Actuarial proactivity must counter COVID pandemic fatigue

In this opinion piece, Brent Walker reflects on his long experience in health insurance and how individual lifestyle decisions influence healthcare utilisation. Brent compares these past lessons to what we have learned in the two years since the earliest known cases of COVID-19 emerged.

The recently emerging Omicron variant reinforces the need for actuaries to continue to progress the thinking on how their clients should respond to this apparently endemic virus.

In 1976, I wrote my first paper, ‘Illth Insurance’ which was subsequently discussed at an Actuaries Institute meeting in May 1977. This paper queried (based on evidence from Australia[1] and the US[2]) whether the healthy, who maintained healthy lifestyles should fully subsidise ‘those who smoke, drink excessively and allow their inactive bodies to become so obese as to fill an early grave’. The final paragraph stated: ‘it has often been suggested that insurance companies should act more in the public interest’.

Much of the discussion about this paper revolved around the suggestion of rating by smoking status (i.e. smoker/non-smoker rating). This was given a very strong thumbs down by the actuaries who were present and the two very senior doctors whom I invited to speak at our actuarial meeting. From my experience, most actuaries and most doctors smoked in 1977! Indeed, 45% of Australian males and 29% of Australian females smoked in 1977[3]. But also, many actuaries argued forcefully that we shouldn’t ‘segregate the risk pool’! Subsequently, smoker/non-smoker rating of term life insurance was adopted around the world.

Governments also actively started to discourage smoking. Smoker/non-smoker ratings didn’t occur in health insurance because the often, earlier deaths (usually by accident) of smokers saved insurers money from later smoker-related illnesses. Smoker/non-smoker rating is used for lump sum trauma cover because the insured smoker status significantly influences claims for heart disease, strokes and most cancers. There is much evidence that smoking increases the severity of COVID-19 infections[4].

Today, there are suggestions that insurers could improve public health within their operational framework by offering contracts that give the community incentives to practice habits that will make them healthier. The adoption of such a strategy by the life insurance and health insurance industries may be one way in which these industries can help avert the coming health cost crisis.

Viral outbreaks

Before discussing COVID-19 and its variants, consider H1N1, the Spanish (avian) Flu, which also mutates a lot. In its mutant forms, it is still circulating over 100 years after the initial pandemic and people, particularly those older, immunosuppressed, and immunocompromised get flu shots for the expected circulating mutant form of this virus every Autumn[5]. Mutant forms of COVID-19 will probably still be with us in 2121 and possibly long after that. Currently, there is no flu vaccine that confers long term immunity to H1N1’s various mutations.

More than two years have passed since the earliest known cases of COVID-19. The Omicron variant makes it imperative to take stock of what we know about this disease, cast aside our pandemic fatigue, and start thinking about what actuaries should now be advising their clients.

Despite the success to date, not everybody on the planet will ever be vaccinated for COVID-19. In any event, current vaccines don’t work for everybody or completely prevent infection. It takes time to produce a new vaccine and get it distributed. So pharmaceutical companies won’t be able to produce new vaccines quickly enough to get them into enough people’s arms early enough to be effective in stopping the spread of new highly infectious variants that have immune escape properties like Omicron.

We know that expensive, modern medicine can reduce the likelihood of dying from many lifestyle-related diseases. This is of comfort to those who smoke, drink excessively or become morbidly obese, particularly when the state or an insurer pays for the expensive medical treatment. But modern medicine can’t cope when large numbers of these people simultaneously require hospital intensive care for their survival of an infectious respiratory disease.

So, the response in Australia (to date) has been to ensure hospitals will be able to cope. To do this, the spread of COVID-19 was reduced through locking down the population until a very high proportion had been vaccinated. But countries cannot afford to keep locking down their populations every time there is a new outbreak of a variant with immune escape properties. As Omicron has now taught us, it is always going to be likely that another, even more infectious, variant will arise sometime soon. Therefore, with COVID-19 becoming endemic there must be other ways to fight this virus.

An important lesson of the COVID-19 pandemic/endemic is that the very lifestyle attributes disclosed in my paper of 1976 happen to be the main drivers for maintaining a healthy immune system. A healthy immune system is the key to personally surviving COVID-19 and its immune escape variants, despite vaccination.

These are:

- Maintaining healthy body weight and fitness level

- Getting adequate sleep

- Not smoking

- Not drinking alcohol to excess, but drinking plenty of water and having a healthy diet, including breakfast

However, this is not health advice, and for good reason. Making these changes doesn’t happen overnight and certainly not rapidly enough to make a difference in the coming months. You should always seek appropriate medical advice and care if you contract COVID-19 (see Coronavirus (COVID-19) health alert | Australian Government Department of Health and call 000 for urgent medical help for serious symptoms such as difficulty breathing).

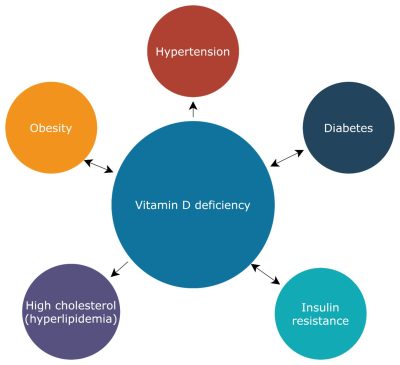

The one key addition to the 1976 list, is getting plenty of summer sunshine (that is, maintaining a healthy vitamin D level). There is much medical research that indicates an infected individual’s vitamin D level determines whether their immune system fights respiratory infections passively with antibodies or aggressively by inflammation, which can then lead to severe disease, hospitalisation and, in the worst cases, death[6]. While immunisation and/or acquired immunity from a former infection tends to push the immune system towards the former, I wouldn’t rely upon this with new, highly infectious, variants with immune escape properties. We should not pin our hopes on Omicron and future variants being less virulent and hence less likely to cause as much serious disease as the wild virus and its earliest variants.

So, what should life and health insurers be doing? Both life and health insurers could use COVID-19 as an opportunity to reiterate the critical message that healthy lifestyles make people more resilient to COVID-19 and a range of other diseases. Community rating constrains health insurers from carving out separate rates for smokers or the obese. But life insurers could re-examine how they might further develop lifestyle ratings beyond smoker/non-smoker ratings, initially targeting obesity as they target smoking. TAL and AIA are two retail players currently giving discounts for healthy behaviour.

Figure 1: The potential relationship of Vitamin D Deficiency

Adapted from Vitamin D Deficiency: Consequence or Cause of Obesity? (nih.gov)

But with the pandemic fatigue, governments will be desperate to find new non-lockdown methods to combat COVID-19. So, health actuaries should become proactive. They should be working on a proposal to the government to use the health insurance industry clout to reduce the incidence of obesity, improve population lifestyles and hence population immunity levels.

This will not just reduce the incidence of severe COVID-19 disease and therefore hospitalisation but also reduce future claims for many lifestyle-related diseases as well. For instance, an industry-wide campaign designed to inform the public on the link between severe COVID-19 and lifestyle-related health conditions, such as obesity, would be a start. This can then link to financial incentives to improve lifestyle attributes.

References[1] Kannel W.B – Recent highlights from the Framington Study, Australia and New Zealand Journal of Medicine, Vol 6(5). 373-385, 1976 [2] Belloc N.B Relationship of health Practices and Mortality, Preventive Medicine Vol 2. 61-81, 1973 [3] see 4102.0 – Australian Social Trends, 2000 (abs.gov.au) [4] see https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7889467/ [5] see Influenza-fact-sheet_10 June 2021_Final.pdf (ncirs.org.au) |

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.