVID-19 will highlight the need to spend a little more to get the right coverage in the future. Many Australians would be reluctant to travel internationally without medical cover for COVID-19, even to ‘safer’ destinations. Given the volume of people impacted by cancelled travel plans, customers will consider how insurers managed and responded to the current pandemic in making decisions on their next policy purchase.

Returning to ‘normal’ after COVID-19

As the market slowly recovers to a new ‘normal’, customer demands will change fundamentally. Cautious travellers will likely lead to lower sales volumes (less trips taken) but higher value products (demand for more coverage). Eventually as focus on the pandemic subsides, customer demand for the more ‘basic’ products can be expected to resume.

There is an opportunity for travel insurers to reset the ‘status quo’. In a market heavily navigated by customer expectations, insurers that pivot their coverage to better align with the new demands, could gain considerably. Insurers could consider opportunities to:

- Tailor cover that complements the flexible offerings from travel suppliers (airlines and hotels) and encourages consumers to feel safe to travel again.

- Enhance the perceived value of the ‘automatic’ cover provided through credit cards.

- Implement technology driven innovation to improve the customer experience. In the US, we have seen insurers using weather forecasts to automatically offer policyholders compensation for say, a cancelled camping trip due to rain.

- Use customer behaviour insights to boost marketing and improve sales outcomes. For example, building an online marketing tool which enables customers to identify ‘safe’ holiday destinations that suit their individual characteristics and circumstances.

The COVID-19 pandemic has placed travel insurers in the regulatory and media spotlight. Insurers that effectively manage customer frustrations and respond to post-COVID-19 customer priorities with transitionary offerings will build brand value and strengthen their pipeline of future sales. How can insurers leverage customer insights and learnings from other countries to rebuild their travel portfolio in the imminent post-COVID-19 world?

This is the second (Part 2) of a series of Finity e-updates on the impact of COVID-19 on the travel insurance market. Re-visit the first part here. We will endeavour to keep you up-to-date on the travel insurance industry as the pandemic evolves.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.