Making traditional insurance products green

In this article, we look at how incorporating ‘green’ features into traditional insurance products can help to address the issue of carbon emissions, which has become a topical issue with environmental concerns.

1. Introduction

Economic progression, coupled with the rapid expansion of the global population, has been costly to the environment. While global GDP per capita has nearly tripled since 1960, global carbon emissions have quadrupled during the same period accelerating global warming and climate change[1].

In the insurance industry, there has been a growing interest in environmental and social issues. How insurers address these issues is becoming an integral part of regulation and agency credit rating. For example, AM Best now considers risks associated with environmental and social issues in its analysis of the financial strength of insurance and reinsurance companies[2].

Furthermore, the UK’s Prudential Regulation Authority (PRA) and the European Union’s European Insurance and Occupational Pensions Authority (EIOPA) have explicitly stated that insurance companies are required to model and quantify the impact of environmental and social factors, particularly climate change, in their Solvency II stress-testing exercises[3].

In this article, we look at how incorporating green features into traditional insurance products can help to address the issue of carbon emissions, which has become a topical issue with environmental concerns.

2. Motivation for going green

The insurance industry can play a critical role in supporting climate resilience by addressing environmental issues. Adding green features to traditional insurance products would support in addressing some of the risks associated with environmental and social issues, and at the same time help insurers commercially by better measuring and managing risks.

- There is a heightened physical risk coming from the increase in frequency and severity of natural catastrophe events with climate change triggered by greenhouse gas emissions. For example, coal-fired power plants were the largest contributor to the growth in carbon emissions observed in 2018[4] driven by increasing energy consumption with robust economic growth. With green features, insurers can promote efficient energy consumption among customers and help to reduce the demand and reliance on high emission energy sources such as coal and fossil fuel.

- Help the transition to a low-carbon economy by helping consumers to reduce their carbon footprint through green features.

- Consumers are also increasingly becoming conscious of environmental issues and shifting towards green preferences. Consumers now perceive sustainability as a key differentiator of their preferred brand and may pay a premium for it [6].

- Help to reduce the liability risk for insurers, which has seen an increase in climate-related litigation claims in recent years by different stakeholders for not adequately mitigating, adapting or disclosing ESG hazards[5]. For example, many insurers have tightened their underwriting and investment policies to exclude some polluting industries[6].

3. Making traditional insurance products green

The focus is on two traditional insurance products, home and contents insurance and motor insurance, which are often large portion of an insurer’s portfolio. In this section, we discuss how these insurance products can add green features to address carbon emissions and improve the performance of portfolios covering them.

3.1 Home and contents insurance

With home and contents insurance, insurers can use the information on the utility consumption of policyholders to help them have more efficient utility consumption. The monitoring of utility consumption can provide insights into unusually high electricity consumption particularly during winter or summer months indicating that heating or air conditioning systems are running at less optimal settings. Similarly, unusually high-water consumption can indicate that plumbing systems are running less efficiently.

Not many households have smart utility system monitoring devices. In comparison, information on utility consumption is available for almost every household making it a widely available source for monitoring. With such insights, an insurer can alert policyholders to regularly maintain and update heating, air conditioning and plumbing systems. With newer and updated systems, policyholders can save on their utility costs with more efficient utility consumption.

Heating or air conditioning systems running at less optimal settings could increase the risk of fire. Similarly, plumbing systems running less efficiently could increase the risk of cracks, leaks or poor water quality. Monitoring utility consumption and alerting policyholders to regularly maintain and update heating, air conditioning and plumbing systems can help mitigate the risk of losses. Insurers tend to view newer updated systems as lower risks for claims, which could translate to lower premiums.

There may be a few different ways in which an insurer can incorporate utility consumption information in its underwriting process.

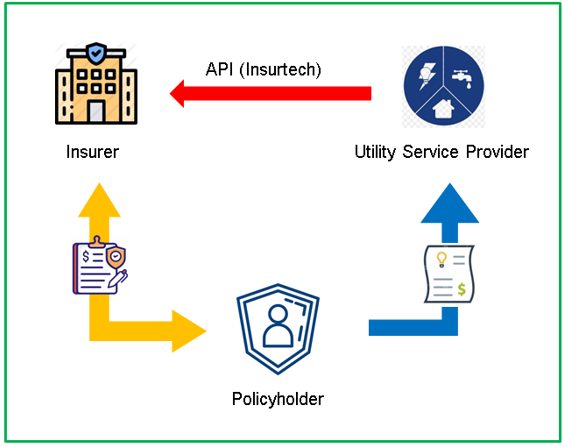

It can be a distribution partnership through which a utility service provider shares information with the insurer or simply policyholders send utility consumption details to the insurer. Alternatively, it can be done through Insurtech technologies as shown in the diagram below making it a seamless process for policyholders.

Figure 1: Access to utility information through Insurtech APIs

Insurers can access utility consumption details of a policyholder through an API using Insurtech technologies (e.g. blockchain). A property address or an identification number of the policyholder can be used as the key to mapping the policyholder to utility consumption information.

Incentivising lower utility consumption

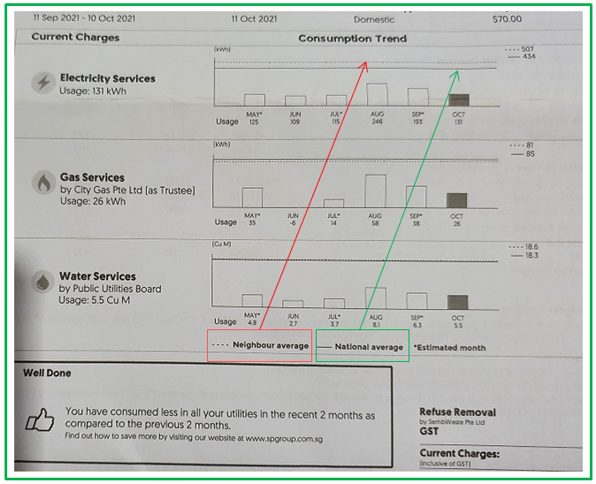

Insurers can also consider incentivising policyholders for lower utility consumption. For example, in Singapore, utility bills provide details on water, gas and electricity consumption and compare a household’s usage against national and neighbourhood averages. The sample utility bill given below shows a household’s consumption against national and neighbourhood averages.

Figure 2: A sample utility bill from Singapore Power (a utility service provider in Singapore)

If the utility usage is below a selected benchmark insurers can consider incentivising policyholders with discounts. For example, in Singapore, the benchmark can be the national or neighbourhood consumption average whereas in Australia it can be a state-level or suburb level average. Such incentives can encourage behavioural changes to reduce utility consumption leading to a lower carbon footprint. In fact, there is greater awareness among customers to reduce carbon footprint at households, which aligns well with incentives for lower energy consumption[7].

Utility consumption as a rating factor

The utility consumption in a household can be a proxy to domestic items covered by home and contents insurance. For example, in a household with a large number of domestic items, the utility consumption can be expected to be higher than a household with a smaller number of domestic items. Therefore, insurers can also consider utility consumption as a rating factor for better underwriting decision making.

3.2 Motor insurance

Telematics is a known and prevalent technology used by insurers for motor insurance. Telematics is a method of monitoring cars, trucks, equipment and other assets by using GPS technology and onboard sensors to gather information. Motor insurance can use telematics to gather information on driving patterns, mileage, etc. Therefore, with motor insurance, telematics can help to reduce carbon emissions from vehicles in several areas as described below.

Promote efficient driving

Aggressive driving behaviours such as speeding, harsh accelerations and sudden breaking attribute to increased fuel consumption[8]. Telematics can help to monitor drivers’ behaviour and alert them to risky activities. Therefore, monitoring and alerting not only help to cut down fuel consumption but also help to reduce the risk of accidents as drivers become aware of their aggressive driving behaviours and take remedial action.

Recommend optimised routes and reduce unnecessary idling

Telematics can help to find optimal routes for drivers by reducing unnecessary miles and avoiding heavily congested routes as much as possible. Particularly for commercial fleets, optimal routes help to cut down fuel consumption and utilise fleet resources in an optimal manner.

One of the main contributors to carbon emissions is the idling of vehicles.

For example, according to the Canadian government, if every Canadian were to reduce daily idling by three minutes, carbon emissions could be cut down by 1.4 million tons yearly, which is equivalent to taking 320,000 vehicles off the road[9]. It will not be a surprise if such staggering statistics are equally applicable to Australia and other parts of the world. With route optimisation, motorists can avoid congested routes that are likely to increase the possibility of idling of vehicles.

Regular vehicle maintenance

Regular maintenance of vehicles helps to save fuel and unnecessary carbon emissions. For example, not properly maintained tyres and breaks can cause high fuel consumption. According to the U.S. Department of Energy, for every one psi that tyres are under-inflated, fuel mileage is reduced by 0.2%[8]. Deteriorating brakes force vehicles to work harder to accelerate as the brakes will not release properly causing high fuel consumption. Telematics can alert motorists to maintain vehicles on regular basis based on the mileage thus helping to cut down fuel consumption.

4. Benefits and challenges

In this section, we discuss some of the benefits insurers and policyholders can enjoy and the challenges insurers would face with the green features discussed above.

Benefits

From an insurer’s perspective:

- Help to reduce the risk of loss incidents with monitoring and alerting mechanisms to regularly maintain utility systems and with telematics to improve driving behaviours thus improving portfolio performance.

- Possible use of utility consumption as a rating factor for underwriting decision making and utility service providers as a distribution channel.

- Telematics monitoring and alerts can reduce the risk of accidents with improvement to driving behaviours thus improving motor portfolio performance.

- Raise the awareness of environmental and social issues not only in the insurance industry but in society as a whole, enhancing the profile of insurers.

From a policyholder’s perspective:

- Reduce premium with lower risk of loss incidents by regular maintenance and upgrading of utility systems.

- More efficient utility consumption can provide cost savings on utility bills.

- Help policyholders adjust to the increasing threat of climate risk.

- Optimal routes and regular maintenance lower fuel consumption leading to cost savings.

- Encourage behavioural changes for leading more sustainable lifestyles.

Challenges

Privacy is a major concern for policyholders with telematics as information gathered could be misused, misplaced and handled in a way that is against the interest of the policyholder.

According to a survey done in the UK, more than 50% of motorists had concerns about an insurer obtaining personal information from a telematics device for calculating premiums based on the driver behaviour[10].

Similar privacy concerns can arise with the use of utility consumption data. To address these privacy concerns, insurers need to be transparent with policyholders on what data are used/not used for and how insurers take care of data and have a compelling proposition for customers to join such a program.

Another challenge is the interpretation of gathered data. Generally, telematics service providers are good at gathering telematics data as their speciality but lack the specific knowledge required to comprehensively interpret vehicle performance and maintenance needs[11]. A closer collaboration with experts could help to address this issue.

Insurers also need to address cost concerns associated with the implementation of green features. With telematics, for example, instead of using costly devices to track driver behaviour, insurers can explore the possibility of using smartphone apps to provide such information and hence reducing cost. In fact, there are third parties collaborating with insurers to provide such services[12]. However, it is always prudent to carry out a proper cost-benefit analysis before considering adding the green features discussed above. As a first step, insurers can consider the following:

- Seek feedback from markets in which telematics and collaboration with utility service provides have worked successfully (e.g. overseas markets).

- Build a proof of concept with a small group of policyholders and assess outcomes.

- Seek feedback from customers on their willingness to participate, intermediaries on providing feasible and cost-effective technologies and other challenges that may arise.

- Collect data on campaigns launched in the past on green or similar other initiatives and find the key drivers for their success.

4. Conclusion

Environmental and social issues are becoming an integral part of business in the insurance industry with regulators and rating agencies putting emphasis on addressing them. In this article, we discussed how traditional insurance products such as home and contents insurance and motor insurance can add green features to address concerns on carbon emissions. Despite challenges, both insurers and policyholders can benefit from implementing such green features. In essence, we believe making traditional insurance products green is a step in the right direction for insurers to address environmental and social issues.

Special Note: Authors would like to thank Mudit Gupta (FIAA) for reviewing the article and providing invaluable feedback.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.