Understanding economic scenarios for actuarial modeling and decision making

Understanding the economic scenarios that may impact actuarial modeling and decision-making was the focus of the Institute’s Insight session with independent economist Michael Blythe and actuary Hugh Miller.

On 8 February 2023, Michael and Hugh discussed the Institute’s recently published Green Paper The Long Run: Low probability, high impact scenarios for the Australian economy.

As a former Chief Economist for the Commonwealth Bank of Australia (CBA), Michael Blythe recognises that scenario analysis is an important tool for companies and policymakers to undertake as they plan for the future.

While difficult to foresee, shocks such as the Global Financial Crisis (GFC), the COVID-19 pandemic and global conflicts show that low-probability shocks do occur and can have long-range impacts on businesses and economies.

In discussing the three scenarios explored in the Green Paper, Michael said that there are common themes to be learnt from the various outcomes of these economic scenarios, including an “aggressive” interest rate response. The three scenarios discussed in the Green Paper are:

- Stagflation – where high inflation is coupled with high unemployment resulting in economic stagnation;

- A major house price correction where home values fall by 30%, possible but low probability; and

- Modern Monetary Theory (MMT) where increases in employment is pursued by increasing government spending funded by increasing the supply (printing) of money.

Michael also addressed the current tight labour market – the unemployment rate is at the lowest it has been since 1970’s and inflation is rising.

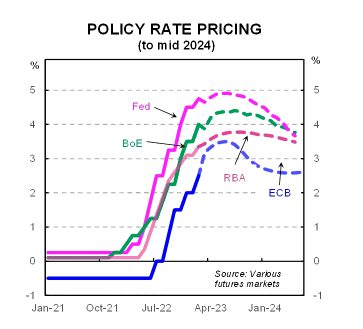

While the Reserve Bank’s cash rate has been increasing since May 2022, recent and anticipated increases are expected to further dampen house prices for the remainder of 2023. House prices are 9% lower than their peak in April 2022 with greater reductions experienced in some capital cities. Michael noted that the “Big 4” banks are expecting further falls in house prices throughout 2023 but well below the 30% in the house price correction scenario. Looking at the factors impacting house prices – demand will increase as foreign students and migrants return back to Australia and the housing market, however, housing supply will remain constrained with labour and materials shortages within the construction sector.

Housing counts for 22% of CPI and these shifts in house prices will flow through to the inflation figure over the next year and impact future Reserve Bank decisions about the appropriate cash rate. Financial markets have already priced in late 2023 cuts to the cash rate.

(Source: Various futures markets)

Elements of the Australian Government’s response to the COVID-19 pandemic could be seen as a modern monetary theory policy response. The Commonwealth Government, through its own spending and attempts to reduce the impacts of community lockdowns, unemployment and economic uncertainty, drove consumer spending and economic stability during the pandemic.

Treasurer Jim Chalmers recent essay “Capitalism after the crisis” talks about governments, businesses and labour working together on “values-based capitalism” where government and businesses invest in social and infrastructure programs to promote economic prosperity. Michael noted that policy shifts like this can have long-term ramifications and getting policy settings right is critical.

Hugh Miller, Actuary and Principal at Taylor Fry provided examples of how scenario analysis is useful for Actuaries. Hugh provided examples of his work with the New Zealand Government determining the long-term costs of the welfare system, where economic assumptions around inflation, discount rates, wage growth and house prices are often the largest contributors to movements in valuations. And while these external factors are outside of an organisation’s control, they are key determinants for actuaries to consider, whether they are valuing a long-tail portfolio or providing data to calculate business outcomes.

Sensitivity testing is another useful tool for Actuaries to use to determine the consequences of changes in economic variables. More sophisticated models will often look at distributions – including the distributions of economic risk and how this may flow to outcomes.

Hugh noted that the three recent economic crises – the GFC, the COVID-19 pandemic and the war in Ukraine – would not have been captured in any detail in scenario analysis. But, what scenario analysis and sensitivity modeling can capture is a shock to the economy to uncover the outcomes these sorts of events may have on economic variables and future investment or business outcomes. One of the key benefits for scenario analysis is around risk management – to uncover opportunities as well as threats and to add flexibility to models.

Careful thinking is needed to look at the probability of scenarios as they are used to make long-term assumptions. Detailed cash flows, revenue growth forecasts out to 10 years – this is where careful forecasting and monitoring of underlying assumptions is needed to adjust for changing conditions and why scenario analysis is not a set-and-forget exercise.

“Just because these scenarios are low probability does not mean that they will not occur.”

Other factors that are external to economic analysis but are likely to have an impact on productivity should also be considered. Hugh provided the explosion of AI and the impact this will have on productivity.

In a deep-ranging question and answer session, Michael and Hugh provided their thoughts on:

- The near-term future of interest rates and structural shifts that may impact the domestic mortgage market, including the switch to higher variable rates from low fixed rate loans – and the flow on impacts to household disposable income;

- How politics changes the relationship with China and Australia and how these may flow through to the Australian economy;

- Economic theory and how to factor in some of the big structural shifts such as climate change, a shift is energy sources as well as policy changes; and

- The importance of “resilient product design” so that insurance products can be flexible to meet changing conditions.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.