Transitioning from Retirement Villages to Aged Care: A Financial Tightrope for Older Australians

In a nation where age-friendly accommodations are gaining popularity, Australian adults are increasingly drawn to retirement villages.

Buys et al. (2006)[1] showed that community living arrangements, such as retirement villages, offer greater freedom and choice, leading to increased face-to-face contact with family. Another author Hu et al. (2017)[2] found that these communities, which are tailored to older individuals, provide accommodation, services, and facilities to meet unique needs, making them a prevalent form of community living for older Australians.

However, when it comes time for retirees to transition to residential aged care, some can find themselves under financial strain.

In this article, we examine the potential financial impact of the transition from retirement villages to residential aged care.

The cost of living well

In retirement villages, individuals pay a refundable entry fee for the right to reside independently, while residential aged care involves a ‘refundable accommodation deposit (RAD). O’Shea[3] and Petersen et al. 2017[4] revealed that exiting retirement village contracts incurs fees, including refurbishment costs, agent fees, and legal commissions which can cause financial distress, and the sale process, often subject to a ‘deferred management fee’ (DMF), can leave residents feeling trapped. At present, elderly residents in Australian aged care typically cover approximately 25% of the overall aged care expenses, even though they receive carrying degrees of financial assistance from the government. Meanwhile, the retirement village is fully funded by the residents themselves.

Methodology and modelling

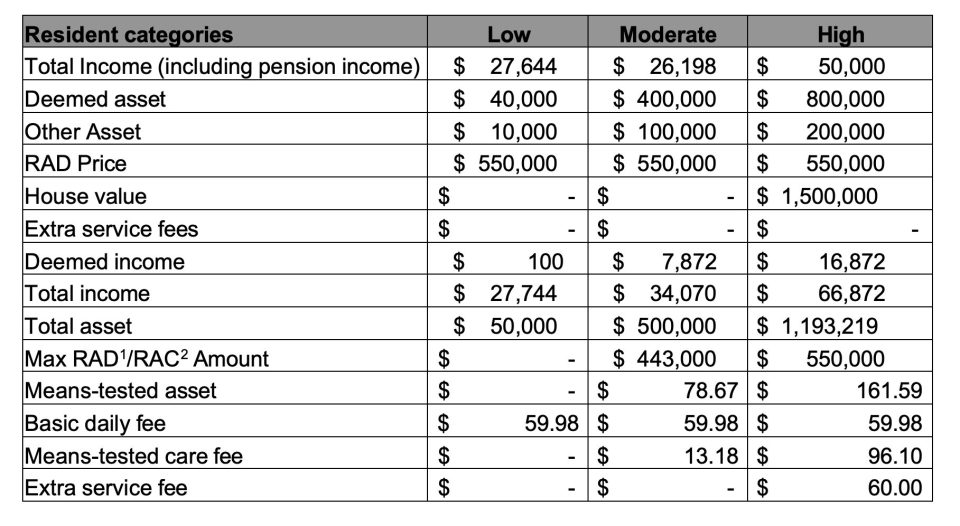

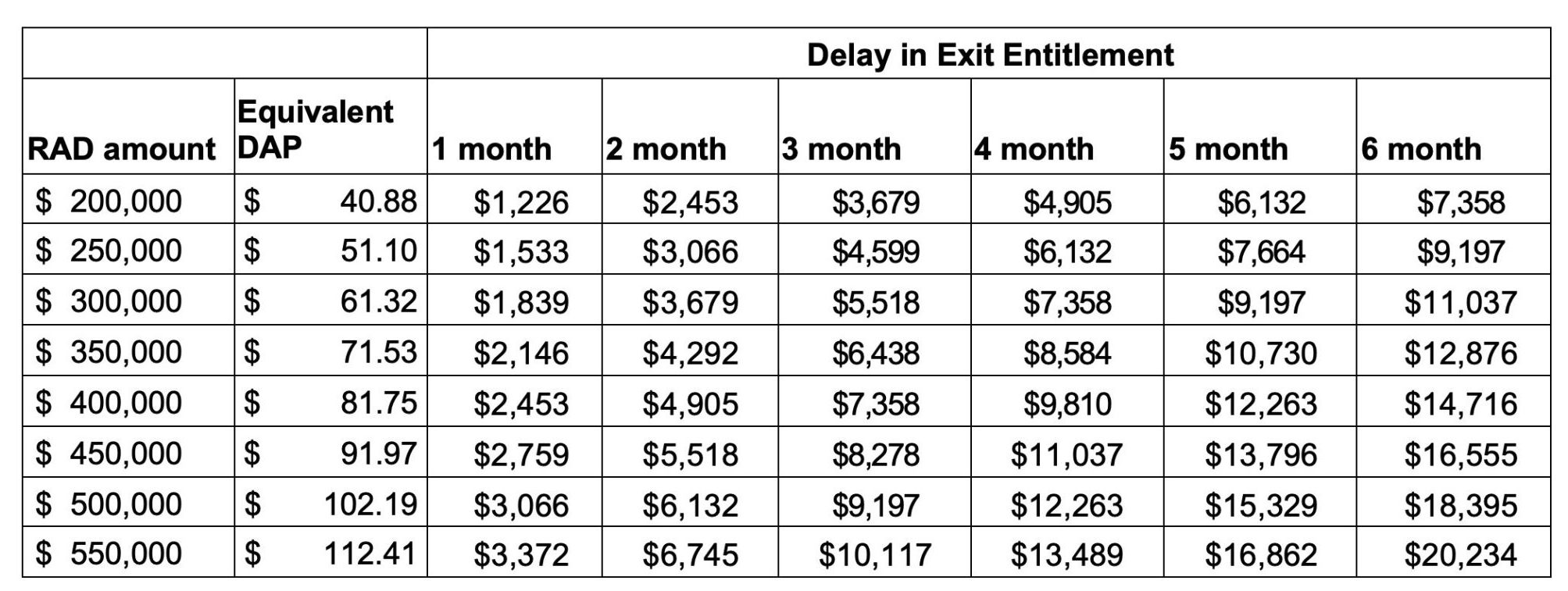

Firstly, we illustrate the fee structure for of residential aged care based on means testing. The costs are derived from Department of Health and Aged Care (DOHAC) publications.

Table 1: Breakdown of costs for different means-tested individuals

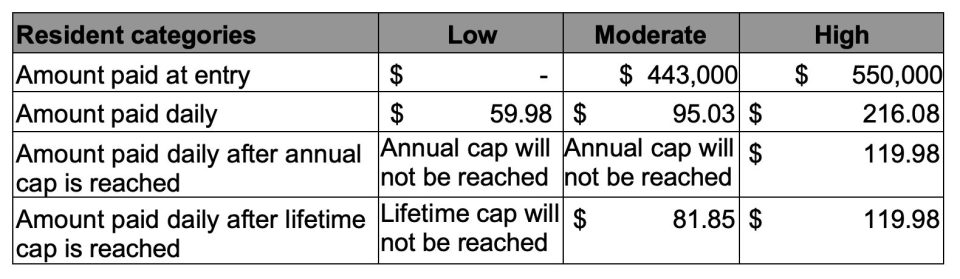

Table 2: Breakdown of costs for individuals who choose to pay lump sum

Table 3: Breakdown of cost for individuals who choose to pay daily fee instead of lump sum

As we can see from Table 2 above, a moderate means resident will incur a cost of $95.03 per day, if they have not received their exit entitlement from their retirement village. For a six-month delay, this additional cost is $17,105.

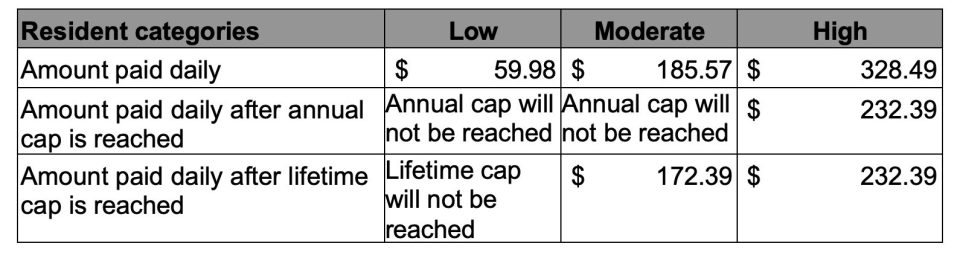

The following Table 4 illustrates the impact of delayed exit entitlement based on different RAD amounts and deferred time. The calculation is based on the recent Maximum Permissible Interest Rate (MPIR) for residential aged care (7.48% p.a) applicable for the 3-month period to 30 June 2023.

Table 4: Monthly cumulative daily accommodation payment (DAP) for a moderate means individual, assuming a delay of up to 6 months

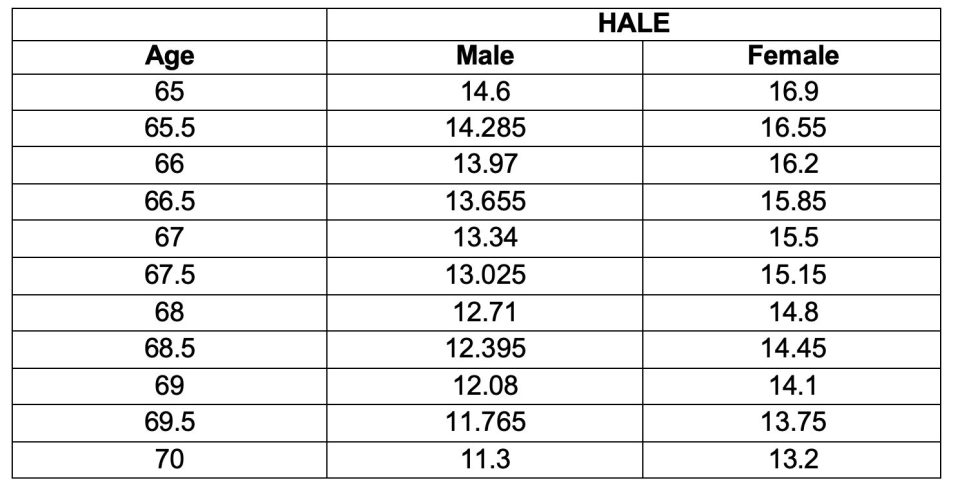

To determine the present value of the additional cost incurred upon eventually moving to aged care, we have utilised Health Adjusted Life Expectancies (HALEs) as developed by Kularatne (2022)[5]. HALE incorporates the morbidity and mortality experience of the population, and considers the overall involvement of health effects due to disease or injury. It reflects the average remaining number of years one can expect to live in full health.

Due to limited data availabilities and time constraints for this article, we use the HALEs derived by Kularatne (2022) [5] for ages 65, 70 and 75 as our base assumptions.

Table 5: Linearly Interpolated HALEs from age 65 to 70, using Kularatne (2022)[5]

The aim of interpolation between ages is to provide a time period for the discount factor to be calculated for various ages based on our Consumer Price Index (CPI) assumption of 3.5% p.a which is based on forecasts from the Reserve Bank of Australia (RBA). The following formula is used:

𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 𝑓𝑎𝑐𝑡𝑜𝑟 = (1.035)𝐻𝐴𝐿𝐸+0.5 .

The aim of the present value method is to provide an amount for the additional cost in today’s dollars. This method is sensitive to the assumption of the discount rate and discount period used.

The assumption of 3.5% p.a for CPI allows for the RBA’s efforts to maintain inflation between 2% and 3% p.a in the long run as well as the recent high levels of inflation which have lifted the forecasr CPI rates for the near future. As shown in May 2023 RBA forecast, the predicted CPI for the next two years is 3.5% and 3.25%.

Results

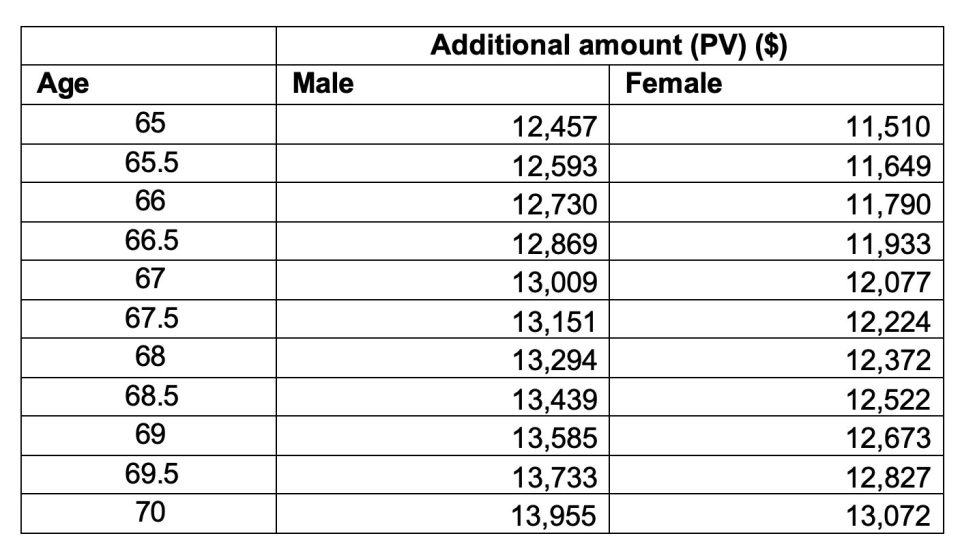

Table 6: Discounted additional cost for RAD $550,000

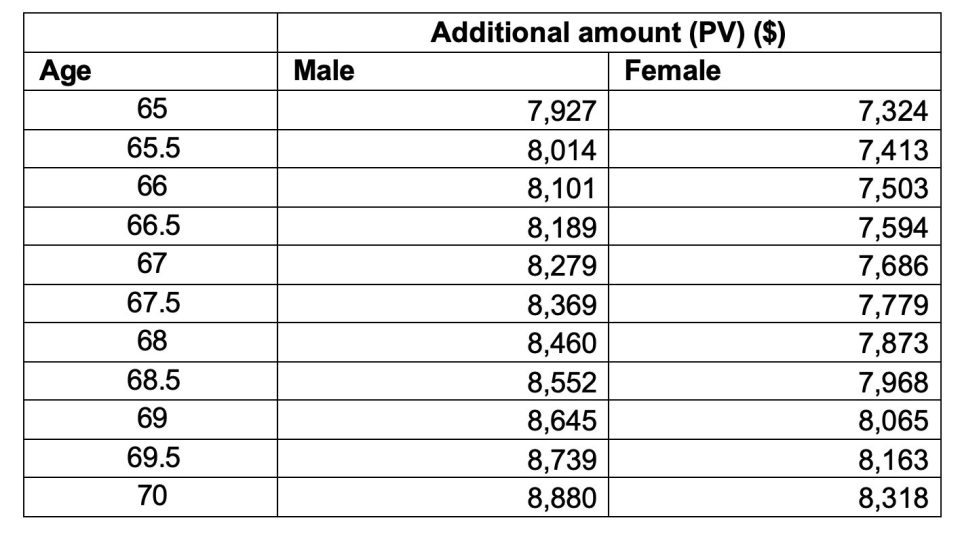

Table 7: Discounted additional cost for RAD $350,000

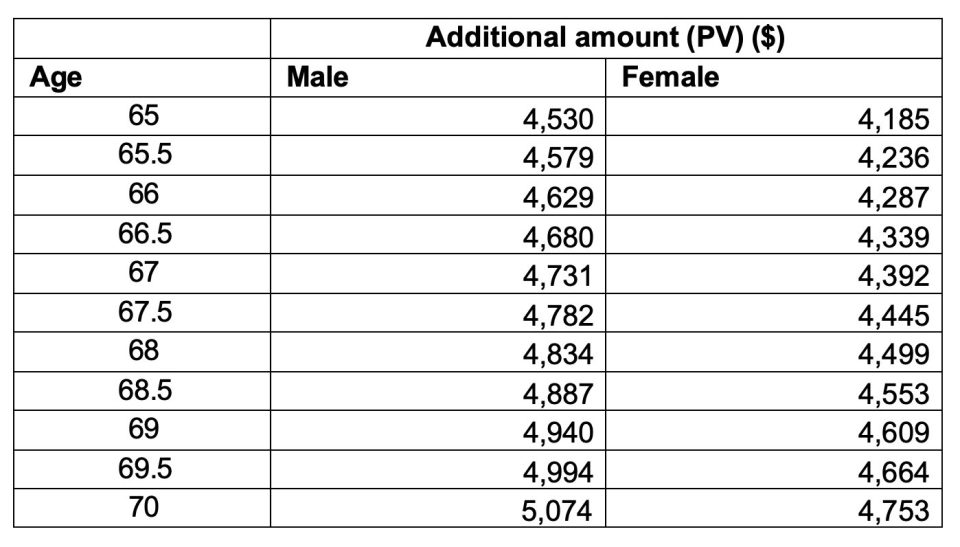

Table 8: Discounted additional cost for RAD $200,000

The above Tables 6, 7 and 8 show the calculated results based on different RAD amounts ($550,000, $350,000 and $200,000) for a moderate means individual, providing a value in today’s dollars for the additional costs at each age. For example, a 67-year-old male of moderate means with a RAD of $550,00 should expect to put aside an amount equal to $13,0009 today to account for the delay of exit payment upon their move to aged care.

Conclusion

In this study, we use health-adjusted life expectancy (HALE) to measure retirement village residency duration, interpolating it for half years from age 65 to 70 to capture more granular impacts on individual financial outcomes.

Using DOHAC publications, we derive costs for various RAD and means assessments, and incorporating a 3.5% inflation assumption, we find that for a 65-year-old moderate means male, costs of delayed exit entitlement range from $4,530 to $12,457 for different RADs in today’s dollars.

To mitigate the financial distress placed onto older Australians under the current system, a few approaches may be considered.

A key factor contributing to the delay in exit entitlement is the time it takes to find a new buyer for the RV unit by the operator. One possible solution is a purchase of the RV unit by the operator at the median price of the unit during the period of residency. This would allow the resident to receive an exit entitlement before the sale of the property. The early payment strategy should be implemented throughout all states and territories in order to reduce the distress financial distress faced by older individuals due to complexity of the system.

Lastly, it is worth considering changes to the cost structure to reduce the potential additional cost, this can come through a change in the legislation around the maintenance fees charged during the period where the resident has exited the RV, but the unit has not been sold by the operator. By exploring these approaches, we can work towards reducing the financial burden on older Australians and improving the efficiency of the system.

References

[1] Buys, L., Miller, E., & Barnett, K. (2006). The Personal, Practical and policy Implications of Older Australians’ Residential Choice. Journal of Housing for the Elderly, 31-46. doi:10.1300/J081v20n01_03

[2] Hu, X., Xia, B., Skitmore, M., Buys, L., & Zuo, J. (2017). Retirement villages in Australia: a literature review. Pacific Rim Property Research Journal, 23(1), 101-122. doi:10.1080/14445921.2017.1298949

[3] O’Shea, L. (2018). Retirement villages: The need to protect residents’ rights. Precedent(148), 24-27. Retrieved from https://search.informit.org/doi/10.3316/agispt.20181031003498

[4] Petersen, M., Tilse, C., & Cockburn, T. (2017, March 2). Living in a Retirement Village: Choice, Contracts, and Constraints. Journal of Housing For the Elderly, 229-242. doi:10.1080/02763893.2017.1280580

[5] Kularatne, T. (2022). Modern Statistical Methodologies in Mortality Forecasting and Insurance Applications. Modern Statistical Methodologies in Mortality Forecasting and Insurance Applications. Sydney, NSW: Macquarie University.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.