COVID-19 Considerations For Insurers In Asia

Many of our Members and employers are closely following the pandemic. In this article, Angat Sandhu, Actuaries Digital Chief Editor and Partner and Head of APR Insurance at Oliver Wyman, shares some takeaways for insurers in Asia battling the impacts of COVID-19.

The COVID-19 pandemic has had a major impact on almost all economic sectors, and insurers are no exception. While governments are limiting the damage by stepping in as insurers of last resort, the pandemic is still unfolding, and customers are currently focused on preserving their health rather than actively lodging claims. In time, as the overall environment improves, we expect the underlying impact on insurers’ underwriting performance to become clearer.

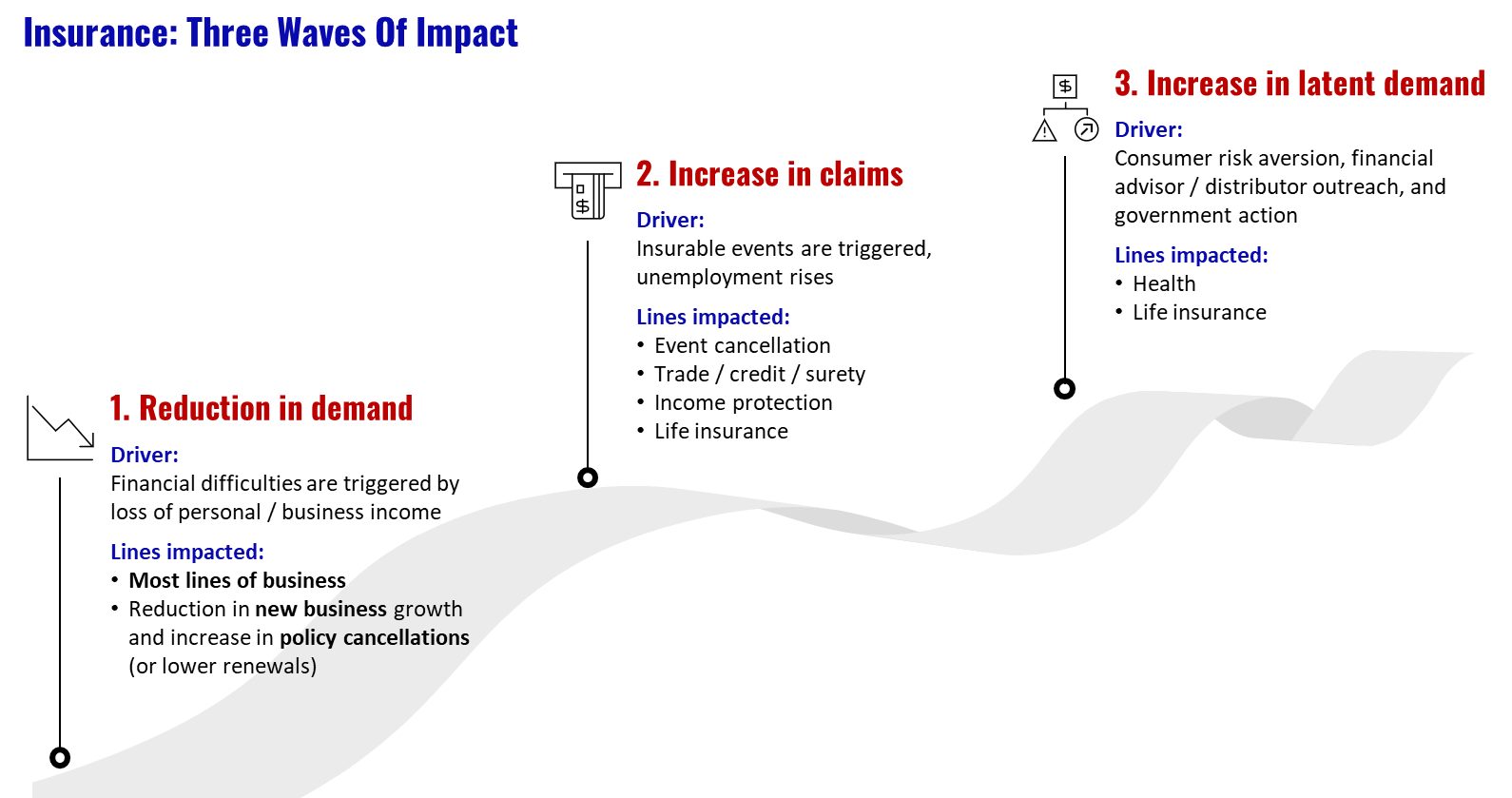

While the consequences unfold, insurers should prepare for the future, by accelerating the digitization of their operations and planning for emerging business opportunities. To do this effectively, they need to understand the likely impact of the pandemic. We expect different lines of business to be impacted to varying degrees over time and the direct impact to unfold in three waves. In the first, new business in most lines will decline, as potential customers are hit by financial difficulties. In the second, claims will increase following insurable events. This will occur in multiple lines including trade / credit / surety, life insurance and event cancelation, while claims in some personal lines will likely decline. The third wave will result in an increase in latent demand for insurance products as people become averse to risks and have greater appetite to purchase insurance to protect themselves (see Exhibit below).

Here is how we think the pandemic will impact different segments of the Asian insurance sector – and how we think insurers should react.

Commercial Lines

Trade, credit, bond, and surety insurance. Liability lines across Asia are likely to be hit hard by widespread trade settlement delays, the drying-up of credit facilities, and insolvencies. Including: trade and credit policies, under which insurers pay up when the holder’s customer doesn’t because of events such as bankruptcy; bond insurance, which repays bondholders’ principal and interest payments in the event of default; and surety policies, which take effect if a party fails to fulfil an obligation, such as a construction project. Despite widespread interventions by most governments and credit institutions, we expect a material impact on this class of insurance.

Event cancellation. The cancellation or postponement of numerous events, such as the Tokyo Olympics and the Grands Prix, are likely to trigger event cancellation claims. Not all events, especially the smaller ones, are insured, and some policies carry pandemic exclusions. So there may be relatively few, but large claims. The Olympics, for example, has a total of $2 billion of insurance cover, analysts estimate.

Business interruption. Though a lot of businesses are directly impacted by the pandemic, business interruption (BI) claims are expected to be limited. BI policies often exclude “extraordinary events”, “forced business closures imposed by authorities”, and “infectious diseases”, and there are strong legal arguments that BI insurance is intended to cover property losses but not disease outbreaks. During the SARS outbreak, for example, BI claims were hotly contested in the courts. So legal challenges are likely to arise again in this instance.

Workers’ injury. Employees infected by a virus while at work might file workers’ injury claims to cover loss of income or medical expenses. Organisations providing essential services – such as medical facilities, airports, and utilities – are particularly vulnerable to such claims. Presently, while most governments in Asia are funding COVID-related treatment costs, there is a chance that claims costs will surge over time.

Personal Lines

Personal insurance claims are expected to be significantly lower until lockdowns are lifted, as people reduce the activities that typically trigger such claims e.g. motor accidents. However, this short-term upside is likely to be offset by an adverse impact on revenues, caused by lower (or delayed) renewals and limited new business.

In the case of Travel, most Asian insurers were quick to announce COVID-related claims exclusions. Airlines and hotels have allowed customers to cancel or postpone trips with limited penalties. Accordingly, travel insurance claims are expected to be limited. However, as virtually all travel has halted, insurers are expecting a significant hit to the volume of new business, compounded by premium refunds on cancelled travel policies.

Life And Health Insurance

A spike in COVID-related life insurance claims will impact most life insurers. Rising unemployment may increase claims from income protection insurance, subject to policy limitations. For both lines of insurance, the severity of claims increases will be directly linked to the pandemic’s health and economic impact.

In several Asian markets – notably China, Japan, Korea, and Singapore – most of the medical expenses from COVID-related treatment are currently being borne by governments. The impact on private health insurers in those markets is therefore likely to be limited. However, in emerging countries with large vulnerable populations – such as India and Indonesia – the impact of a volume-driven spike in medical claims could be higher.

In future, the heightened awareness of mortality and health risks should result in a surge in demand for life and health products in several markets. During the six months after the SARS outbreak in China1, total health insurance premiums more than doubled.

The Way Forward: Shifting Priorities

Insurers are currently assessing the impact of the pandemic, and many have been unable to provide updated earnings guidance. Concurrently, they should take the following steps:

- Consider a range of scenarios and the impact these will have on their businesses. Then formulate response plans.

- Increase client outreach by using digital distribution channels and working with partners. Remind customers of the importance of insurance.

- Accelerate their own digital transformations.

The insurers that emerge successfully from this crisis will be those that serve their customers in their time of need, while revising their business model for the post COVID-19 world.

References:

-

SARS and its Impact on Insurance, July 2003, Asia Insurance Review

Original article by Angat Sandu and Prasanna Patil here: https://www.oliverwyman.com/our-expertise/insights/2020/apr/covid-19-considerations-for-insurers-in-asia.html

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.