Running on empty

Scott Collings, Managing Director of Finity Consulting, analyses the performance of the Australian General Insurance Industry throughout 2020.

General Insurance Industry Performance 2020

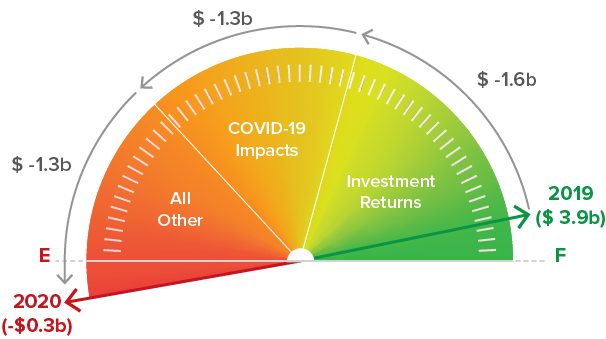

The Australian General Insurance Industry has just experienced its worst year of financial performance in over two decades. In 2020 the industry suffered a before-tax loss of $300 million compared to profits of $3,900 million in 2019. Both the underwriting result and investment returns were substantially down compared with the 2019 performance.

Without doubt COVID-19 has had an impact, but just how much of 2020’s poor performance does it explain? We have broken down the year on year movement in profit into three components:

1. Investment returns in 2020 were dragged down by lower interest rates, compressing credit spreads and low share market returns. With over $60 billion in invested assets this shift in performance of $1.6 billion is the difference between a 4.9% rate of return in 2019 and just 2.2% in 2020.

In some ways the 2020 investment experience was very similar to 2019 – interest rates fell by 1% and credit spreads compressed by 20 basis points, both factors producing capital gains on fixed interest securities. The first difference for 2020 was that opening yields started 1% lower, which flows directly into the overall performance gap. The rest of the difference is down to the dramatically different outcome for equity markets in 2020 (1%) versus 2019 (23%), which was significant for the industry despite relatively small (7%) holdings in this asset class.

It is tempting to suggest at least some of the investment market impact is a direct result of COVID-19, the timing coincided closely with the huge equity market sell-off in March. Bearing in mind that a lot of those losses were clawed back in the nine months following, other potential causes include global economic events such as increased trade protectionism, Brexit, and the collapse of oil prices which also immediately preceded the stock market sell-off.

2. The COVID-19 pandemic has clearly had a very significant impact on overall underwriting performance. The impacts are unevenly spread across insurance classes with the most apparent being:

- Fire & ISR: roughly $3 billion in additional claims reserves for business interruption losses were set aside late in 2020 after an important court judgement ruled out a key legal defence many insurers would have otherwise relied upon. A significant component of these losses are expected to be recoverable from the reinsurance market, leaving the industry with an estimated $1.6 billion net cost. With very few claims settled this amount remains highly uncertain.

- Domestic Motor: a $600 million improvement in underwriting result due to reduced vehicle usage (and fewer road accidents) linked to various state lockdowns (loss ratio 8% lower).

- Commercial Motor: a $200 million improvement in underwriting result due to reduced vehicle usage (loss ratio 8% lower).

- Lenders Mortgage Insurance: a $300 million strengthening of reserves as insurers acknowledged the deteriorating employment conditions in a number of industries/regions and increased prospects for loan defaults.

- Expenses: $200 million in additional industry-wide expenses. This is the component of extra expenses we estimate is attributable to the disruptive effect of the pandemic on insurer operating models.

Overall COVID-19 appears to have cost the industry around $1.3 billion in 2020. While the favourable impacts (on Motor classes) are now fairly certain, there is considerable residual uncertainty associated with business interruption liabilities.

3. For reasons other than COVID-19 the industry also suffered unusually poor underwriting results across a number of major classes of business:

- CTP: underwriting profits were $400 million lower in 2020 compared to 2019, as underlying profitability in the various state schemes and releases from prior year reserves continue to contract.

- Public Liability: $400 million in additional reserves were required as the industry deals with a surge in claims for historical child abuse, worker to worker claims and an unprecedented number of large losses.

- Professional Indemnity: $200 million in additional reserves were added in response to the growing frequency of large claims and an increase in class action activity.

- Home: there were $300 million of unexpected additional costs (compared to a ‘normal’ year) due to weather-related events (bushfires, storms and hail).

All up these non-COVID-19 impacts were a drag on industry performance worth $1.3 billion in 2020, similar in magnitude to the specific COVID-19 impacts themselves.

Looking forward

2020 has put a hole in the industry balance sheet but the impact is unevenly shared around. At one extreme are pure play Motor insurers who have actually done better than normal. Commercial and diversified insurers on the other hand have all experienced varying degrees of pain. Those with significant business interruption exposures have the added unwanted issue of significant residual uncertainty being carried into 2021.

In the short term investment markets seem unlikely to help much, with low interest rates locked in as central banks everywhere try to trigger economic recovery. For an industry invested 90% into fixed interest securities this scenario offers only a continuation of low investment returns and leaves the pressure firmly on underwriting performance.

The economic disruption caused by COVID-19 has been typically greater overseas so the global insurance market will arguably be even more impacted (relatively) than Australia. According to the latest tally there are $42 billion of COVID-19 losses reported in the rest of the world. Since commercial premium rates were already in a strong hardening phase at the end of 2019, the pressure on premium rates is set to be heavier and last longer. This will be supportive of commercial insurers seeking to claw back some of their 2020 losses with all of their competitors being in pretty much the same boat (whether local or foreign owned). Unfortunately the increased cost of buying reinsurance will offset some of these gains as reinsurers themselves have suffered heavy losses globally not just from COVID-19 but from recent natural catastrophe events too.

Insurers now face a situation where large rate increases need to be pushed through to rebuild capital and to meet the higher cost of reinsurance. But rate increases inevitably trigger higher levels of price shopping by policyholders and their brokers, creating elevated risks around retention and risk selection. 2021 looks set to be a serious test in the commercial market of insurer pricing and underwriting sophistication, and brand strength.

Running on Empty was originally published at Finity.com.au.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.