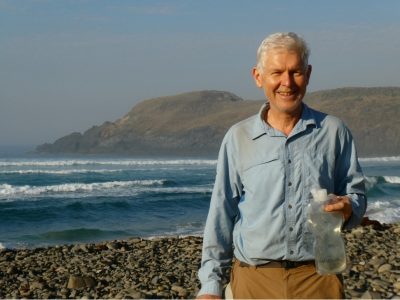

Under the Spotlight – Anthony Asher (Councillor)

Newly appointed Councillor Anthony Asher delves into what inspired him to becoming an actuary, his views on the future of the profession, and his advice to younger actuaries in the latest Under the Spotlight profile series.

My interesting/quirky hobbies…Writing poetry (not that good, but serious!).

My favourite energetic pursuit…Hiking.

What gets my goat…Abuse of power.

I’d like to be brave enough to…Do a swallow dive.

Not many people know this but I…We have 10 grandchildren under seven – just kidding, I tell everyone I can.

Short description of career…Eight years in life assurance, and then 14 years as Director of Actuarial Studies at Wits University in South Africa, then APRA, Deloitte and then to UNSW. Some directorships, investment committees, lots of government submissions. My main interest has been product development and super benefit design, which has led also to research on ethics. Product design can be used to mislead customers as much as to provide for their needs. It has been a privilege along the way to teach bright, enthusiastic students and to work with many actuaries seeking to build a better world.

I became an actuary because…It was a good fit to my interests and skills, and I was naive enough to believe that it must be socially useful because it was so well paid.

Where I studied to become an actuary and qualifications obtained…University of Cape Town and the Institute and Faculty of Actuaries in the UK, in 1980.

My proudest career achievement to date is …Contributing to the South African legislation that saw pension surpluses returned to members who had been disadvantaged.

Who has been the biggest influence on my career (and why)…My earthly father has probably had the greatest influence on my approach to work – the technical and ethical sides of being a professional. Particularly in the big decisions, I have worked at aligning my motives with my religious beliefs.

Why I’m proud to be an actuary…For the thousands of volunteers mentoring students, marking, organising events, serving on committees (83 listed on the website!).

The most valuable skill an actuary can possess is …General reasoning. Our models are tools to manage real world risks.

At least once in their life, every actuary should…See what financial advisors recommend.

If I could travel back in time I would…Make better investment decisions.

When I retire, my legacy will be…Great students and a number of not so great papers and publications.

One of the most creative applications of actuarial capabilities that I have used in my career…Estimate the number of young males leaving South Africa to avoid conscription by using travel statistics and the census.

The most interesting or valuable job or project I have worked on in my career and why…My contribution to the Committee of Inquiry into a Comprehensive Social Security System for South Africa. It covered private and public provision of all insurances and pensions and gave me wide exposure to the variety of those involved in the different sectors – and an opportunity to contribute.

How my skill set evolved over my career…In my case I have strived to get a better overall picture and perspective, but this has become increasingly difficult with the proliferation of un-curated publications and other media.

The advice I would give aspiring actuaries to be able to do my job…Read, read, read – and give yourself time to digest what you have read. And set up networks with other actuaries to talk things through.

My view about the future of the Actuarial profession – in 10 years?…I hope we will be more proactive in detailed consideration of our role in addressing the big risks facing society (and the institutions we serve). The work on climate change is a harbinger, but we need to reflect on where we fell short in the planning for COVID and the failings reported to the Royal Commission.

If I were President of the Institute, one thing I would improve is…Our reflection on where we have come from.

My best advice for younger actuaries…Remember the origin of our profession – to contribute towards people’s financial security by ensuring financial institutions remain solvent in the long term. The long term means commerciality has to be fair/just, so hold fast onto your values. Also, read poetry – starting with the two poems I read to my class last year:

- ‘Self Portrait’ by David Whyte

- ‘Hymn to love’ 1 Corinthians 13

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.