Actuarial perspectives on crypto assets and regulatory developments

The Actuaries Institute hosted an Insights session on Cryptocurrencies and Risk Management in July 2022. This article is the third in a series of three which draws on content from the session as well as some more recent related developments.

The first article explores some use cases of crypto assets and blockchain, while the second article focuses on risks that stem from crypto exchanges, custodians and other services that support the crypto ecosystem.

The growth of cryptocurrencies over the last five years has been both exponential and volatile. As an emerging asset class, however, there are currently some significant challenges that dissuade most institutional investment. A prudent approach for actuaries at this juncture would be to keep well-informed of developments, particularly if cryptocurrencies start to interconnect more deeply with the traditional financial system.

A cursory glance at the recent crypto market trends highlights the significant fluctuations in this asset class. In 2021 alone, the crypto market grew by 3.5 times to USD2.6 trillion, however following the market crash earlier this year, the value has since fallen below USD1 trillion as of October 2022.

Figure 1: Cryptocurrency total market capitalisation, October 2017 – 2022

(Source: Tradingview.com)

The crypto market in its current form presents several barriers for institutional investment. The extreme volatility of returns makes it difficult to match, the risk management requirements (including operational, fraud and cybersecurity) are considerable, credit and liquidity risks are high, and regulatory uncertainty remains a primary concern. Institutional investors will likely exercise prudence until sufficient data and comfort around key risks have been obtained. From a historical perspective, when equities as an asset class were introduced over a century ago, it took decades for actuaries to become comfortable with including equities in investment strategies that until then consisted primarily of bonds and cash. Nevertheless, it is in actuaries’ interests to keep abreast of crypto-related developments, particularly as it starts to impact banking and the broader financial services sector.

Another major concern that has been raised across a broad audience, including actuaries, is the environmental impact of the underlying blockchain technology that supports crypto assets. The process to verify transactions before they can be added to the blockchain (known as ‘mining’) consumes enormous quantities of energy, estimated to be comparable to that of mid-sized countries.

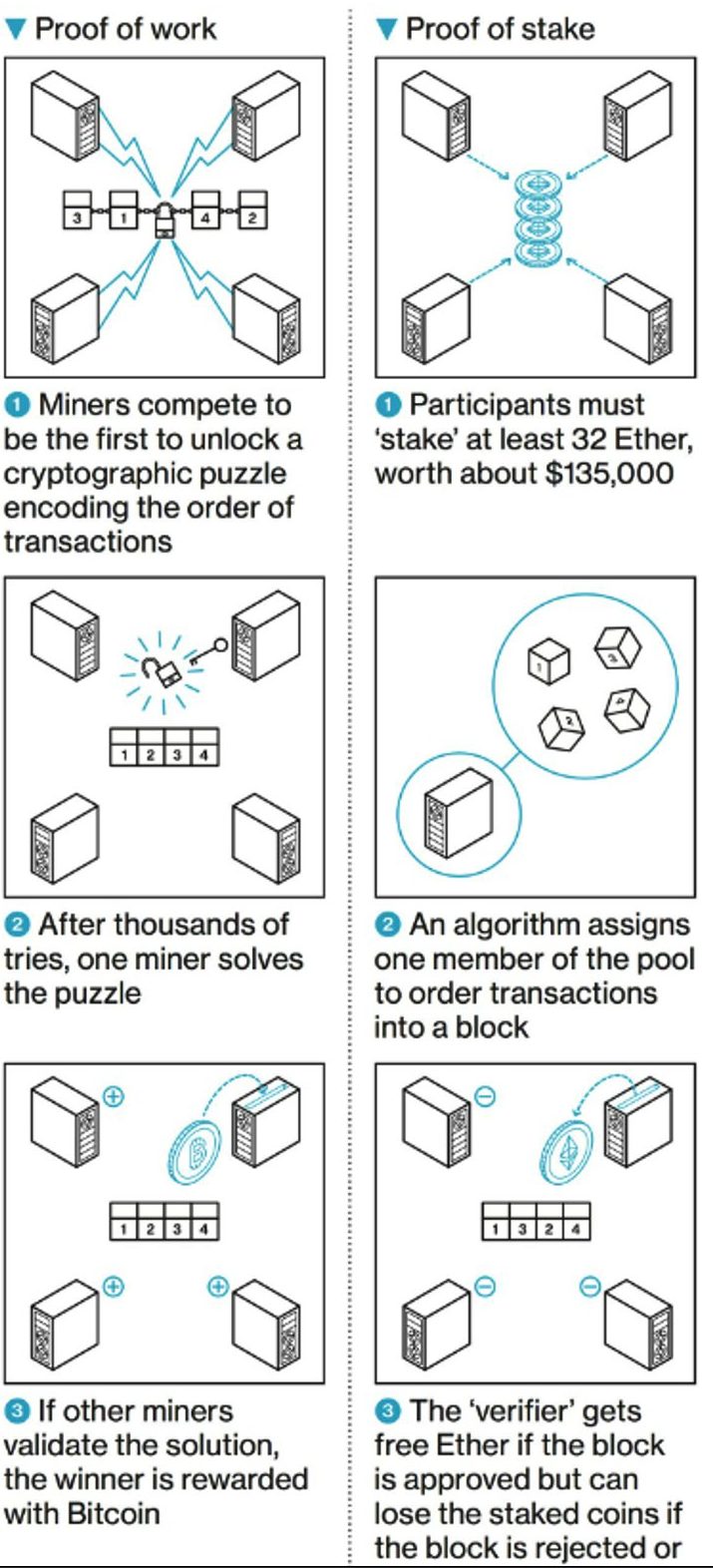

In September, the Ethereum blockchain changed its verification process from the industry standard ‘proof-of-work’ approach, where different miners compete to verify the transaction (thereby resulting in redundant work), to a ‘proof-of-stake’ approach, which allocates the verification task to a party within a pool of participants who have provided their own crypto as collateral to mitigate potential gaming behaviour. Etherium believes that this software change will reduce energy consumption by up to 99.95 per cent[1]. Although this could go some way to alleviate environmental concerns, some market commentators have noted that other issues, including asset volatility and regulatory uncertainty, arguably present greater impediments to widespread adoption[2].

Figure 1: Verifying transactions on blockchain

(Source: Bloomberg.com)

Regulators have provided a variety of guidance and views on crypto, but as indicated in the Australian Government Treasury’s Consultation Paper, a holistic regulatory framework is still in development. The Australian Securities and Investments Commission (ASIC) released an information sheet in October 2021 which details the obligations for businesses involved in crypto-assets under existing laws[3]. The Australian Prudential Regulation Authority (APRA) issued a letter to all regulated entities in April 2022 outlining its risk management expectations and policy roadmap for crypto assets[4]. Both regulators have emphasised the expectations of strong risk governance, including Board engagement, and the need for an international approach to instil a sound regulatory framework.

A speech by the Vice Chair of the Federal Reserve, Lael Brainard, on ‘Crypto assets and Decentralised Finance through a Financial Stability Lens’ in July 2022 similarly noted that the cross-sectoral and cross-border scope of crypto assets require regulators to work together internationally[5]. Further, Brainard observed that the recent turbulence in the crypto ecosystem shows that it is vulnerable to risks already experienced in traditional finance, including deleveraging, fire sales and contagion. Such risks can be managed by “extending the regulatory perimeter” to crypto finance under the principle “same risk, same disclosure, same regulatory outcome”. Additional regulations will be required to fill any gaps that new technology brings, such as the hidden identities and structure of DAOs.

Regulators are also exploring whether blockchain and crypto technology can provide new ways to facilitate financial stability. Brainard suggested that a central bank digital currency (CBDC) could provide a neutral trusted settlement layer in a crypto financial system. In this vein, the Reserve Bank of Australia (RBA) released a White Paper in September 2022 detailing a pilot CBDC to explore potential use cases with industry participants[6].

Cryptocurrencies are still in the early stages of innovation and will continue to exhibit high levels of risk and market volatility until the underlying technology matures and use cases bear fruit. The implementation of appropriate regulation will remove legal uncertainty and help protect consumers and investors, as well as support overall financial system stability. The potential for cryptocurrencies to impact, and even disrupt, the traditional financial sector is still an open question – actuaries should be well prepared by keeping informed of latest developments in this space.

For more information on blockchain fundamentals, refer to “Building a blockchain in a spreadsheet and critically evaluating blockchain opportunities” by Rob Deutsche from the All-Actuaries Summit in 2021.

References

[1] https://www.rba.gov.au/payments-and-infrastructure/central-bank-digital-currency/pdf/australian-cbdc-pilot-for-digital-finance-innovation-white-paper.pdf

[2] https://asic.gov.au/regulatory-resources/digital-transformation/crypto-assets/

[3] https://www.apra.gov.au/sites/default/files/2022-04/Crypto-assets%20-%20Risk%20management%20expectations%20and%20policy%20roadmap.pdf

[4] https://www.federalreserve.gov/newsevents/speech/brainard20220708a.htm

[5] https://ethereum.org/en/upgrades/merge/

[6] https://www.smh.com.au/business/banking-and-finance/crypto-merge-a-win-for-tech-heads-but-fails-key-test-20220920-p5bjf4.html accessed on 18 October 2022.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.