Discussing the profession at the AMSI Members’ Meeting

The Australian Mathematical Sciences Institute (AMSI) Members’ Meeting was held at the Australian National University on 16 July 2019. In the spirit of exploring opportunities for collaboration between mathematical scientists and other professions, Guy Thorburn, Australian Government Actuary, was invited to present at the meeting on behalf of the Actuaries Institute. Guy provided an overview of the profession and discussed two of the current trends the profession faces.

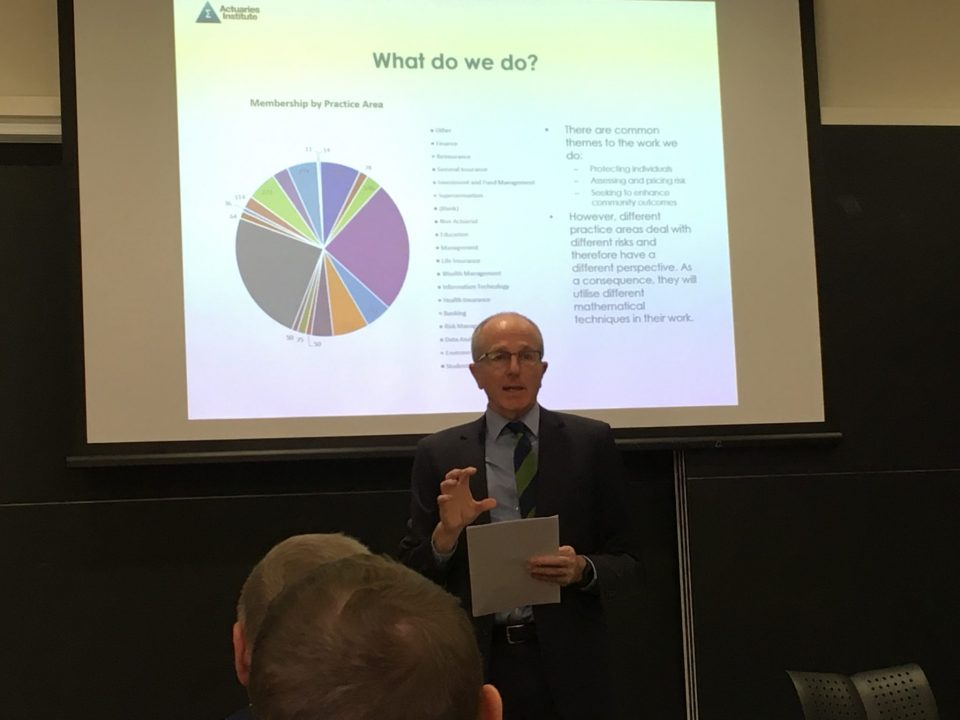

Role of actuaries and their practice areas

Guy provided a high-level summary of the roles of actuaries. He emphasised that actuaries are equipped with an in-depth understanding of risk, probability and finance, as well as the analytical skills that help business and society plan for the best possible future. Insurance, superannuation, wealth management, investment, health financing and banking are among the readily recognised fields where actuaries work. Actuaries are also highly sought after in the new and emerging fields such as data analytics, energy resources and InsurTech as well as not-for-profit sectors.

“An actuary is someone who combines business, statistical and economic knowledge to prepare for future financial uncertainty”, said Guy.

He followed up by giving some brief examples of how actuaries are involved in predicting life expectancy, road accident rates, investment, the efficiency of new technology and financial impact of climate change, stating the positive difference actuaries make in the various practice areas.

Then he took the audience through a closer look at the actuaries’ adaptive involvement in different practice areas. For example, in the field of life insurance, superannuation and retirement income, actuaries are heavily involved in mortality modelling and financial risk management, helping stakeholders understand the associated life contingency and investment risk. In the general insurance industry whose underlying risks are different to risks faced by life insurance, actuaries rely on other techniques such as GLMs, multi-variate analysis, and data analytics, which has proven to be very helpful in dealing with large and complex data.

Guy also highlighted the work of actuaries in the public sector, such as the Australian Life Table, one of the most widely known contributions by the Australian Government Actuary. Besides this, actuaries in the public sector are also involved in the Social Security investment approach, accident compensation plans and income-contingent loans, to name a few. Actuaries participate in a wide range of tasks ranging from estimating the cost of welfare payments and programs to providing tailored advice on program design.

Increasing attention on data analytics

Currently, nearly a quarter of actuaries practice in the area of data analytics. “It is a skill that is increasingly embraced by a large proportion of profession, including those who work in general insurance, worker compensation and state and the Commonwealth government”, he said. At the same time, the Actuaries Institute has taken multiple initiatives to foster an engaging environment for members to learn and enhance their technical ability in this emerging field. For instance, data analytics is being included in each of the three phases of actuarial education and an active data analytic community is available allowing opportunities for peer learning and networking. Guy highlighted that a few areas where practitioners should not overlook, such as the ethical use of data and dealing with inherent bias within the data collected. He also suggested that professional standards and guidance rules around these issues might be developed in the future.

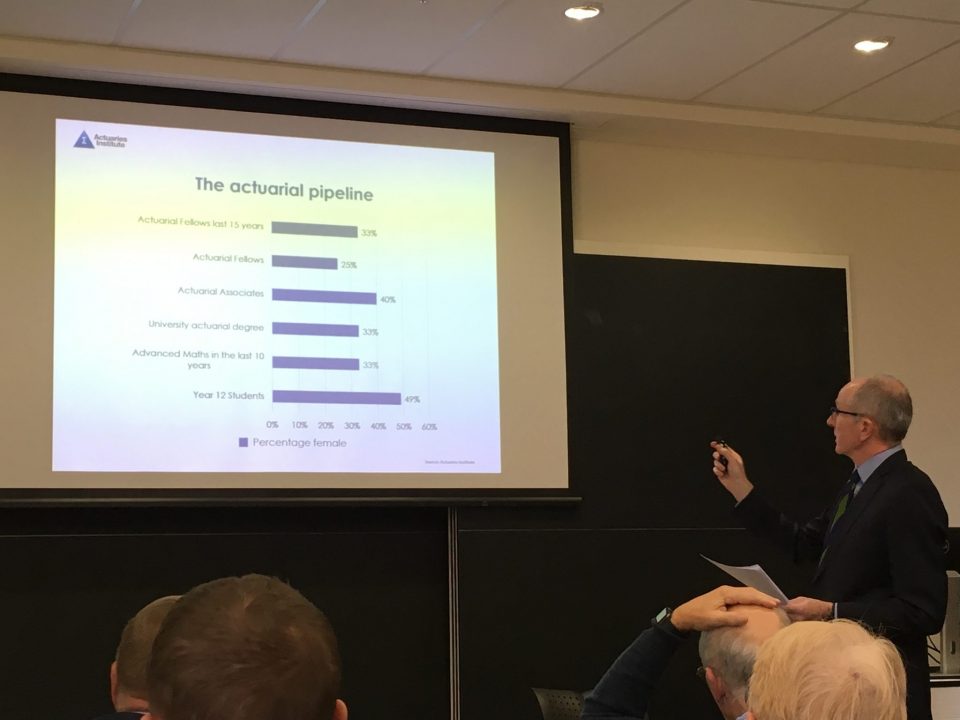

Gender diversity in the actuarial profession

Building a gender diverse profession is also one of the focus areas of the Actuaries Institute. At the moment, about one-third of the Actuaries Institute’s members are females, which is not surprising given the relatively low number of female students taking advanced mathematics in high school, according to a recent report by ASMI [1].

“Until we increase the percentage of girls taking advanced mathematics in school, we will not significantly improve the gender diversity of actuaries”, Guy emphasised.

AMSI and the Actuaries Institute have a common interest in promoting gender diversity in their respective professions. It is anticipated more and more jobs in the future will require skills in STEM (Science, Technology, Engineering and Mathematics) fields. Poor gender diversity among the STEM students means more women will be disadvantaged and underprepared for the future. Guy also mentioned some of the initiatives taken by universities to promote gender diversity among students [2]. In addition, the Actuaries Institute is seeking to improve the marketing of the actuarial profession to female students and to provide support for female Associates in their journey to becoming Fellows.

Guy’s presentation ended with a short Q&A session where he discussed the challenges the profession faces in promoting interest in STEM and actuarial studies among students. He shared his personal experience talking to high school students about pursuing mathematics-related studies. “It can be hard to get them to relate to the great things the actuarial profession can offer”, he said. Members of ASMI also shared some of their past campaigns in raising awareness of mathematics and its application in different careers among the high school students.

[1] Li, N. and Koch, I. (2017). Choose Maths Gender Report: Participation, Performance, and Attitudes Towards Mathematics. Melbourne: Australian Mathematical Sciences Institute. https://amsi.org.au/publications/gender-report-2017-participation-performance-attitudes-towards-mathematics/

[2] Tickle, L. and Butt, A. (2018). Building a Gender Diverse Profession. Actuaries Digital. https://www.actuaries.digital/2018/07/18/building-a-gender-diverse-profession

Don’t miss: In conversation with the Australian Government Actuary – A Podcast with Guy Thorburn and Elayne Grace.

“one of the things that’s really fascinating about the role is that it is probably one of the most diverse actuarial roles that you could find. I thought working in consulting was diverse but actually this covers a different level altogether” – Guy Thorburn.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.