Insurance Affordability in Northern Queensland

What is the scale of the problem? What can improve insurance affordability? These were questions discussed at the insurance affordability session at the Virtual Summit. Cindy Lau provides an overview of this session presented by Kate Lyons, Simone Collins, Alison Drill and Mat Ayoub – members of the General Insurance Affordability Working Group.

The natural perils of Northern Australia have led to a multi-year ACCC inquiry to address insurance availability and affordability issues. In response, the Institute formed the General Insurance Affordability Working Group to further its contribution in this area. Chaired by Rade Musulin, this Group looked at the measurement and scale of the affordability problem, as well as possible solutions. On 26 August 2020, members of this Group presented its work so far at the 2020 All-Actuaries Summit. They were Kate Lyons, Simone Collins, Alison Dill and Mat Ayoub.

What gets measured, gets action

Currently, there is no widely accepted measurement of insurance affordability.

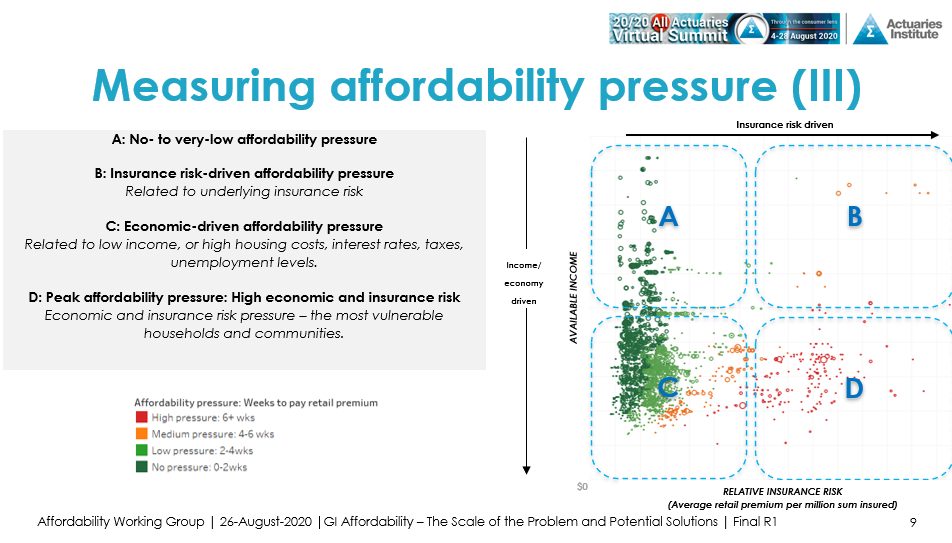

The Group proposes an approach of using a Housing Affordability Pressure metric (essentially net disposable income after housing costs using ABS data) alongside a Relative Insurance Risk metric. The Relative Insurance Risk metric measures retail premiums per sum insured. In this way, this approach leads to quadrants that point to the reasons of affordability pressure, e.g. living in a high perils area and/or low socio-economic status.

Overlaying a measure that links a householder’s income level to insurance cost gives further insight on the extent of affordability pressure. The average number of weeks needed to pay for the annual cost of home insurance is a measure developed by Tim Andrews and Stephen Lau in 2018.

The following graph shows affordability pressure at the postcode level. The postcodes under the high financial pressure are those that require more than six weeks on average to pay their home insurance annual premium (red points). The drivers are the policyholder’s poor economic situation and their high insurance risk. Drilling deeper into these postcodes can show the underlying demographics and natural perils.

One limitation of this approach is the challenge of isolating granular differences between households within a postcode, or even at street level, due to limitations of the ABS datasets. Nevertheless, the proposed affordability measures may already assist to prioritize and form targeted policy responses.

Possible solutions

While the Group also strongly supports mitigation to address capacity and affordability, other solutions exist in the short and long term.

Non-pool options include:

- Design of traditional insurance products and schemes: These include community rating, risk equalization, design of a compulsory base level product and premium financing options.

- Reduce frictional costs and other costs: These include taxes and brokerage costs, and allowing tax deductible catastrophe reserves.

- Government intervention: Direct subsidies to means-tested policyholder’s premium and/or deductible or government given direction, approval or oversight of private insurers’ pricing and cost base.

Pool options are also explored through the Group’s research of many overseas catastrophe pools. It noted that the objectives of the pool determined the method and features of their design. Government sponsored pools can spread losses across space (e.g. to overseas reinsurance markets) and time (e.g. future generations through capital markets issuance), as well as address disruptive fluctuations in the private reinsurance market.

One noteworthy observation of existing pools is the challenge of quantifying the financial benefit to customers. Quantification would require a clear picture of what the situation look like in the absence of the pool, which is usually unclear after a pool has been in operation for a number of years.

There are two types of pools, being reinsurance pools and insurance pools (i.e. government acting as a direct insurer). Their key differences are in policyholders’ interactions and capital implications.

Design factors

The research allowed a compilation of design factors for policy makers to consider. These factors fall into four broad areas:

- Product design features

- Which geographic regions and perils are covered?

- Which consumers are eligible?

- Pricing and funding

- What is the source and cost of funding?

- Operations and the market

- Relationships with current market players and stakeholders

- Distribution

- Maintenance, Monitoring and Exit

- Ability to respond to changing conditions, e.g. climate, societal, market and environmental changes

- Ability to monitor effectiveness

- Ability to terminate arrangements

Which option should be taken?

The Working Group is agnostic and has not determined which options or design features are the most desirable. Rather it seeks to provide a framework for considering the relevant issues.

The option taken by policy makers will need to account for many view-points. The Group notes these views are generally consumer-focused or system-focused. The consumer-focused views (consumers, ASIC, local and state governments) tend to be short-term in nature, while the system-focused views (insurers, APRA, Federal government) tend to be longer-term and include a wider breadth of requirements, such as industry sustainability, solvency, competition, economic growth and risk mitigation.

However, a number of guiding principles for assessing any option could be as follows:

- Ability to target vulnerable/affected customers

- Degree of economic impact and premium relief

- Ability for price signal to promote long term requirements and their impact to communities and government

- Ability for maintenance, monitoring and smooth exit of the adopted option

Concluding Remarks

Almost every option to address affordability involves some distribution of cost across time and space to the benefit of a subset of the population today. Further research in the development of affordability metrics will assist.

A mix of options may be required given there are limitations on how quickly some options can take effect, for example, implementation of stronger building codes when building turnover is slow.

Public policy makers should identify and implement options that yield the largest long-term benefit whilst minimising disruption. In doing so, they must consider distributional impacts between current and future consumers, how stakeholder behaviours may change and the government’s role.

The over-arching goals should be to improve the risk profile of the population to maximise insurability of properties and build resilient communities.

A recording of the session is available to view for registered 20/20 All-Actuaries Virtual Summit attendees on the app.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.