The Long Haul: Insights on Long COVID

This week, the Institute hosted the first Insights Session from the Long COVID Working Group.

Led by NDIA actuary Sally Galbraith, actuary Darren Stevens and actuarial consultant Linda Kemp, the session gave a summary of their discoveries so far, and observations that could impact the life and private health insurance sectors in Australia.

Established in June 2023, the Long COVID Working Group’s primary objective is to provide relevant insights to actuaries working in various areas of specialisation regarding the potential impact of Long COVID. The secondary objective is to look at the broader impacts on the public health system, other government agencies, and organisations outside of the financial services industry.

Understanding Long COVID

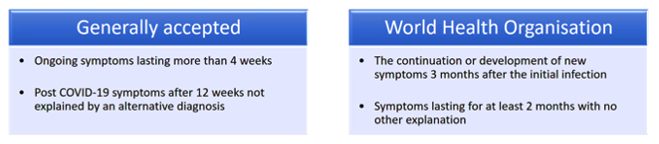

Darren Stevens – who himself experienced Long COVID – explained the history of the illness and its medical definition, breaking down the two main definitions as follows:

In the past, it has been difficult to ascertain what constitutes Long COVID due to the nature of the illness; over 200 symptoms have been reported in association with the illness. From this wide-range of symptoms, three main phenotypes have emerged:

- post-viral symptoms

- fatigue and fog

- neurological and inflammatory

On the symptom of ‘fog’, Darren said,

“Sometimes you have the words on the edge of your tongue but you can’t get them out. You just cannot do what you used to be able to do.”

Testing and data

Understanding how to test for Long COVID will help us gain a better understanding of how to manage symptoms and what the implications might be for actuarial practice – in particular, the risk factors that are likely to affect communities. This includes the severity, duration, and research statistics in Australia and overseas.

While blood tests could be available in the next couple of years, and faecal testing may present a possibility, as yet there is no accepted test for Long COVID. This not only makes diagnosis difficult, but inhibits data collection, making the potential impact on insurers and health professionals difficult to extrapolate.

According to current estimates, the proportion of people getting Long COVID are[1]:

- Australia: 5-10%

- UK: 8-17%

- US: 14+%

- Netherlands: 13+%

In the UK, there are currently over 2 million people with Long COVID, while in the US, it is estimated that up to 23 million people have developed the illness.

If Australia experienced the same proportions as those estimated by the US Centre for Disease Control (CDC):

- 4 million Australians would have had Long COVID

- 1.6 million would currently have Long COVID

- 325,000 Long COVID sufferers would have a significant impact on their daily activities

Potential impacts

As part of their research, the Working Group surveyed Institute members practising in the health and life insurance sectors to understand the attitudes towards Long COVID in these sectors, and how the actuarial profession in Australia is responding.

While the sample size was relatively small, the answers are in keeping with their research thus far.

Survey findings showed that although 23% of respondents noted they or a family member have personally experienced Long COVID, information has not been collected about this condition at insurance policy inception and therefore, is not considered a key risk factor or allowed for in portfolio management or reserve calculation.

A small proportion, 12% of those surveyed, do use it in scenario testings. There is some data collected at claim but not capturing detailed risk factors for Long COVID such as variant, vaccination status, number of infections, etc.

Perhaps the most illuminating feedback we received from the survey was the view of the importance of Long COVID studies, over and above its application to insurance.

As general insurance actuary and Working Group member, Linda Kemp said,

“So far, we have not observed a significant impact on the life and private health insurance sectors… [but] it’s not just about the financial impact on our companies. It’s also the individual Australians who will be impacted.”

Where to now?

The Long COVID Working Group is currently developing a knowledge hub, with a series of resources to assist actuaries working within the life and health sectors to understand the impact of Long COVID from an actuarial perspective.

Further exploration of datasets and modelling will also be undertaken, with the most promising data being the COVID-19 register and linked dataset from the Australian Institute of Health and Welfare, and the Australian National University poll on COVID-19 attitudes and behaviours.

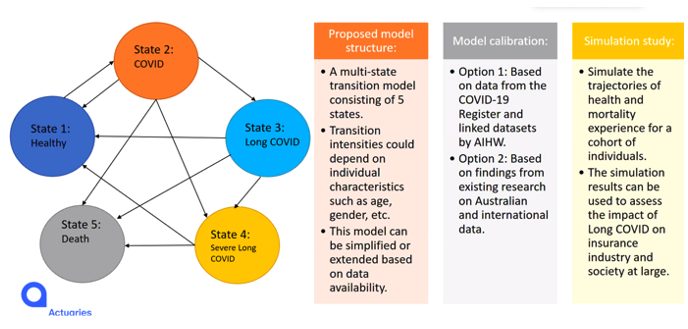

The current proposed model is illustrated below:

This is not a prescribed or prescriptive model, but rather a descriptive structure that can be simplified or expanded depending on the data and information available.

The Working Group will continue developing this illustrative model and provide another update at the All Actuaries Summit in May 2024. Find out more about the All Actuaries Summit here.

About the Long COVID Working Group

Established in June 2023, the Long COVID Working Group works with two phases in mind – research-focused, and modelling and scenario testing.

Members of this Working Group include Chris Scheuber, Daniel Langford, Darren Stevens, Han Li, Kelly Yong, Linda Kemp, Maggie Lee, Nicholas Stolk, Rui Zhou, Sally Galbraith, Shelley Agrawal, Xu Shi and Zhan Wang (Chair).

You can view copy of this presentation here or watch a copy of the session here. To learn more about the Long COVID Working Group and its members or the research mentioned in this presentation, reach out to Zhan Wang (Chair) or Clare Marshall (Actuaries Institute Liaison).

Disclaimer

This Long COVID analysis is intended for discussion purposes only and does not constitute consulting advice on which to base decisions. We are not medical professionals, public health specialists or epidemiologists.

To the extent permitted by law, all users of the monthly analysis hereby release and indemnify The Institute of Actuaries of Australia and associated parties from all present and future liabilities that may arise in connection with this monthly analysis, its publication or any communication, discussion or work relating to or derived from the contents of this monthly analysis.

References

[1] The estimates were drawn from research with varying definitions, sample sizes, methodology, and conducted at different point in time throughout the pandemic. It is important to be mindful of these variations when drawing conclusions from these estimates.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.