Are “Great Actuaries” and “Great Leaders” Mutually Exclusive?

Two people are flying in a hot air balloon and realize they are lost. They see a man on the ground, so they navigate the balloon to where they can speak to him. They yell to him, “Can you help us – we’re lost.” The man on the ground replies, “You’re in a hot air balloon, about two hundred feet off the ground.” One of the people in the balloon replies to the man on the ground, “You must be an actuary. You gave us information that is accurate, but completely useless.”[1]

You don’t have to look far to find jokes about actuaries who can’t communicate or work effectively with others. However, most jokes are funny because there’s an element of truth.

If we are sufficiently intelligent and hard-working to become actuaries, why do so many of us find it hard to communicate, lead teams or work with non-actuaries? How do we ensure that “Great Actuary” and “Great Leader” are not mutually exclusive descriptors?

Book learning versus practical application leads to a dual learning curve.

Mastery of technical skills often follows a process of learning and practising a technique, often on our own. We learn the rules of how a spreadsheet operates, or how our preferred programming language is written, and we practise. Our university and post-graduate courses help us do this and over time we become very adept at solo learning.

Of course, we need to build our technical actuarial skills to be effective actuaries. However, this is not enough for us to become great leaders and make a difference in the world. If we can’t communicate the “so what” and if we can’t lead teams to deliver insights, what value are we adding? How can we make sure our technical work is used? Great actuarial leaders traverse dual learning curves: one is the technical foundations of actuarial work and the other is the communication and leadership skills that allow our technical work to be used.

“Our actuarial training conditions us to fear failure – does that stop us from building other skills?”

At school, solving maths problems came far easier to me than writing essays, and I’m probably not the only actuary with that experience. Actuarial exams further reinforced this differential, with little time given to writing full responses (“bullet points are fine!”) and added an element of fear around making mistakes.

Some of you may have taken a university subject on actuarial modelling where, in a mid-semester test, marks were deducted if you wrote an incorrect answer. Some students got negative marks for that assessment! Perhaps the purpose of this experience was to teach us not to guess or attempt to answer something we weren’t confident about. After all to be an effective actuary and leader it is not always an option to stay silent when we aren’t 100% sure.

We need to manage risk around our advice and communicate limitations to stakeholders but, we also need to give clear advice that can be used. I have worked with many actuaries who fear making mistakes lead to missed opportunities for their organisations and themselves and this fear can be paralysing.

We know we need more support

It appears there is some degree of truth in these stereotypes and many actuaries are aware of these limitations.

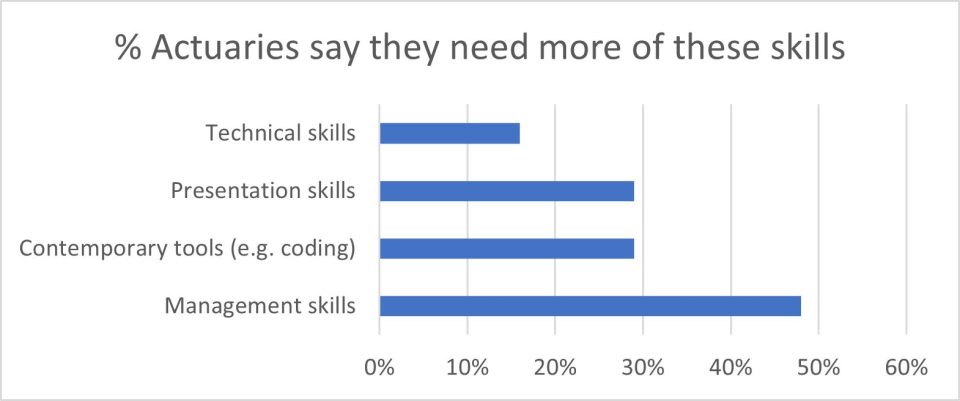

In the 2022 “What do actuaries really want[2]?” survey, we asked actuaries to identify whether they need more technical skills, coding or tools training, management skills or presentation skills to support their career success.

Actuaries could select more than one response and nearly half of respondents (48%) identified management skills (48%) such as delegation and communication as an area for development.

There is a better way of learning – the new learning curve

Communication and leadership skills can be hard to learn on our own. While we can learn the theory and build our toolkits, we need to be able to apply these skills in a dynamic environment: interacting with other humans!

If we could effectively learn “soft skills” just by reading books perhaps the intelligent actuarial profession would not have earned such jokes about our interpersonal interactions.

So how can we best develop these critical skills to support our career development beyond qualification?

Feel the fear and do it anyway

Speaking up in meetings and delivering verbal presentations are not well-known skills in most of our actuarial toolkits. If you’re anything like me, the idea of speaking to a room full of people can evoke feelings of dread! The survey results showed that 29% of actuaries wanted to build their presentation skills. So how can we do this?

What I’ve learned over two decades of actuarial presentations is that practice helps you to get better and it also helps calm the nerves. Writing, speaking and presentation skills may not come as easily as mathematical skills for many actuaries.

But if we seek opportunities to practise, and ask for feedback, we can build this skill to improve our impact and accelerate our careers.

Some ideas include:

-

- Volunteer to present on a recent project or industry topic to your team (or wider),

- Team up with a colleague and present on a topic you know well at a conference or seminar,

- Find ways outside work to build your skills, such as taking a course, or joining Toastmasters.

Explore new ways to present our results

As actuaries we often perform very complex analysis. We are using our technical skills to estimate things that are not exactly known or quantifiable. Amongst ourselves, we speak the same language. But as we become more senior the likelihood of communicating results to non-actuaries (who don’t speak “actuary”) becomes a lot higher.

In a recent consulting project, my team and I used infographic pictures to convey the key results from our analysis. We’d gone to great lengths to set assumptions and develop scenarios, however, these details were not of high interest to our client. Instead, we used a range of charts, maps and icons to highlight the important results that informed actions. Communicating with pictures instead of tables can be a very effective way to support your key messages.

Some ideas include:

-

- Explore new visualisation tools to find better ways to present your results

- Keep it simple – apply the test of “could I explain this to a preschooler?”

- Ask for feedback from a colleague or even a client or stakeholder – how do they prefer to view analysis results?

Actively build a network of peers to build soft skills

When I started work as a graduate in a large consulting team, I was fortunate to be surrounded by talented actuaries willing to teach me how to use the tools and techniques I needed to become an actuary. This apprenticeship model is common across actuarial teams and is a very effective way to build actuarial judgement and professional decision-making.

But what if we could extend this model to also include communication and leadership skills training? Perhaps some teams already do? It appears that if we do, actuaries still want more of this training.

I’ve seen how effective networking and small group learning can be to develop communication and leadership skills through my three-month, small group coaching program for new and aspiring actuarial people-managers[3]. While the foundation of the program includes comprehensive management theory, the magic of the program comes from the practical application and networking. Graduates cite the group discussions, where actuaries can bring current work challenges and ask for advice from the group, as one of the most valuable parts of the course.

Some ideas include:

-

- Join a group or committee on a topic related to your role to meet and discuss current issues and challenges

- Gather some colleagues or friends to share your communication challenges and practise listening to learn some new ways to approach situations.

- Enrol in a course or program to help you build these skills in a more structured way.

Conclusion

Building technical actuarial skills is a key foundation for all actuaries. But to reach the heights of great leadership, we need to keep learning once our actuarial exams are over. We must actively learn and practise important skills in communication and leadership to ensure that the actuarial magic we produce can be understood and applied by stakeholders.

Approaching our development of communication skills in the same way as our technical skills – working through books on our own – is unlikely to be the most effective way to build these skills. We need to collaborate, listen and utilise an apprenticeship model so we can learn, apply and reflect on these skills as we add them our professional toolkits.

|

IFoA UK Professional Skills Videos

Have you fulfilled your annual Professional Training requirements? You can get 5 CPD points by watching selected highlights from the IFOA’s Professional skills videos:

Each of these videos has a follow-up discussion to watch and you can view the collection of curated videos on our website or by searching the CPD Hub. |

References

[1] Attributed to Fred Kilbourne at Fred@thekilbournecompany.com in the Journal of Commerce on 21 April 1978

[2] 2022 Survey developed by Ryan Boyd, Matthew Webster and Julia Lessing.

[3] https://www.guardianactuarial.com.au/ga-leadership-program

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.