Climate Change Blog – May 2019

Welcome to another instalment of the Climate Change Blog, an article series that aims to cover news and events related to climate change and relevant to actuaries and the industries they advise. This month’s edition looks at two pieces of work from the International Actuarial Association (IAA) and the CRO Forum that discuss how the world’s response to climate change can affect many aspects of actuarial work.

At the time of writing, the Prudential Regulation Authority (PRA) of the Bank of England released a supervisory statement for insurers and banks within the scope of Solvency II. This supervisory statement is an emphasis of how climate change and society’s response to it presents financial risks and affects actuarial work.

Decarbonisation: A Briefing for Actuaries

Who developed the paper and why?

The Resources and Environment Working Group (REWG) of the IAA developed a paper entitled Decarbonisation: A Briefing for Actuaries in September 2018, then also held a webinar in January 2019. The aim of the paper was to introduce the topic of decarbonisation for actuaries around the world.

The REWG is a working group devoted to environmental issues that can affect the work of actuaries in their various areas of practice.

What is decarbonisation?

Decarbonisation refers to policies or actions that result in a reduction of greenhouse gas emissions, for example by substituting coal-fired power with lower-carbon sources of energy. While the energy sector is always front of mind when emissions are discussed, the sources of greenhouse gas emissions are spread across all sectors of the economy: Electricity (25%), Agriculture (24%), Manufacturing (21%), Transportation (14%) and Building (6%) (sourced from Climate change and the 75% problem). Effective decarbonisation, therefore, will require broad transformation across the economy, including how food, goods and services are produced, transported, stored and consumed. The scale of change implied is comparable to the industrial revolution or the rise of the internet.

Drawdown, a global research and communication organisation, ranked 100 potential solutions to reduce greenhouse gas emissions by effectiveness, costs and benefits. The following figure summarises the top 10 solutions.

Trends of decarbonisation

There are clear trends that the importance of sustainability and combating climate change is being recognised by businesses, for example:

- The green finance market continues to grow, with a universe of USD1.45tn climate-aligned bonds as at 2018, of which USD389bn are labelled green bonds (sourced from Bonds and Climate Change report)

- The Financial Stability Board (FSB) Task Force on Climate-related Financial Disclosures (covered in Climate Related Financial Disclosures – The Way Forward?)

- Climate disclosures published by the Australian Accounting Standards Board and Auditing and Assurance Standards Board (covered in Climate Change Blog March 2019)

Decarbonisation will affect actuaries’ work

Actuaries will need to assess the impact on their clients and identify opportunities to bring their professionalism and forward-looking financial skills. Actuaries need to:

- Assess the impact of decarbonisation on their markets, products, and customers

- Consider how decarbonisation could be reflected in investment strategies and long-term investment returns

- Consider the impact of decarbonisation on actuarial assumptions g. discount rates and mortality rates, and their impact on liabilities

- Communicate implications for their clients or employers so they can continue to provide long-term financial advice

CRO Forum Position Paper

Who developed the paper and why?

The CRO Forum is a high-level discussion group formed by Chief Risk Officers of several major European insurance companies. In January 2019, as part of its third core aim, providing insights on emerging and long-term risks, the CRO Forum has produced a Position Paper, “The heat is on; Insurability and Resilience in a Changing Climate”. Their position seems clear, ‘The time to act is upon us. The climate is changing and “the heat is on”.’

The intent of the Position Paper is to provide the insurance sector and wider stakeholders with a clear, up to date view of the current challenges of climate change, centred around the insurance sector. It discusses implications for underwriting climate related risks, investment activities, and reporting and disclosure.

Findings

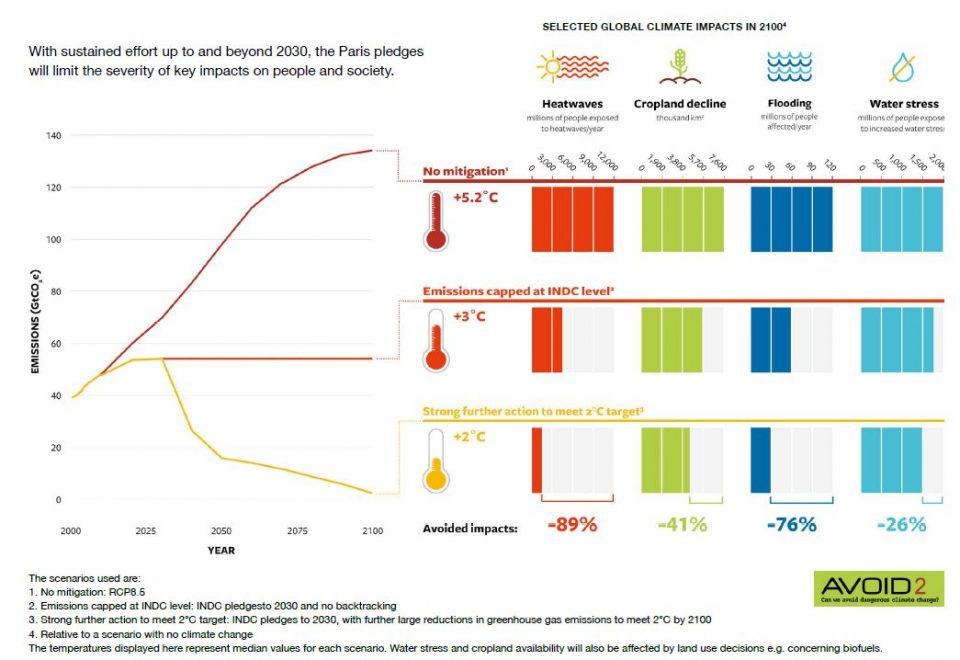

The Paper outlines climate change as both physical risk and transition risk, and narrows the focus down to three sample pathways, noted in the figure below:

- No mitigation or the business as usual mitigation

- An intermediate pathway

- An ambitious mitigation pathway

There is a wide variation in the potential paths the world may take, which have different physical impacts. There is also commentary on the transition risk impact, ranging between the ambitious and no mitigation pathway:

- The ambitious mitigation pathway: “The effects on the global economy are likely to be significant… a 13% net reduction in global GDP is forecast vs a no-increase scenario”.

- The no mitigation pathway: there may be stranding of assets for several reasons, from a potential backlash against carbon emitting businesses to the abandonment of inhospitable environments.

How is the insurance sector impacted?

The breakdown of these impacts in insurance from the different sectors are as follows:

- P&C underwriting, including transition resulting in technology insured with limited claims histories, and climate change litigation affecting liability insurance.

- Life underwriting, including climate change related impacts to mortality and morbidity and impacts on sales of insurance.

- Investment, including stranded assets and physical effects of climate change altering asset values and economic performance.

What can risk professionals do?

This wide variety of risks and their impacts across the industry require a range of responses. The responses put forward by the CRO Forum for consideration include:

- Supporting transition and adaptation through both existing products and innovating new products

- Managing investment portfolios, allowing for mitigation and adaptation

- Driving better behaviour in customers, suppliers and companies invested in

- Providing insight for low carbon intensity infrastructure to industry and government

- Driving better disclosure of climate related risks internally and in companies invested in

PRA supervisory statement

PRA expects firms to incorporate financial risks from climate change in their risk management framework and to use scenario analysis to inform strategy setting. The scenario analysis should include both short-term and long-term assessments of the firm’s exposure to financial risks from climate change on their solvency, liquidity and, for insurers, their ability to pay policyholders.

The PRA has indicated that they intend to request this scenario analysis alongside market-wide stress tests for both Life and General insurance firms. This indicates a need to quantify the impact of climate risk scenarios on capital and reserving, although the PRA has also acknowledged some gaps remain to be filled, including for data and the development of reference scenarios for firms to use.

PRA expects the short-term scenario analysis to cover a period within the firm’s business planning horizon. There should be quantification of these risks.

The long-term scenario analysis should cover a time horizon over decades long. Rather than a precise forecast, PRA expects this analysis to be a qualitative exercise to help inform strategic decisions. There should be a range of different climate-related scenarios, for example:

- Average global temperatures increase by around 2˚C, or more

- Transition to a low-carbon economy occurs in an orderly manner, or not

More detail in the supervisory statement.

Would you like to know more?

Other climate change articles published by members of the Climate Change Working Group:

- Climate Change Blog – March 2019 by James Yap

- Climate Change Blog – February 2019 by David Hudson & Evelyn Yong

- Insight Session: Peril, Pricing and Climate Change – Richard Carter

- Climate Change Blog – November 2018 by Evelyn Yong

- Climate Change Blog – October 2018 by Evelyn Yong

- Climate Change Blog – September 2018 by David Hudson

- Climate Change Blog – August 2018 by David Hudson

- Climate Change Blog – July 2018 by Evelyn Yong

- Climate Change Disclosure – Financial Institutions Feel the Heat by Sharanjit Paddam and Stephanie Wong

- Climate Related Financial Disclosures: The Way Forward? by Wayne Kenafacke.

- An Overview of the Actuaries Climate Index by David Hudson

- Climate Risk Management for Financial Institutions by Sharanjit Paddam, Stephanie Wong and Alison Drill

- TCFD Webinar: Climate Leadership – How to Support the TCFD

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.