Coronavirus and future investment returns

In light of a major economic event such as COVID-19 it is critical to return to first principles when thinking about investing. When there is a downward market reaction to an event, this does not mean future return estimates should also be revised down (indeed they may even be revised up). Where valuations are today for some equities and bonds, achieving ambitious long-term return goals may be challenging. Douglas Isles explores considerations fo future investment returns.

Actuaries may be asked to provide estimates of future returns for investment portfolios. A market event, like the current coronavirus pandemic, has a direct impact on the price of assets and as a result potential future returns.

The temptation in an environment of risk aversion may be to reduce future forecasted returns. However, one must reconcile this against a negative market reaction, which reduces the price being paid for future cash flows, even if they are impaired.

The increased awareness of behavioural finance in recent years has not led to improved collective behaviour. Humans struggle with social pressure, and in dealing with information and time. The sensible framework is to go back to first principles in setting expectations for future returns, noting that market pricing can be used to derive reasonable estimates, from where assumptions can be challenged, rather than trying to forecast returns, which tends to anchor to historic return paths, rather than current pricing.

For fixed income (nominal) assets, the yield to maturity provides a reasonable estimate of future nominal returns, while for equity (real) assets, a cyclically adjusted earnings yield provides a reasonable estimate of future real returns.

With government bonds at record low yields, and cyclically adjusted earnings yields below historical averages, despite recent falls in equity markets, the long-term return prospects for portfolios may be lower than many return objectives would suggest is necessary.

The balance of the article looks at fixed income and equities in turn. The US market is used for illustrative purposes, as it has the most readily available data, and dominates the global component of most portfolios. I have written two papers which go into more detail on this, accessible via the following links.[i]

Fixed Income[ii]

The nominal return from owning a bond, if held to maturity, and if there is no default event, is the Yield to Maturity. If the bond is sold, or marked to market, this will be affected by changes in valuation.

Bonds have moved in very long cycles – in the US over the last 120 years, these have been 20-40 years of rising yields, followed by 20-40 years of falling yields.

At the broad level, the 10-year US government bond has acted as a reasonable proxy for long term returns from a portfolio of government bonds. From a real perspective, bond returns globally were poorest in the periods of World Wars.

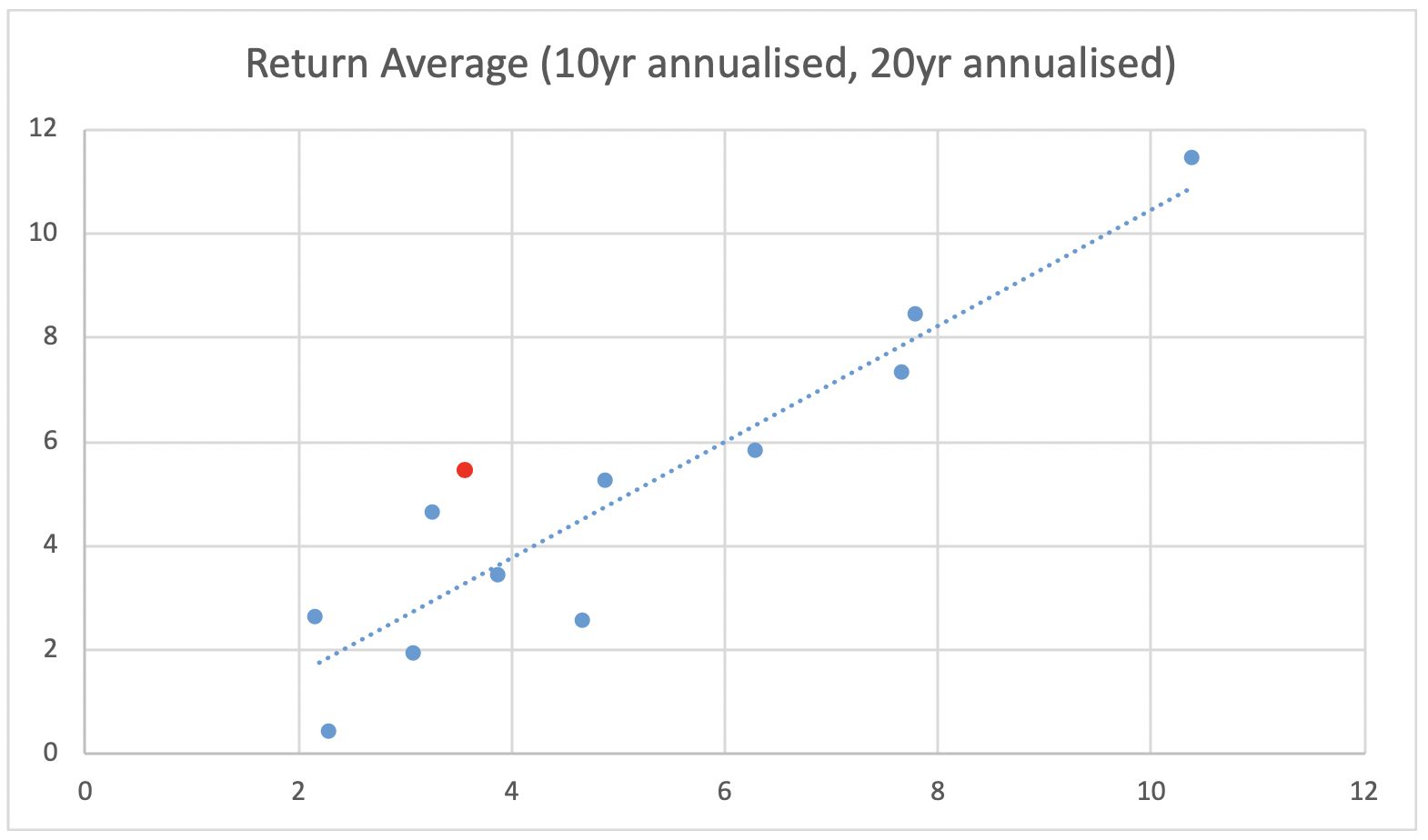

The nominal 10-year yield is a starting point for a forecasted nominal return from bonds. Looking at the last 12 decades of US data, the long-term return (average of 10-year annual, and 20-year annual returns) has been within 2% of the starting nominal yield, as the following scatter plot shows.

X-axis : starting nominal yield Y-axis : average of 10 and 20-year annualised returns.

Note while this only uses one data point per decade, it has an R-squared of 0.85[iii].

Given that this decade started (i.e. 1 Jan 2020) with a 1.9% 10-year bond yield and with the moves in the market, this had fallen to a record low 0.7% by mid-June, then the outlook for nominal bond returns is poor. If there is any inflation, this could lead to negative real returns from bonds.

Some things to consider in the specific case for today include:

- Impact of increased government debt (funding COVID-19 response, and potential further spending to further boost confidence/ economy re-building)

- Potential shift in policy was starting to be discussed ahead of COVID-19 update, with some groups arguing that monetary policy had hit its limits and it was time for fiscal spending.

- Manipulation of long end of curve by governments and/or central banks

Equities

The return from owning an equity comes from the dividend yield, growth in dividends and any change in valuation over the holding period. Over the very long run, the growth component has been lower than many commonly believe. For US equities, the capital growth component has been around 2% real pa. Owning equities has been challenging where there has been permanent destruction of capital or labour – generally in world wars, or catastrophic on confiscation of assets (Russia 1917, China 1949) – but through most of time, again valuation has provided a good guide to returns.

Growth in dividends is a function of retained earnings being reinvested to enable companies to grow – and hence it is reasonable that earnings whether retained or distributed are the major driver of future returns, when related to current price. By focussing on real earnings, again eliminates that need to make forecasts about inflation.

Equity returns over time have been higher than bonds, totalling around 6.5% pa over the last 120 years in the US and 4.4% in the rest of the world, though Australia at 6.8%pa has been one of the stand-outs.

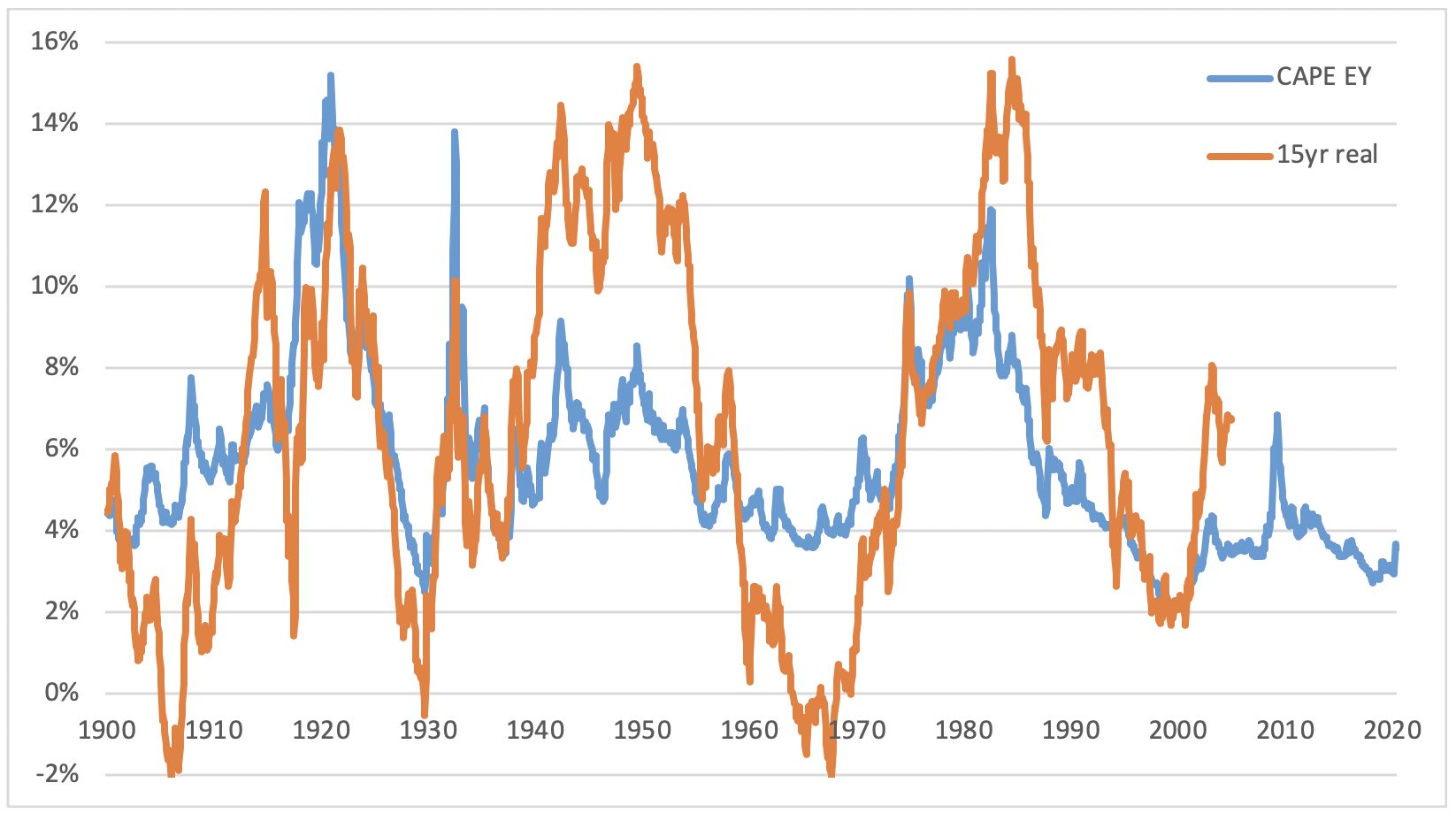

The work of Robert Shiller at Yale, on the cyclically adjusted P/E ratio[iv] (“CAPE”) is helpful, as he suggests that smoothing earnings for the economic cycle, provides a more valuable valuation tool. This looks more at trend earnings or “earnings power” relative to price.

This chart shows that over the long term, starting from the inverse of the Shiller CAPE gives a reasonable starting point for future returns with for example, realised annualised 15-year returns within 6% of this number through time.

If one starts today for a CAPE earnings yield of 3.5% as an estimate for future real returns, to make a higher or lower estimate requires a view to be taken on the path of earnings and of valuations.

Some things to consider in the specific case today include:

- Corporate profit margins have been at record highs so this may have inflated trend earnings, and led to the CAPE earnings yield of 3.5% being higher than it should; and

- Will the COVID-19 impact on the market generally be transient, or will there be permanent destruction of capital and/or labour. The early evidence is that there is not a loss of working age lives on a scale that has a lasting impact, and capital is not destroyed unless it becomes obsolete through a prolonged curtailment of economic activity or significant change to future behaviour.

- For Australia specifically, thinking about changes to franking credits as a result of much higher government debt, may have an impact on likely future equity real returns.

- Creation of excess liquidity by governments and/or central banks distorting valuations.

The challenge for many investors is that if equities are the assets required to do the heavy lifting for portfolio returns, and their long term real return expectations are around 3.5% then there is a high chance that products targeting real returns of 4% or more, will fall short of this, and a meaningful risk that lower return objectives may also fail to be met.

[i] https://www.platinum.com.au/Insights-Tools/Investment-Fundamentals/Investing-What-Matters/Article-Item/Earnings-yield-as-an-estimate-for-expected-returns and https://www.platinum.com.au/Insights-Tools/The-Journal/Between-a-Rock-and-a-Hard-Place

[ii] All data in the article is sourced from “Credit Suisse Global Investment Returns Yearbook 2020” by Dimson, Marsh & Staunton and from “Online Data Robert Shiller”, from Yale University: http://www.econ.yale.edu/~shiller/data.htm accessed on 10 May 2020

[iii] The red dot uses a starting yield of 3.6% on 31.12.09, the return of 6.5% for the 2010’s and an imputed return of 1.9% for the 2020’s being the yield on 31.12.19

[iv] More detail in the source document, but note I have used the CAPE TR

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.