Remaining Relevance of Reserving Report Recommendations

March 2006 was a month of big releases.

David Attenborough’s nature documentary Planet Earth premiered on the BBC. Jack Dorsey sent out the first ever tweet on Twitter. English-language Wikipedia published its one millionth article. And, perhaps most importantly to me at the time, Ice Age: The Meltdown came out in cinemas.

And while it may not have had quite the same reach or cultural cachet, an important paper was also released by the UK’s General Insurance Reserving Issues Taskforce (GRIT), which has proven to be relevant to this day: A Change Agenda for Reserving: Report of the General Insurance Reserving Issues Taskforce.

In my previous article, UK Unit Urges: Upgrade Understanding, Unveil Uncertainty and Uplift Usefulness, (as part of a series from the General Insurance Practice Committee (GIPC) Reserving Working Group), I summarised the key findings and recommendations from the paper.

In this article, I further reflect on how actuaries of today can still extract learnings from the research conducted nearly 20 years ago.

While the actuarial environment in Australia in 2025 is clearly different – and, I would argue, more mature and advanced in many respects – compared to that of the UK two decades ago, it is clear that there is still work to be done across the industry to continue to enhance the quality of reserving practices.

Part of our job on the Reserving Work Group is to help the industry take these next steps forward, in order to help:

- actuaries increase the efficiency and accuracy of our processes

- improve the communication of our findings and;

- ensure the ongoing relevance of our profession and skills.

Recommendations from the paper

It is an interesting exercise to reflect on the recommendations made by the GRIT back in 2006, and to consider (in a 2025 Australian context) the areas in which we have progressed and the areas that still need to be addressed (noting as well that we operate in a different regulatory environment with respect to prudential and financial reporting).

Different actuaries may also have different opinions depending on their exposure to various datasets, classes of business, actuarial methodologies and stakeholders, amongst other factors. In my opinion, developments over the past two decades have increased both our capabilities and the challenges that we face.

For example, our ability to collect and process data and conduct statistical analysis is far superior to that of the past (reflecting an increased maturity in the level of knowledge that actuaries and insurance companies have, as well as the sophistication of open-source tools and vendor software) – however, this begs the question of whether we are appropriately capitalising on the information available or whether we are just using the same data fields that we used to use back in the day.

Similarly, a significant amount of research and work on risk margins (and now risk adjustments) has been done since 2006, which may improve our communication around uncertainty (and indeed, the Australian Prudential and Professional Standards appear to be more rigorous and prescriptive than those implied to be applicable in the UK based on the 2006 GRIT paper) – but stakeholders still question the performance of actuaries when results are not aligned with our “best estimates”. This suggests that there is still room for improvement.

On the other hand, from an Australian perspective, our use of techniques beyond the chain ladder and BF approaches suggests that our methodologies may be more robust than those considered by the GRIT – but this has been the case for many, many years, and we should not be complacent just because we have more models available than those in the UK in 2006 (especially when our approaches have not necessarily progressed in line with technological capability advancements).

There are also some recommendations from the paper that have not necessarily been addressed. For example, considerations around the underwriting cycle are less obviously ingrained in our reserving processes.

Other considerations

As noted in my previous article, the authors of the paper did not make any recommendations around sophisticated mathematical and statistical methods. Given the enhancements in our data processing and analysis capabilities since 2006, I believe that these approaches are worth, at the very least, discussion and consideration.

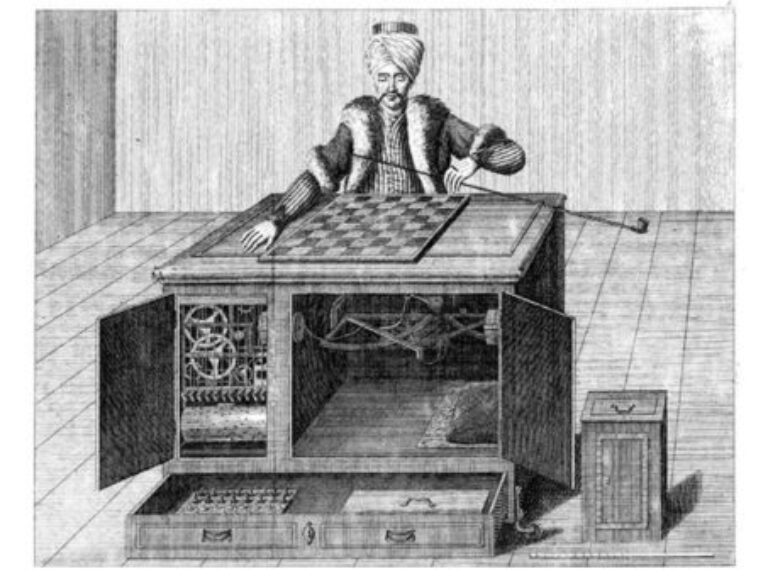

Now, perhaps I am biased – I am on the Institute’s GI Reserving Work Group, which formed with the intention of assessing the reserving landscape and investigating the possibility of such alternative techniques. But I do believe that we would be foolish not to at least consider the potential that alternative approaches (such as GLMs and Machine Learning) could have.

In my view…

For actuaries to remain relevant within the financial industry more broadly, we need to ensure that our approach is suitable for the times as we cannot afford to uncritically maintain the same approach year after year.

If we do research and test alternative possibilities and conclude that they are not worth the investment, then that can be justified – but I do not think that this is a conclusion we can come to without proper deliberation.

If we are willing to stand behind methods that have been around for many decades, then we should be comfortable that they are sufficiently accurate, robust and explainable and our members should be equipped to communicate their satisfaction with the results and methodology.

At the very least, we should be giving due consideration to the recommendations of the GRIT paper, which remain relevant to this day in many ways.

Since the release of that paper in 2006, the Ice Age franchise has released four more films, an animated series, two television specials, a play, and three video games. The least we can do as actuaries is an in-depth review to determine whether our methodology remains appropriate.

If we can’t keep actuaries at the forefront of reserving practices, then – like Manny, Sid and Diego – we may need to start facing the prospect of our own extinction.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.