Forecasting in a COVID-19 world for Private Health Insurers

During this uncertain time, actuaries continue to forecast for businesses. In this article, Andrew Gower details how vaccines and restrictions may affect PHI forecasting.

Forecasting is a critical element of actuarial work and underpins both our strategic and regulatory roles. While there has been discussion over recent years that a pandemic may occur, this is unlikely to have ever formed part of a central estimate. With the COVID-19 pandemic, Health Insurance (amongst other insurers) has faced greater uncertainty around central estimates; thus, requiring an increased focus on the underpinning scenario of the forecast.

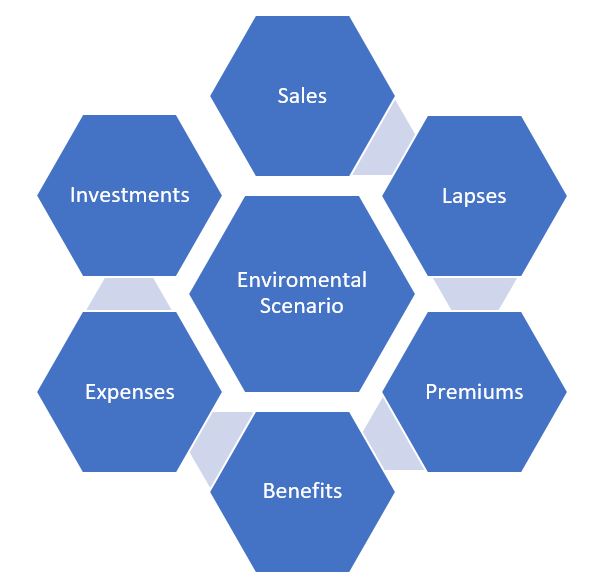

While the development of a robust environmental scenario is often overlooked or considered implicitly in many forecasting exercises; the complexity of COVID-19 and the need for consistent assumptions sets make outlining a clear scenario critically important. This scenario is likely to consider the broader environmental considerations rather than specific impacts on individual assumptions. Once the scenario is outlined, the impacts to individual assumptions can be considered separately, with reference to the scenario, as outlined in the figure.

With COVID-19, while these areas remain important; additional areas to explore how COVID-19 will impact the assumptions need to be considered. Two of the areas that are most critical to consider how these will impact the detailed assumptions are:

- When will a vaccine will be available? The timing of any vaccine impacts when COVID-19 is expected to be easily controlled thus resulting in a new normal way of life.

- How will restrictions impact society? These restrictions have a direct impact on benefit payments, but also broader impacts on economic activity.

When will a vaccine be available?

Viruses are often controlled via a combination of approaches. The main two areas being non-pharmaceutical approaches (such as social distancing, good hygiene and robust approaches to minimise spread in clinical settings), herd immunity or a vaccine.

Given the extensive spread of COVID-19, it is unlikely that non-pharmaceutical approaches will be able to be applied over the long term to ensure on-going control of COVID-19 while the sociality impact of generating herd immunity is unpalatable. Given this, great focus has been placed on developing a vaccine which is expected to lead to improved population immunity and a return to more normal activity levels across society.

Vaccines, like many other pharmaceuticals, are heavily regulated and can take 5 to 10 years to develop. Over this period, a range of activities need to take place to ensure that the vaccine is both safe and effective. Work on a vaccine has already commenced, although it is expected that the fastest one could be developed is 12 to 18 months away provided everything goes well. In addition to the development, the manufacturing of a vaccine in the quantity required could also be a challenge. This may delay the widespread availability, thus immunity to COVID-19, by an additional .

Until a vaccine is found, a range of impacts could occur to the individual assumptions. Some areas for insurers to consider include:

- Restrictions of some form are likely to be in place or may be reintroduced if needed, with flow on to assumptions such as:

- Sales and lapses; as these assumptions depend on the perception of value of holding health insurance in some segments of the market. This also expands to suspended members and their potential re-activation processing.

- Investments; as a vaccine could result in changes of market confidence and create instability around asset values and interest rates.

- The timing of a vaccine may present an opportune time to consider how best to return excess profits to customers as a vaccine will, in the minds of consumers, signal the end of COVID-19.

- Travel restrictions (or quarantine periods) may be kept in place until a vaccine is available impacting:

- The ability for overseas visitors and students to enter Australia. As part of visa requirements, these people need to hold health insurance. Where overseas business is a critical part of the portfolio; the sales, lapse and benefit assumptions may be impacted with flow on impacts to overall profits.

- Australian’s to travel overseas. If an insurer sells travel insurance (underwritten by general insurer); any revenue from this activity is likely to be reduced. This also may expand to other insurance products distributed.

In addition to these, a vaccine is likely to be the start of a new post COVID-19 normal. What this looks like remains extremely uncertain; although understanding some of these drivers is likely to be critical for setting business strategy.

How will restrictions impact benefits?

While a vaccine is developed, governments around the world are restricting activity across society. These have generally limited large gatherings and social interactions; but other restrictions have been placed on health services. It is likely that the general restrictions will form an important part of the economic considerations in scenario setting, hence the following focuses on restrictions placed on health services. Given that the benefit payments represent the largest cost of any insurer, understanding the nature and length of restrictions is critical when developing benefit assumptions.

When considering assumptions for benefits, consideration as to the purpose of restrictions is also important as this drives when they are likely to be lifted and what capacity may be available across the system. Overseas, limits in the number of ventilators or supplies such as oxygen have driven certain restrictions; while in Australia greater focus appears to have been placed on personal protective . Other limits, e.g. staffing of operating theatres, may also drive how these restrictions are removed and how much activity can occur.

An additional complexity is that restrictions can vary by region, an example is those seen in North West Tasmania in late April, however the other limits are also likely to vary by region. Depending on the amount of data and desired accuracy of any forecast; understanding these regional impacts could play an important part of developing forecasts for many insurers.

It remains unknown how quickly health activity will return to normal levels and if there would be any catch-up of services that were cancelled during periods of however these aspects should be considered and incorporated into any forecast along with possible sensitivities given the level of uncertainty of both the timing and size of these.

Summary

COVID-19 has added additional complexity into preparing robust forecasts for Australian health insurers. The two areas outlined above are both complex and, whatever impacts assumed, are likely to have material impacts on forecasting financial outcomes. While understanding them in full detail may not be required, ensuring that impacts on various assumptions are consistent is critical the robustness of any forecast. This then enables greater focus on what business strategies can be adopted to navigate this uncertain period and ensure that actuaries can continue to support a sustainable health insurance system in Australia.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.